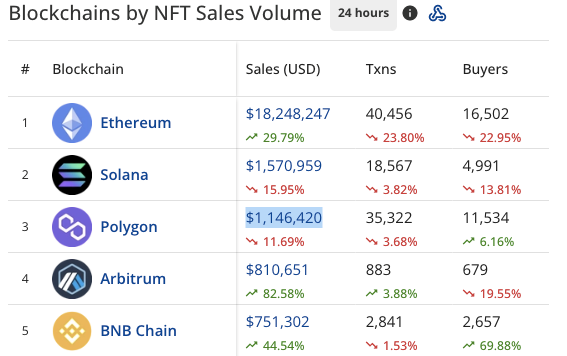

Polygon (MATIC) has lost ground to Solana ($SOL) in $NFT sales volume, bringing Solana to second place on the leaderboard. With a staggering 11.69% drop in the previous 24 hours, Polygon’s sales volume has set down to $1,146,420, establishing Solana as a major participant in the rapidly developing $NFT sector, according to Cryptoslam data.

The second-placed stock, Solana, has a sales volume of $1,570,959. Ethereum continues to rank first in terms of $NFT sales volume. As Solana transforms the $NFT market, this most recent event substantially changes the on-chain mentality.

Given the platform’s relative youth, Solana’s rise to the top of the $NFT sales volume chart is unquestionably an impressive accomplishment, according to market watchers on Twitter. The significant increase in sales volume is evidence of Solana’s success in using the Ethereum network’s dependability while tackling scalability difficulties.

Additionally, it is anticipated that the platform will continue to see a spike in sales due to the rising demand for NFTs, reaffirming its status as a game-changer in the $NFT industry.

In other related reports, the well-known social networking site Reddit released its most recent $NFT collection on Polygon, including thousands of original digital artworks created by over 100 gifted artists. The third generation of Reddit’s NFTs promises to be the biggest and best one yet. The collection is now more widely available to the $NFT community thanks to the transition to Polygon, creating new options for collectors and artists.

At press time, $SOL trades at $24.11, a 1.1% surge in the past 24 hours, according to data from CoinMarketCap. On the other hand, Polygon’s MATIC is changing hands at $1.11, a 1.95% gain in the same timeframe.

Disclaimer: The views and opinions, as well as all the information shared in this news piece, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

coinedition.com

coinedition.com