Recently-launched $NFT marketplace Blur has surpassed OpenSea, the largest $NFT marketplace in the world, in terms of trading volume over the past month. However, an analysis of those trades has revealed that wash trading is rampant on the platform, accounting for almost half of all transactions occurring over the past 30 days.

How Blur Won Over OpenSea

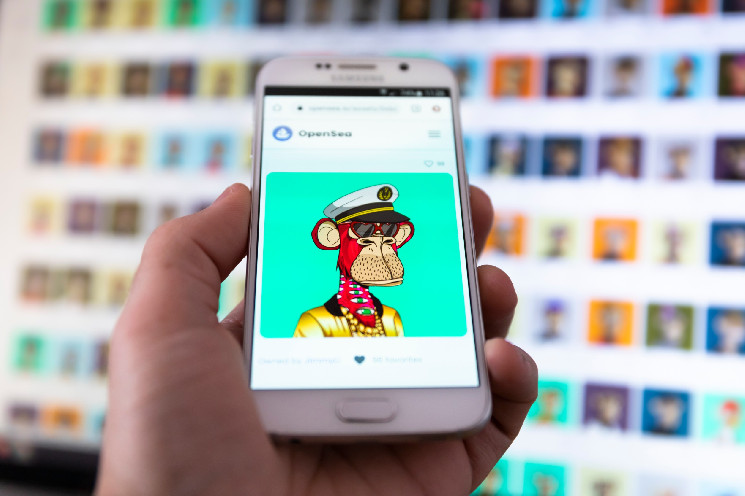

Blur is an $NFT marketplace and aggregator launched in October last year. The platform caters to professional traders, offering sophisticated trading tools and features such as zero marketplace fees, optional royalty payments, portfolio analysis, sweeping and sniping tools for $NFT purchases, collection depth charts, real-time data updates, and more.

The $NFT marketplace has also become the #1 trading platform in terms of volume. Blur has been outperforming OpenSea since December but has accelerated its lead in relative volume over the past few days, data DappRadar shows.

More specifically, Blur has registered more than $1.35 billion in trading volume over the past month. OpenSea’s trading volume is around $482 million, or one-third of Blur’s volume.

Aside from its key features, Blur’s token incentive has also played a key role in helping the marketplace claim the top spot as the largest $NFT marketplace by trading volume. On February 14, the marketplace announced its long-anticipated airdrop of $BLUR tokens to reward $NFT traders.

Shortly after, Blur revealed that it plans to airdrop some 300 million tokens to loyal users. “What’s the secret to maximizing rewards? Loyalty,” the marketplace said in a February 22 tweet. “Users with 100% loyalty have the highest chances of Mythical Care Packages, which are worth 100x Uncommon Care Packages.”

300M+ $BLUR will be distributed to the community in Season 2.

— Blur (@blur_io) February 21, 2023

What’s the secret to maximizing rewards? Loyalty.

Users with 100% loyalty have the highest chances of Mythical Care Packages, which are worth 100x Uncommon Care Packages.

Here are 3 ways to maximize your loyalty👇 pic.twitter.com/Cgiemrvpxh

Wash Trading Surged on Blur Following Airdop Incentive

Following the announcement of its token incentive, Blur saw a steep rise in wash trading as users tried to boost their allocation of the upcoming token airdrop, according to $NFT data aggregator CryptoSlam. The company detailed that it has identified around $500 million worth of wash trades.

“We’re taking action to remove nearly $500 Million in wash trades, retroactively as well as applying an updated algorithm to prevent future wash trades,” CryptoSlam said in a recent tweet. The platform noted that the current behavior is similar to when LooksRare saw around $8 billion in wash trading last year.

Notably, a dashboard by Dune Analytics shows a much smaller percentage of wash trading on Blur. The dashboard estimates that wash trading accounts for around 13.64% of Blur’s trading volume or just over $175 million over the past month.

Wash trading, which is illegal in the traditional finance sector, is the practice of a user serving as both the buyer and seller in a transaction. Wash trading remains a gray area in the unregulated crypto market, specifically in the $NFT space.

Data by Dune Analytics shows that more than 42% of all $NFT trades were wash-trades, worth around $31.1 billion. LooksRare continues to see most wash trades, constituting around 95% of all trades on the platform.

tokenist.com

tokenist.com