Blockchain data platform Dappradar released a report on Wednesday exploring the aftermath of the Silicon Valley Bank (SVB) collapse and its impact on non-fungible token ($NFT) trading activity and volume.

On March 10, California state regulators seized startup-focused Silicon Valley Bank due to liquidity concerns, handing it off to the Federal Deposit Insurance Corporation (FDIC). On March 13, the FDIC said it would help bank customers access their funds, as the regulatory agency attempts to auction off the insolvent bank. Many investors who held digital assets from companies that had exposure to the bank made moves to offload their assets.

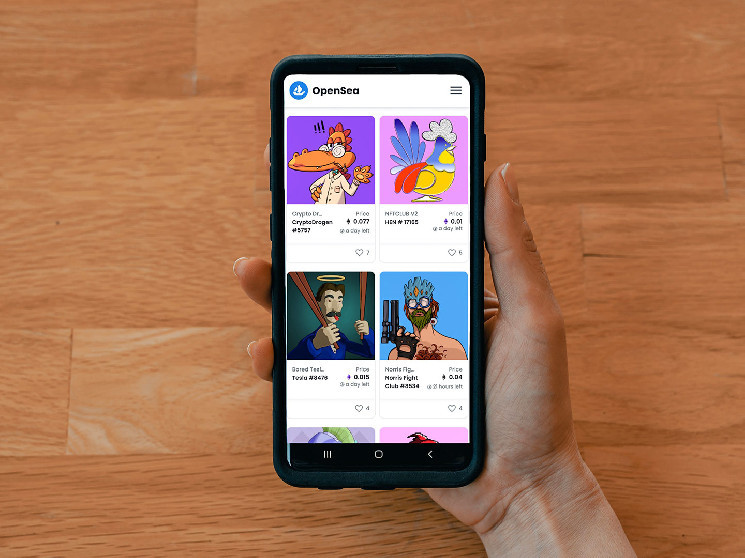

According to Dappradar, there were only 12,000 active $NFT traders on Saturday, March 11 – the day after the bank was shut down – a number not seen since November 2021. Saturday also saw the lowest number of single $NFT trades in 2023 thus far, totaling 33,112.

Since the beginning of March, $NFT trading volumes have fallen 51%, with sales declining about 16%, Dappradar says.

However, not all $NFT collections were impacted in the same way. Projects from $NFT giant Yuga Labs, including Bored Ape Yacht Club and CryptoPunks, saw their floor prices dip slightly on Saturday but quickly recovered. One Twitter user compared CryptoPunks to USDC, claiming it was more stable than the stablecoin, which lost its peg to the U.S. dollar after SVB’s collapse.

Sara Gherghelas, a research analyst at DappRadar, told CoinDesk that Yuga Labs’ success has been amplified by its investment in CryptoPunks as well as its ability to build community. Although the company said it had limited exposure to SVB, its token holders did not make major moves on the news.

“They have a very clear roadmap, the team is visible, and they decided to deliver a good project after the Ape ecosystem,” said Gherghelas. “They keep building, they are showing that if you're part of their community, they have so many perks and benefits.”

Not all collections made it through the SVB collapse unscathed. Shortly after the news broke on March 10, Proof, the $NFT collective behind the popular collection Moonbirds, took to Twitter to share that the company had some funds invested in SVB, sparking uncertainty among holders.

Over the weekend, Moonbirds lost about 18% of its value, according to Dappradar. One whale sold 500 Moonbirds on March 11, incurring losses between 9% and 33% totaling over 700 ETH, or about $1.1 million.

Gherghelas told CoinDesk that while the news of Proof’s exposure to SVB contributed to uncertainty in the project, people were prompted to sell because of the company’s shortcomings in recent months. After canceling its Proof of Conference set to take place in May, the community has been left feeling uncertain about the company’s ability to keep its promises.

“People, users and consumers are becoming pickier and they don't want hype, they want the perks, the benefits and the utility behind that $NFT collection,” said Ghergelas.

coindesk.com

coindesk.com