While current non-fungible token ($NFT) market conditions are far from where they were at the height of the bull market, $NFT traders continue to fervently pump money into the ecosystem. Established projects, such as Bored Ape Yacht Club (BAYC) and Azuki, have maintained trading momentum by releasing new products, while other lesser-known creators have taken advantage of mechanics including open edition mints and dynamic NFTs to spark intrigue.

Still, major brand deals and high-ticket $NFT sales have slowed, and new projects finding widespread appeal are few and far between in 2023. In recent months we’ve seen an uptick of projects that reference meme culture and current events, including Jack Butcher’s popular Checks VV and Mason Rothschild’s This Artwork is Subject to Change, though other meme projects that once captivated traders, like Art Gobblers and Goblintown, have experienced a steady decline in trading.

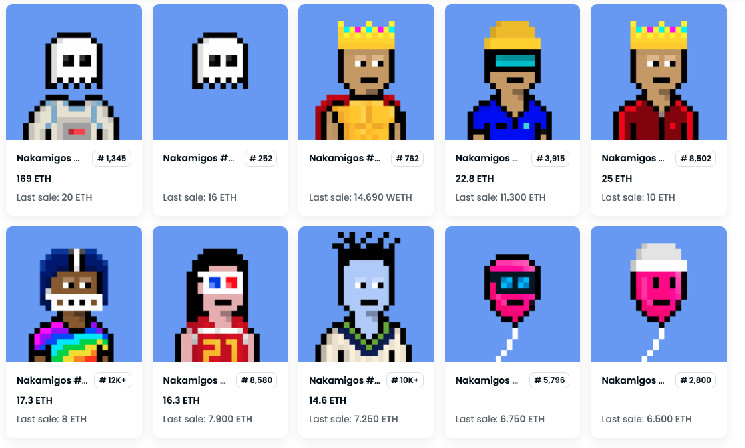

With this context in mind, the overnight success of Nakamigos, a 20,000-edition $NFT project featuring pixelated avatars, has bewildered some analysts and traders. Launched last month, the project taps into the name of Bitcoin’s pseudonymous creator, Satoshi Nakamoto, and added the Spanish word for friend “amigo” to create Nakamigos, and leveraged art for the collection that nods at the pixelated profile picture (PFP) collection CryptoPunks. Nakamigos quickly gained popularity and reportedly outpaced Bored Ape Yacht Club in the number of lifetime trades within days of its mint. At the time of writing, the project has done 21,035 ether ($ETH) in trading, or about $39 million, and has a floor price of 0.5 $ETH, or about $930.

Soon after Nakamigos’ successful launch, several derivative projects referencing Nakamigos began to crop up, including Nakamigas, a series of female-presenting pixelated avatars, and Magamigos, a collection of 5,000 pixelated avatars depicting former President Donald Trump in the wake of his indictment.

These projects offer onlookers a lesson in understanding $NFT trends in real time. And while the $NFT market welcomes a boost in trading volume brought about by new, hyped-up projects, the impact usually remains short term and follows a familiar playbook of copycat projects glomming onto a trend.

Understanding the Nakamigos hype cycle

Nakamigos was created in March 2023 by an anonymous collective called HiFo Labs. Little is known about the project’s founders, although according to a blog post it was created by an “‘OG’ crypto artist with many years of experience in digital art.” Rumors spread that the project was connected to CryptoPunks creator Larva Labs because of its aesthetic, though its founders quickly shut down the idea.

The collection grants holders full commercial rights to their characters. Early on, the project partnered with $NFT influencer Sartoshi, creator of the popular mfers $NFT collection, on marketing, allowing holders of the end of Sartoshi (eos) $NFT collection to claim free Nakamigos at mint.

The project’s enormous growth in such a short span of time is likely tied to clever marketing and its connection to Sartoshi. In a public stunt, the Nakamigos team gifted 24 NFTs to major crypto influencers including Art Blocks creator Erick Calderon, $NFT trader DJ Seedphrase and artist XCOPY that were created in their likeness, going as far as to amplify the act via a paid exposure campaign.

Notably, $NFT artist Beeple, who has a history of parodying projects and pop culture in his own work, pledged to create “chapter 2” for Nakamigos if its floor price hit 1 $ETH. As of writing, it hasn't.

It’s unclear if Nakamigos will offer greater utility or long-term value for holders that swept up these NFTs in a frenzy. In any case, it provides a glimpse into how new $NFT projects can seduce traders and cement their projects into memedome.

“The rise of Nakamigos is a prime example of how marketing can have a significant impact on the value of these digital assets,” writes DappRadar. “Nakamigos’ successful marketing strategy leveraging Twitter influencers has driven demand and sales despite the project not having any concrete plans at the moment.”

Magamigos and the shady world of derivative NFTs

The proliferation of meme projects can be good for the $NFT ecosystem – we’ve seen sporadic spikes in trading volume and sales over the last few months, according to Nansen. But as our proclivity for hype takes hold, opportunistic sellers will often clutter the space with low-brow derivative projects that are often devoid of long-term value, or worse, end up being a rug pull.

In the hours after former President Donald Trump was arraigned in New York on Tuesday afternoon, his Trump Digital Trading Card collection experienced a brief jump in sales following months of stagnant trading. The project, which has done over 13,432 $ETH (about $25 million) in trading since its release in December, has been able to capitalize on its cultural relevance and attachment to the 45th U.S. president, despite its shady origins, reliance on stock imagery and so far unfulfilled promises of prizes like a zoom call with Trump or dinner at Mar-a-Lago, neither of which have happened.

The Trump Digital Trading Card project has since inspired other meme $NFT collections that cannibalize its trendiness: There are Trump Criminal Digital Cards that depict the former president in a prison uniform, Donald Trump Yacht Club, which takes inspiration from BAYC, MagaPunk, a collection of CryptoPunk-like characters with Trump-like traits. And the list goes on.

Magamigos, which takes elements of the Nakamigos art style and the Trump Trading Cards traits, minted in the hours following Trump’s arraignment and quickly made its way to OpenSea’s trending page with the tagline “Make NFTs Great Again,” a nod to Trump’s MAGA base.

Despite the fact that Magamigos doesn’t have a website, let alone a white paper or road map, and seems to offer no utility for holders, the project managed to secure 150 $ETH in trading volume, or about $279,000. Its Twitter account, which launched moments before its mint, even conducted a giveaway for a Nakamigos $NFT, which garnered dozens of comments and likes.

There are projects, like Checks VV, that have encouraged and even promoted derivative projects as a marketing tool. Humanity Checks, an open-edition $NFT collection in the same style as creator Jack Butcher’s original Checks VV, was created to raise funds for Doctors Without Borders following the destructive earthquake in Turkey and Syria in February.

But other projects have used their resemblance to legitimate projects to scam unsuspecting collectors. In January 2022, after the success of $NFT giant Yuga Labs’ Mutant Ape Yacht Club (MAYC) collection, $NFT creator Aurelian Michel created the Mutant Ape Planet collection, featuring a familiar name and monkey-themed PFPs. But shortly after, Michel was arrested by French authorities for facilitating a $2.9 million rug pull after he failed to deliver on any of the many promises made about the collection.

Doing it for the memes

The nature of internet memes is that they have a short lifespan of going viral that produces brief but meteoric results. In some ways, the fleeting nature is partially what drives people to continue producing memes, keeping internet culture thriving.

It’s the same internet culture of memes that has inspired popular cryptocurrencies (aka meme coins) such as dogecoin and shiba inu coin and popularized crypto slang like HODL and gm, and even inspired celebrities to add “laser eyes” to their Twitter profile pictures to signal an allegiance to bitcoin.

Not all memes are bad. Pepe the Frog, for example, has been transformed from a racist dog whistle into an emblem of crypto resilience and has been splattered across many $NFT projects.

Sergio Silva, senior director of business development at crypto custody firm Fireblocks and creator of meme-driven $NFT collection Seize the Meebs, told CoinDesk that in order to understand the intersection of memes and crypto, it’s necessary to revisit the definition of a meme.

“A meme is this idea that through its virality, it becomes socially accepted that it represents something,” said Silva. “In the world that we live in with $NFT communities mostly congregating around visual objects or JPEGs, memes in crypto become different illustrations of different things that we are constantly repeating to ourselves, which we are using whether we do it consciously or subconsciously to propagate the culture.”

Silva said the nature of memes being entertaining and easy to understand create a “double-edged sword” in the $NFT space.

On one end, the highly speculative nature of digital assets that are tethered to memes can create massive onboarding ramps for $NFT adoption, as non-natives who identify with the meme in a collection may finally feel a strong enough connection to buy their first $NFT. Trump’s Digital Trading Cards, for example, showed strong evidence that the majority of buyers at mint were purchasing their first $NFT. That said, it’s important to note these collections are often risky, with shaky road maps and uncertain deliverables that ultimately pump and dump by the time internet users are already eyeing their next meme.

On the other end of the sword, without memes $NFT markets would operate much differently. Communities wouldn’t be brought together around the shared love of an internet trend and, instead, celebrities might take the lead in pumping projects, which has previously been detrimental to adoption. In October, the Securities and Exchange Commission fined Kim Kardashian $1.2 million for promoting cryptocurrency ethereumMax and failing to disclose that she was compensated for doing so.

In the end, as much as the meme economy might drive money into $NFT markets, it's important to scrutinize collections that appear to rip off elements of other projects and fail to provide long-term solutions for building a more robust $NFT marketplace. As much as “hype” can help bolster the market, it's not enough to drive innovation and encourage folks to stick around for the long term.

coindesk.com

coindesk.com