- 1 Pudgy Penguins saw a steep decrease in the last 24 hours time period, though percentages were not very high.

- 2 Seed round with investor 1kx, Pudgy Penguin collected $9 million from this fundraiser.

Pudgy Penguin (PPG) is counterbalancing the effects of increasing raw material prices with 8,888 Pudgy Penguins located in a chilly Arctic region of the metaverse. It is going to rail the selling prices past its business tranche. The company foresees altogether recouping the cost hiking experienced since 2021, with continued price raise going to happen in 2023.

Towards the advancement of Web3 intellectual property, PPG has raised $9 million through a seed round with the lead investor 1kx (Blockchain angel fund). It helped the company to set up the financing round terms and decide its pre-money worth. It ranks 715th in general and 53rd in collectibles.

PPG Examining its Worth-Infrastructure via Seed Round

The telethon comes after a lead variation resulting in a heightened focus on intellectual property usage. In the seed round, usually, the lead investor in such processes communicates between the company and the rest of the other investors committing to investing themselves with equal justification.

PPG has raised $9 million in a seed round with lead investor 1kx. The in-demand NFT brand has expanded its IP since its launch in 2021 and procurement by Luca Netz (present CEO) in April 2022.

After a year of the Pudgy Penguins fundraising project, the founders were voted out reportedly for emptying treasury funds and defaulting to meet community aims. In April 2022, Luca Schnetzler (Netz) acquired the Pudgy Penguins rights worth $2.5 million with the assurance of building the brand, which involved licensing deals and social media crusade, and last December pushing the Non-Fungible Tokens to the unsurpassed high floor price.

Vi Powils, Investors Head, Pudgy Penguins, in a Press Release, expressed the thrilling feeling to be able to accomplish the strong energy, built in a bear market over the years. This breakthrough is an indication of the strategic partner’s outlook, acknowledged Pudgy Penguins is not only a Web3 brand for crypto-locals but also a within-reach IP for daily customers globally, along with an immensely talented batch of people.

Pudge Penguins has improvised and included events, the latest monetizing techniques, and utilizes their tokens and physical goods having Intellectual Property including others like books and toys.

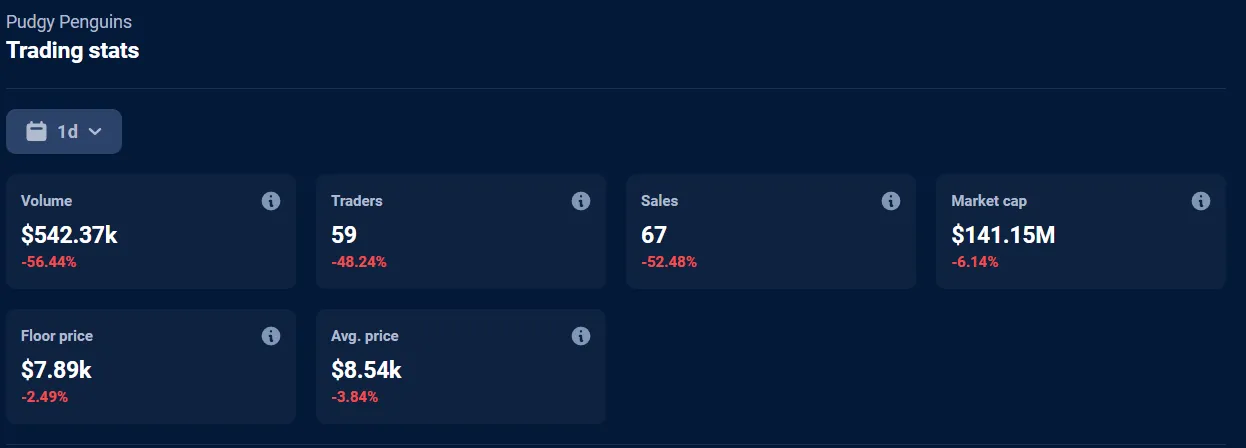

The present PPG market statistics reveal its time frame change since its last recording. Taking the time frame of 24 hours of its data the following changes have been seen on the Ethereum network of Pudgy Penguins.

The Volume of Pudgy Penguins faces a major decrease of 56.44% since the last 24 hours where the traders lessened by 48.24% in the same time frame. To be obvious traders will have a shortened sale and so sales were seen going down by 52.48%. The company’s Market Capitalization (MC) stood at $141.15 million which was 6.14% less than what it was before the day. The final value of Pudgy Penguins stood as-

- Volume – $542.37k

- Traders – 59

- Sales – 67

- Floor Price – $7.89k

- Average Price – $8.54k

Clearly, the business has seen a steep slope of downfall in various percentages which are often undesirable to any company’s management and authorities. Less market cap decreases cap stocks. Small-caps are more of riskier investments for the market investors, the more the market cap the less the risk survives. Also, it creates a mesmerizing effect on the investors regarding the companies with high MCs. The determining factors of the market; demand and supply make the stocks run. High demand increases the business of the company and hikes in MC show that’s how larger markets decide the company’s worth.

thecoinrepublic.com

thecoinrepublic.com