Blur, the digital art startup that markets itself as the $NFT marketplace for pro traders, has managed to post some impressive numbers in the trading volume field. The platform has dethroned industry leader Opensea in terms of daily trading volume and has held the top spot for more than a month now.

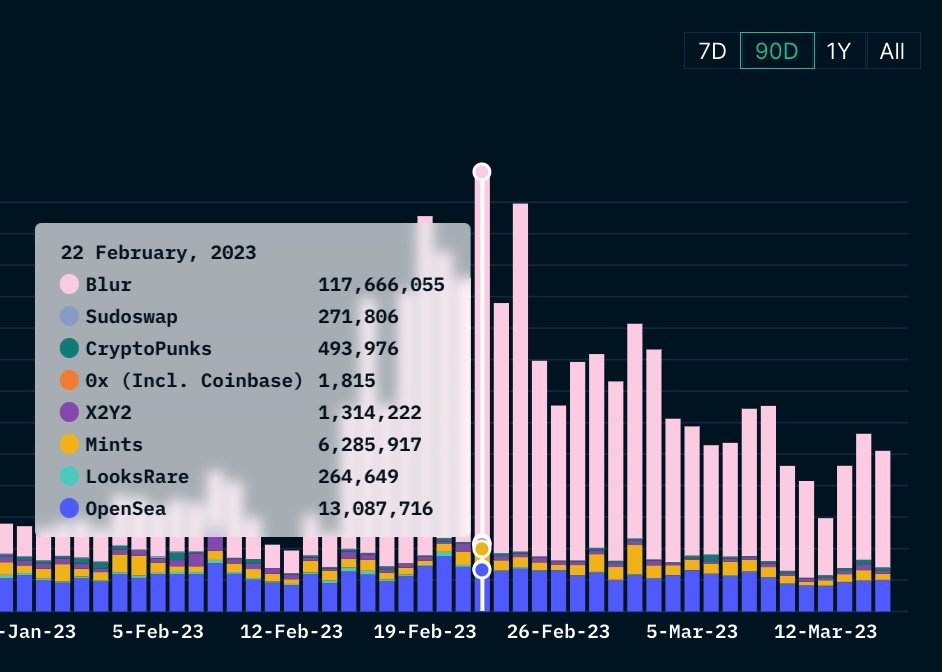

According to data compiled by on-chain analytics firm Nansen, Blur’s daily trading volume peaked at a whopping $117.7 million on February 22. OpenSea’s volume came in at a little more than $13 million at the time, meaning that Blur’s volume was about nine times that of Opensea.

Nansen compared the top ten most traded $NFT collections of all-time on Blur and OpenSea. Mutant Ape Yacht Club was the most traded $NFT collection on Blur, with a trading volume of 230,226 $ETH. As for OpenSea, Yuga Labs’ flagship $NFT line, the Bored Ape Yacht Club, was the most traded collection with a volume of 697,154 $ETH.

The trading volume data concluded that Blur achieved 46% of OpenSea’s volume in less than five months, an amazing feat for a relatively new $NFT marketplace. It is important to note that the data compiled by Nansen filtered out wash trades when calculating the trading volumes of both marketplaces.

The growth of Blur in terms of trading volume and market share has failed to reflect in the performance of its native token $BLUR. On the day of the $NFT marketplace’s highest daily trading volume, $BLUR was trading at $1.08. The token has since lost more than 44% of its value and is currently trading at $0.60.

coinedition.com

coinedition.com