You can flip NFTs by participating in the mints of upcoming NFT projects, or by using NFT marketplaces to trade NFT collections that have already been released. Flipping NFTs refers to buying NFTs and selling the later at a higher price. In other words, it’s just a cooler way of saying “NFT trading”.

In this guide, we’ll provide an explanation of how to flip NFTs for beginners. Please keep in mind that just like other forms of trading, flipping NFTs comes with risks. You might lose a portion or the entirety of the funds you commit to a trade, so never invest more than you are willing to lose.

What do I need to start flipping NFTs?

The first thing you’ll need to do is decide which blockchain(s) you will use to trade NFTs. The most obvious choice is Ethereum, as it has the most active NFT ecosystem and is also the home of the most valuable and liquid NFT collections. However, there’s also lots of interesting NFT projects on other blockchains like Solana, Polygon and even Bitcoin.

After deciding which blockchain you will use, you’ll have to create an NFT wallet that you will use to buy NFTs and store them securely. Most popular cryptocurrency wallets can be used to also store NFTs, but make sure to check if your wallet of choice supports NFTs before you try to make any transactions.

In addition, you’ll have to fund your wallet with some crypto in order to pay for gas fees. Since NFTs are typically traded directly on the blockchain, you will have to pay a transaction fee every time you mint, buy and sell NFTs. If you’re planning to use Ethereum, make sure to send some ETH to the wallet you’re planning to use for your NFTs.

Now that we know what we need to get started, let’s explore the two main ways of flipping NFTs. You can participate in the minting of new NFT projects, or trade existing collections on NFT marketplaces.

NFT mint flipping

Most NFT collections have a minting process where interested users can mint their NFTs at a fixed price that’s set by the issuer of the NFT. In many cases, NFT collections implement a whitelisting process in an attempt to keep the mint as fair as possible.

Since most NFT collections implement randomness to some extent, you usually won’t know exactly what your NFT will look like after it’s minted. This adds some excitement to the minting process, as you could potentially get an NFT with very rare traits.

If there is no whitelisting or other restrictions to minting, tech-savvy users can create bots that will automatically scoop up a large amount of NFTs during the minting process. This results in an uneven distribution and can negatively affect the project’s future potential. Ideally, projects want their NFTs to be held by a large number of different users, as this creates powerful network effects that can ultimately make the collection more desirable.

Participating in NFT mints can be very lucrative if you have a good eye for identifying projects with a lot of potential. Typically, minting prices are not too excessive, so you can get very nice returns by selling your minted NFTs on a secondary marketplace later down the line.

For example, the minting price for a Bored Ape Yacht Club NFT was just 0.08 ETH. Currently, the floor price of the collection is 51.4 ETH. So, if you minted a Bored Ape Yacht Club NFT and held it until now, you would see a return of at least 642x by now (and even more if your NFT had rare traits).

Of course, the NFT collection needs to be in demand for you to realize any returns. There’s no shortage of NFTs that are trading below their mint price, so participating in mints is definitely not risk-free.

Secondary market NFT flipping

Flipping NFTs on secondary markets is more convenient than trying to mint NFT flips, as you don’t have to go through the hassle of finding upcoming mints and getting on whitelists. However, the potential returns of secondary market NFT flipping are often lower when compared to participating in NFT mints.

To flip NFTs on secondary markets, you simply use NFT marketplaces to buy NFTs from existing NFT collections that you think will gain value in the future. Here’s three NFT marketplaces that you can use to flip NFTs.

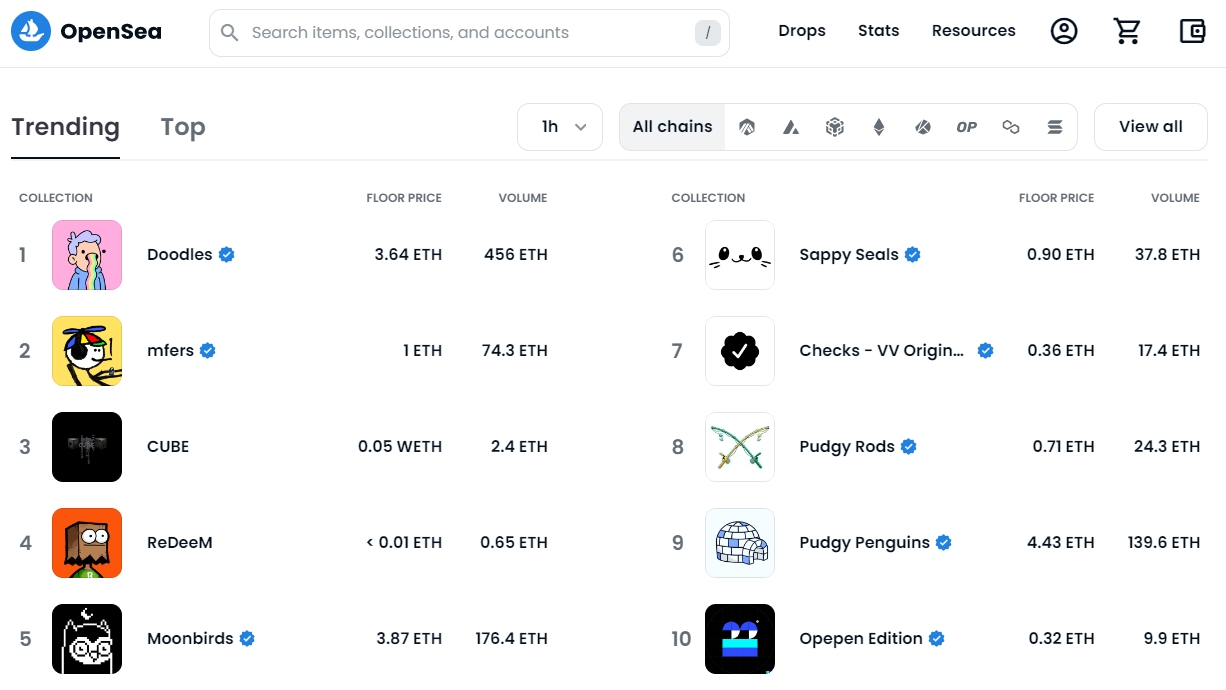

OpenSea

Although the competition is getting stiffer, OpenSea is still the leading NFT marketplace. The platform has set the standard for what NFT traders and collectors expect from an NFT marketplace.

On OpenSea, you can trade NFTs issued on the Ethereum, Polygon, Klaytn, Solana, Arbitrum, Optimism, Avalanche and BNB blockchains. This makes it an extremely versatile platform that’s suitable for anyone that’s looking to flip NFTs on multiple blockchains.

In addition, OpenSea makes it easy to explore trending NFT collections and sort them by trading volume, floor price, category and more. Due to the diversity of NFT collections listed on the platform, OpenSea is not just a great tool for trading NFTs, but also identifying NFT projects with potential.

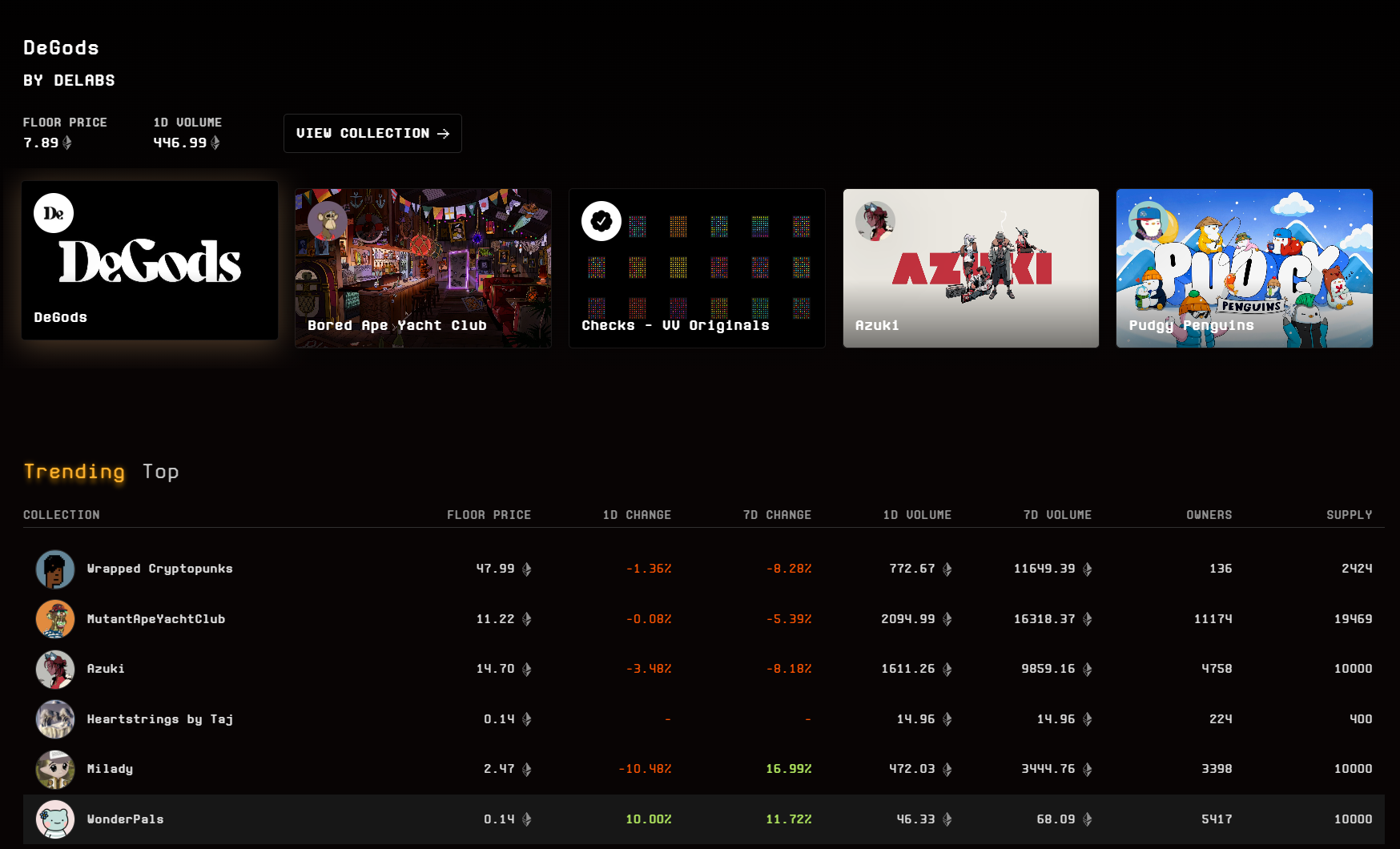

Blur

The Blur NFT marketplace is a relatively new entrant in the NFT space, as it launched in October 2022. However, Blur has already made a big splash and it has established itself as a credible competitor to OpenSea.

Blur is focused on speed, as it allows users to execute trades faster than what’s possible on competing marketplaces. It also implements a number of features designed for advanced traders. For example, Blur users can sweep an NFT collection’s floor on multiple NFT marketplaces at once. The platform also provides advanced analytics that makes it easy for NFT traders to have a comprehensive overview of their portfolio.

While OpenSea does not have its token, Blur has launched their own token called BLUR. The BLUR token is used in governance, giving holders a say in the future direction of the Blur marketplace. The token was distributed to users of the Blur marketplace, which gave it a large boost in activity.

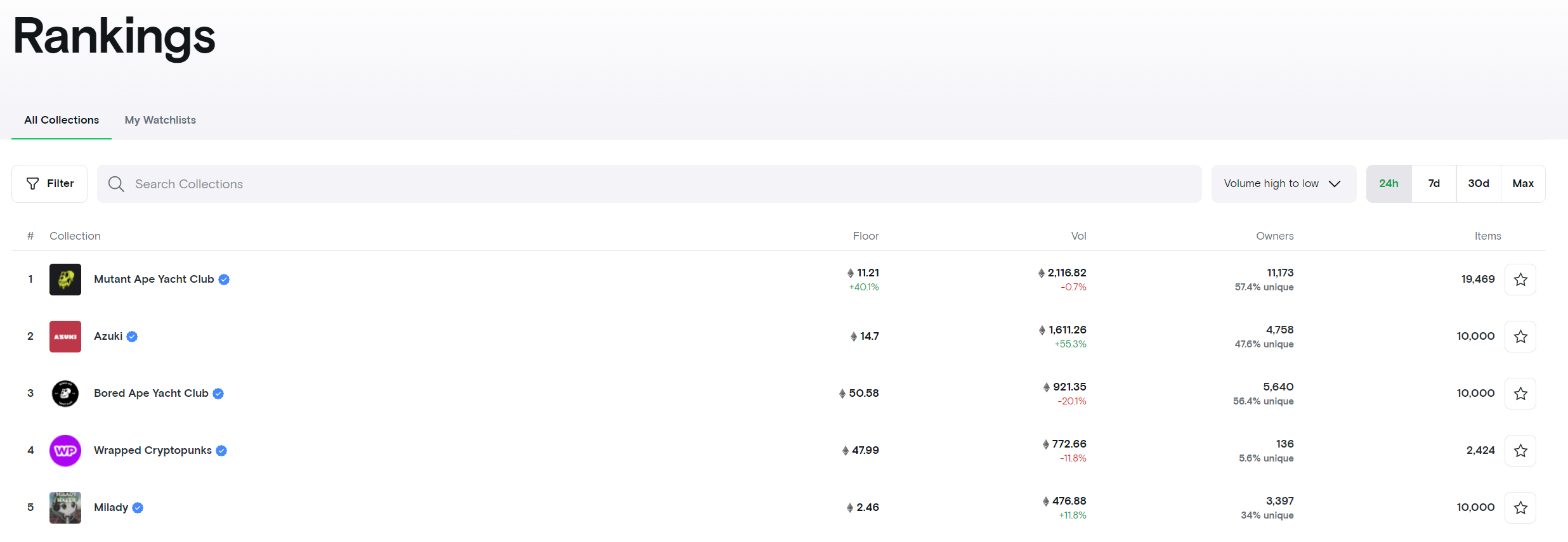

LooksRare

LooksRare is another NFT marketplace that’s attempting to compete with OpenSea by launching a token and distributing it to users.

LooksRare is designed as an NFT marketplace that’s owned by holders of the LOOKS token. Holders of LOOKS tokens can stake them to earn a portion of the trading fees collected by the LooksRare platform. In addition, users can also earn LOOKS tokens by trading NFTs on the LooksRare marketplace.

Overall, LooksRare provides a solid experience for trading and collecting NFTs and is especially worth checking out if you are interested in the way they have implemented the LOOKS token.

How to evaluate NFT projects?

When it comes to flipping NFTs, it’s key that you know how to evaluate NFT projects and identify potential red flags. Here are the areas you should focus on when evaluating whether an NFT project has what it takes to succeed.

Founders

An NFT project’s founding team can tell you a lot about how the future of the project is likely to pan out. In many cases, NFT project founders remain anonymous at first. However, you can still learn a lot about them by how they present themselves online.

Be wary of founders that spend a lot of time talking about how their collection is going to bring profits to its buyers. Such projects are usually just looking for a quick profit with the mint and tend to be abandoned shortly after.

Community members

In many ways, NFTs are status symbols that show the holder’s allegiance to a particular community. Top NFT projects usually count well-respected members of the crypto and blockchain community among their holders.

When looking at a project’s social media profiles, Discord and Telegram servers and other online platforms, keep an eye on the quality of their community. Communities that express a genuine interest in the project and its plans are usually much more likely to see success than communities that are filled with people only interested in a quick profit.

Low-quality projects will often resort to bots and fake accounts to promote themselves. If you see that the project is being discussed on social media primarily by accounts that look like bots or paid traffic, it’s best to stay away.

Quality of art

While the quality of art is subjective, it’s not too difficult to identify NFT projects that put a lot of effort in their art direction and have a visually distinctive style. An NFT project’s art is a key ingredient to its appeal. If you see a project where the art seems to just be an afterthought, it’s best to be careful.

For example, we’ve seen countless projects trying to imitate the success of Bored Ape Yacht Club by releasing ape-themed NFT collections with low-quality art. Generally speaking, such copycat projects are typically forgotten about very quickly and never reach significant valuations.

NFT utility

When evaluating an NFT project, it’s important to consider whether the NFTs have any additional utility that could positively impact their value.

On the other hand, you should be wary of projects that promise too much utility to holders of their NFTs. Unrealistic promises only lead to disappointment down the line, and you don’t want to be holding NFTs from a project that’s known for not living up to its hype. In the NFT space, a project’s reputation can degrade very quickly, which is usually also negatively reflected in the value of their NFTs.

In addition, an NFT having no extra utility is not necessarily a red flag. For example, when CryptoPunks were released in 2017, they didn’t have any utility other than being cool-looking avatars stored on the blockchain. Despite this, CryptoPunks became one of the most expensive and iconic NFT collections out there.

The bottom line — Flipping NFTs can be lucrative, but requires time and effort

While the process of buying and selling NFTs is very straightforward, making a profit is another story. The NFT markets are very unpredictable, and identifying projects with potential requires a pretty diverse set of skills. You have to be able to evaluate art, be on the lookout for red flags, and also need to have your finger on the pulse of the prevailing sentiment and culture in the crypto and blockchain space.

Instead of trying to buy and sell NFTs right away, a good first step would be to simply immerse yourself in the NFT community on Twitter, join Discord and Telegram channels related to NFT projects you are interested in, and simply observe and discuss with other community members. This will help you get a sense of the latest trends in the NFT space and it will also give you an understanding of what successful NFT projects look like in their early stages.

If you want to get started with NFTs but don't want to take on risks, you can try to find free NFT drops. While you shouldn't expect to make profits with free drops, you'll gain some valuable experience. If you're not looking to commit too much money, you can also check out some cheap NFTs to collect and trade.

coincodex.com

coincodex.com