New data from @NFTStatistics shows a unique dynamic emerging within the $NFT space.

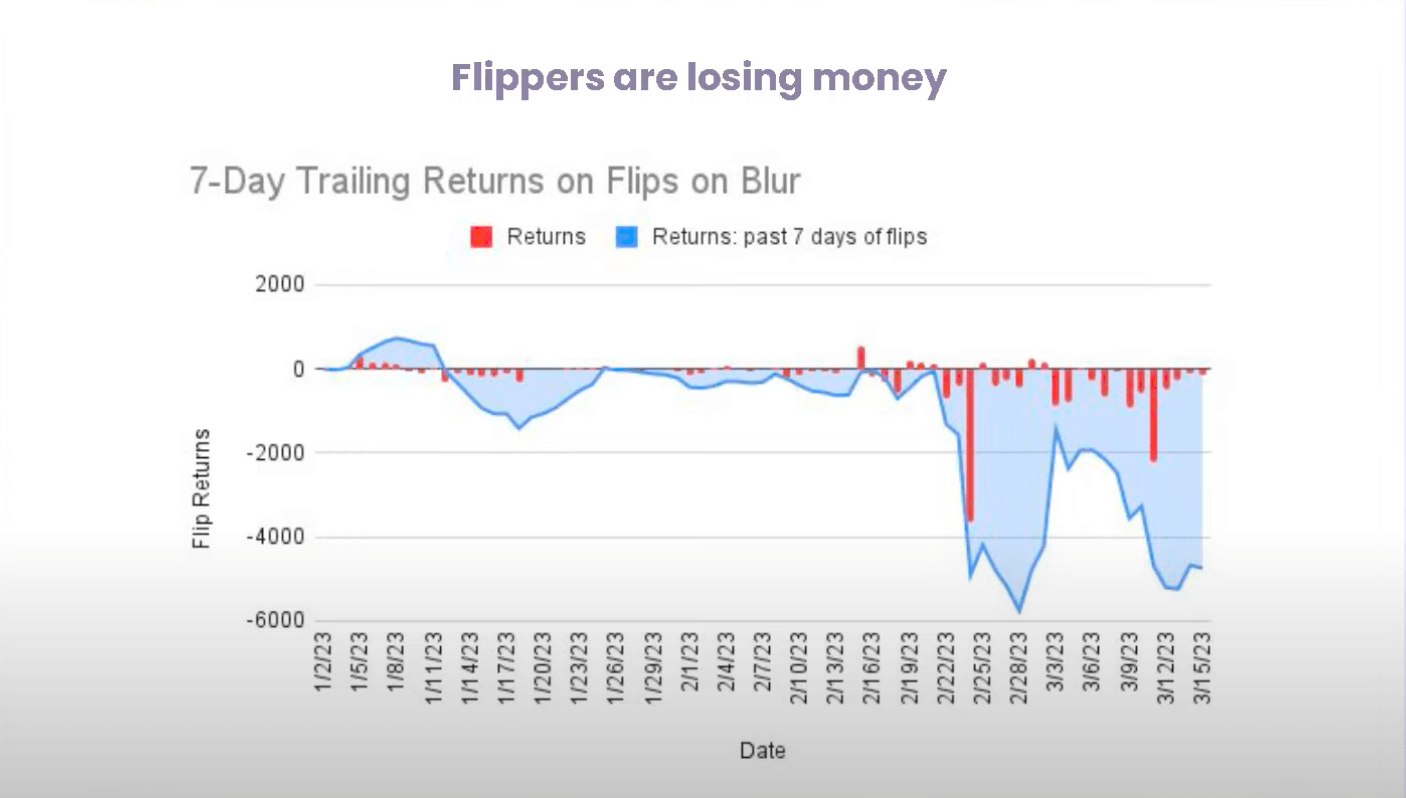

Data shows that as $NFT flipping has increased with the market upswing, flippers are now losing 4,000 $ETH per week over the past two weeks, which has baffled market watchers.

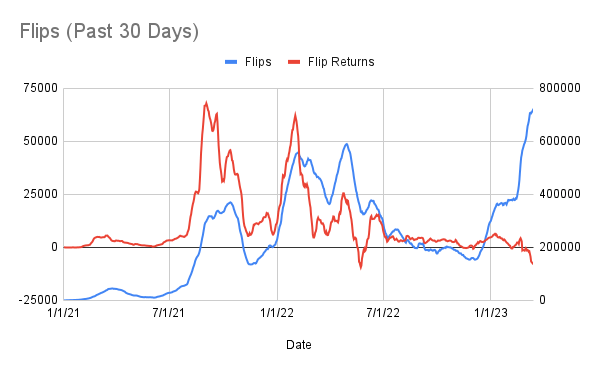

Currently, the opposite is true, says @NFTStatistics. The 30-day period has seen the highest number of flips ever recorded. However, he notes that despite this, losses from these flips are approaching historic highs.

$NFT flippers losing money

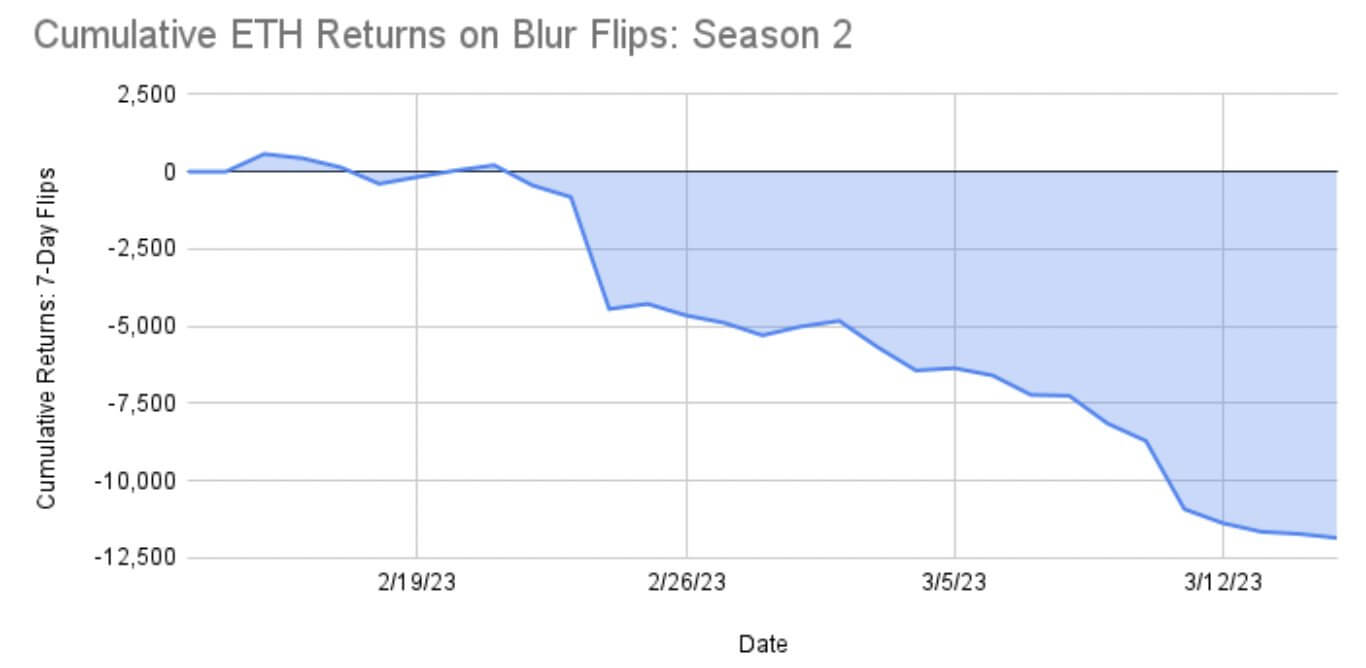

Moreover, @NFTStatistics shows using on-chain data that flippers have lost over 12,000 $ETH so far on Blur trades in the last month, which he speculates may be in anticipation of the Season 2 token unlock — with listings accruing value in BLUR token based on their listed value.

@NFTStatistics postulates that the losses can be attributed to the downward trend of the market, and adds that volumes of trading have resulted in high gas fees and royalties, adding to the losses.

Additionally, @NFTStatistics said $NFT holders have been dumping their assets onto bidders, contributing to the losses incurred by flippers.

Other notable $NFT news this week:

- Meta, Instagram and Facebook have decided to wind down their $NFT offerings 6 months after their debut.

- Manifold offers paid burns, the new feature allows creators to choose whether to add an option fee on top of a burn redemption per edition minted, with 100% of funds being diverted to creator.

- Salesforce is tapping into NFTs through a suite of customer offerings designed to help integrate with cloud computing.

- Yuga Labs continues to expand the Bored Ape ecosystem with new Sewer Pass NFTs, alongside a generative drop and an Ordinals one too.

- Sotheby’s announced on March 15 a swanky new $NFT exhibition and auction opening at its Paris location March 17-24, inspired by the “Oddly Satisfying” subreddit, it features meme-inspired art works by the likes of Anyma, Beeple, Lucas Zanotto and Josh Pierce.

cryptoslate.com

cryptoslate.com