On Monday, the collaboration between the Ordinals market and Bitcoin Miladys birthed a new smart contract called BRC-721E. If the nomenclature looks familiar, it ties into Ethereum’s ERC-721 smart contract standard for minting non-fungible tokens (NFTs).

In contrast, the ERC-20 standard is reserved for regular Ethereum-borne altcoins such as MATIC, DAI, or PEPE. Therefore, the new BRC-721E has a particular function, to bridge Ethereum NFTs (ERC-721 tokens) to the Bitcoin network (the “B” in BRC), which then become Ordinals.

BRC-721E Bridges Brings Ethereum NFTs to the Bitcoin Blockchain

In both cases, ERC or BRC, the “RC” stands for Request for Comment. In other words, calling a function on a smart contract to do something. In the case of tokens, it calls for addresses and their balance, colloquially known as a token transfer.

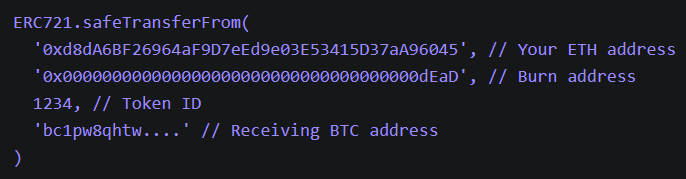

The BRC-721E bridge token turns NFTs into Ordinals by calling a burn address on Ethereum, which means that users send their ERC-721 NFT to an irretrievable wallet, with the ETH gas fee paid. In turn, BRC-721E grants for Ordinal inscription on the Bitcoin network as a single on-chain inscription request that cannot be undone.

Because these requests can remain unfulfilled, someone else can make an inscription on users’ behalf so they don’t have to spend sats (100 millionths of 1 BTC) on their end as a fee. With the bridging completed, the NFT becomes visible on Bitcoin’s NFT marketplace – ordinals.market – with full metadata available.

Why Did Bitcoin Inscriptions Become Controversial?

Since the inception of the Ordinal protocol in January, it has drawn much controversy. Should the Bitcoin network offer extra utility in addition to sound money? What if the popularity of a new utility congests the network?

Predictably, the Bitcoin network congestion happened, quadrupling transaction fees. Some Bitcoin maximalists have even framed this development as a denial of service (DoS) attack, as it became feasible to spam the network with inscriptions to make it costly. Some core developers even hinted at canceling the code that made Ordinals possible.

However, all that happened was a view of Bitcoin’s future if it was globally adopted. After all, transaction fees would soar if the Bitcoin network onboarded millions of users with no Ordinals in sight. This is why we will likely rely more on layer 2 scalability solutions.

Just as Ethereum relies on Optimism, Arbitrum, and Polygon, Bitcoin is relying on the Lightning Network to relieve congestion woes.

New Bitcoin Market Brings New Revenue Source

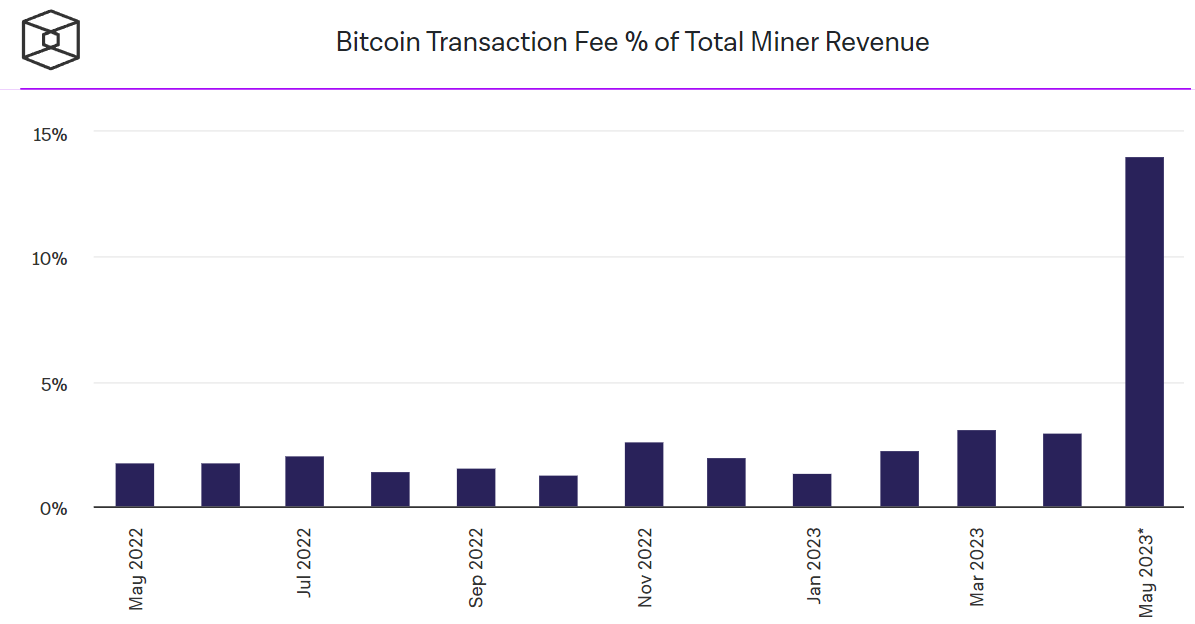

Following the drop in Ordinals traffic, resulting in over 500,000 unconfirmed transactions in mid-May, BTC transaction fees returned to normal at around $2. However, Bitcoin miners had a field day by the end of May. Due to so many inscriptions waiting in the mempool, miners could up the fees, setting new priority tiers.

As a result, Bitcoin transaction fees, as a percentage of total miner revenue, increased to 14.3% as of May 29. According to The Block’s Data Dashboard, this is the highest since April 2021.

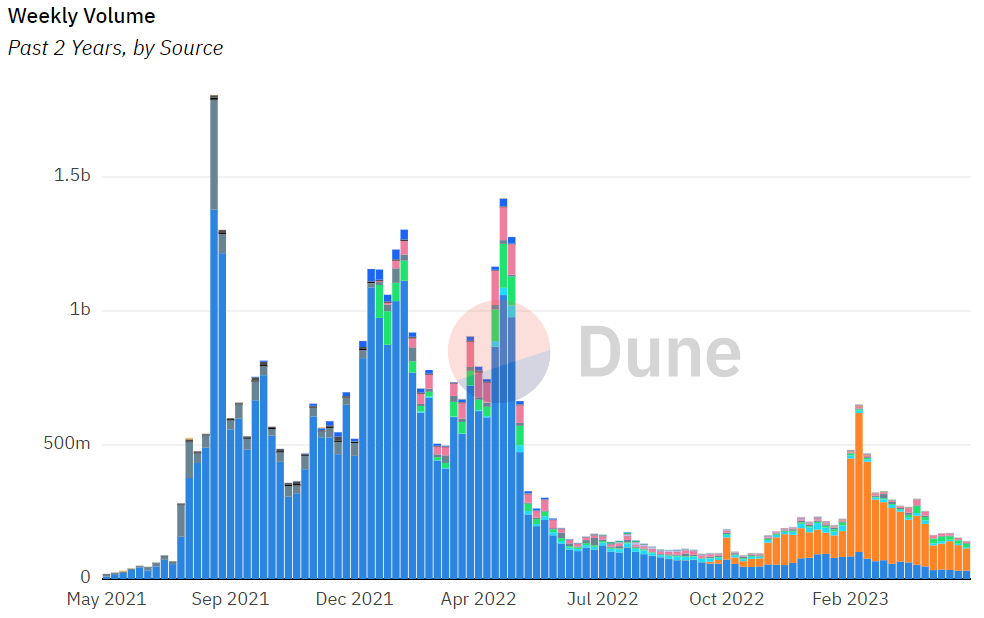

Nonetheless, NFT trading volume dropped like a rock from the heydays of January to May 2022.

NFT/Inscriptions Volume Down

Previously holding over 70% market share dominance in the NFT marketplace space, OpenSea (blue) seems to retreat against the newcomer, Blur (orange).

In addition to NFTs being inherently speculative, the high-quality AI image generation is likely putting a damper on the concept of inscribing unique art into the blockchain. If such AI apps were prevalent back then, Beeple would unlikely have sold their artwork for $69 million.

When it comes to Bitcoin Ordinals, the demand is also fizzling out. So far, the Bitcoin network hosted over 10.2 million inscriptions, accruing ~$44.2 million in cumulative fees. Compared to the first half of May, weekly inscriptions dropped by -85%.

Do you think Bitcoin inscriptions will eventually be code-canceled, or will this become a new market? Let us know in the comments below.

tokenist.com

tokenist.com