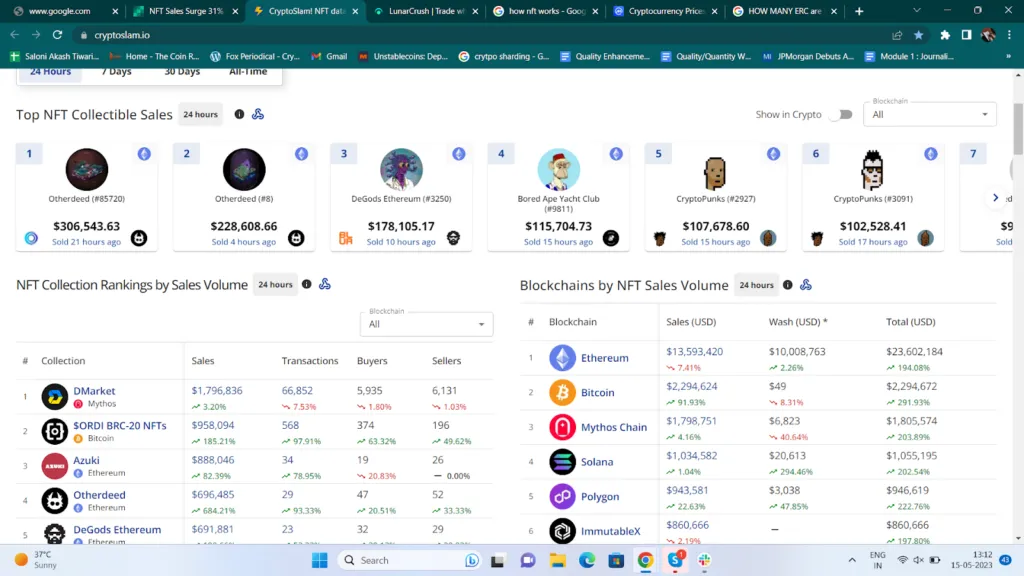

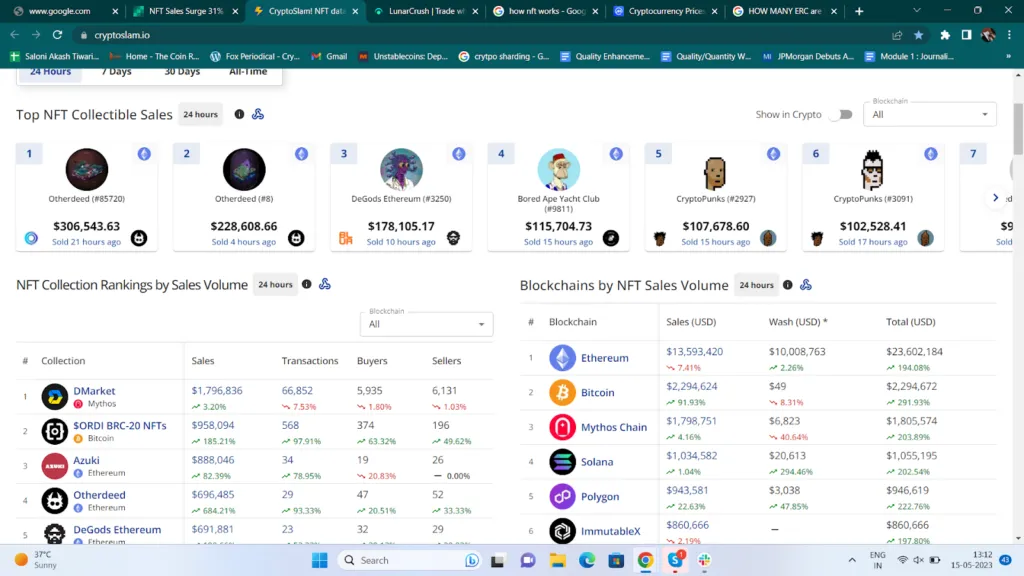

- 1 Otherdeed ranks on top in NFT sales in the last 24 hours.

- 2 The Increase is hiked to 31% in sales volume of the NFT market.

Weekly observations of the Non-fungible Token market state the rise of volume percentage of NFT. It’s been a rise of 31% in the market. The rankings show that Ethereum as said is the King of NFT. The sales values rank in no less million dollars where the artist through his creativity does earn from this online market. User-known NFTs can be

- Digital artwork.

- In-game items.

- Essays and articles.

- Virtual fashion items

- Tickets and coupons.

- Digital collectibles.

- Domain names.

The above-mentioned are the common NFTs through which the sellers gain or earn their profit. Ethereum as a whole ecosystem has been an improvised and well-accepted format of blockchain where the trades are vitally taking place by the buyers and sellers.

NFTs Sold – Rankers

The 24-hour updates of NFT collectible sales show the rankings. Otherdeed NFTs (O’NFTs) secured the first two positions. The latest news of the selling of the Otherdeed made a sale of $306,543.63 and the second highest went for $228,608.66. The DeGods Ethereum stood third with 4178,105.17 and Bored Ape Yacht Club in 4th Rank with $11,704.73. The last in the Top five rankers was CryptoPunks sold 15 hours ago before writing this article which amounted to $107,678.60.

Otherdeed became the star performer of the 24-hour time frame. Otherdeed’s equations and summations of the past day show that sales of These NFTs have seen a rise of 668.12% which in total accounted for $697,825.00. With a decrease in no. of owners the NFT toppers are left to be in total 19,303. But other Buyers’ percentage has increased by 45.16% and the sellers’ by 7.69%. Otherdeed’s collection of outstanding NFTs possesses all of the gaming features. Individually Otherdeed has a set of riches, but some are scarce which include Koda in it which is an acronym for Kid of Deaf Adult.

NFT Market – Workology

The NFT owners obtain their profits in either way of royalty or staking. Every time the NFT is sold the owner gets his share as ‘ Royalty’. On the other hand, staking is the part where an investor’s investment gets opened in the market. The exchanges have the digital currency format and these owners of NFTs or coins through their action open their funds for trade. In return, they get the interest on their investments. The amount of this investment is what makes the market formulate.

Smart contracts make NFT minting happen. Also, they do allocate and reallocate holding. Smart contracts reassign titles for NFTs on the condition that an NFT is being sold, ceding it from the old to a new purchaser. These NFTs have been a great sale if seen from the past date. The sales volume here for Mythos has been on a maximum hike. Bitcoin’s $ORDI BRC-20 ranked second. Taking the scenes of the top five here it’s clearly depicting the increased percentages of sales in the NFT market. The majority of coverage is on Ethereum undoubtedly. The maximum sales have gone to $1,796,836 even though the no. of transactions, buyers, and sellers had seen certain percentages of fall. Bitcoin on the other hand has given only an increased percentage and the increased no.

Bitcoin-Based NFT Sales attain crucial impetus. Bitcoin NFT sales have come up as an imperial supporter in the digital collectible sales landscape. The total accounts for 21 different blockchains in all.

thecoinrepublic.com

thecoinrepublic.com