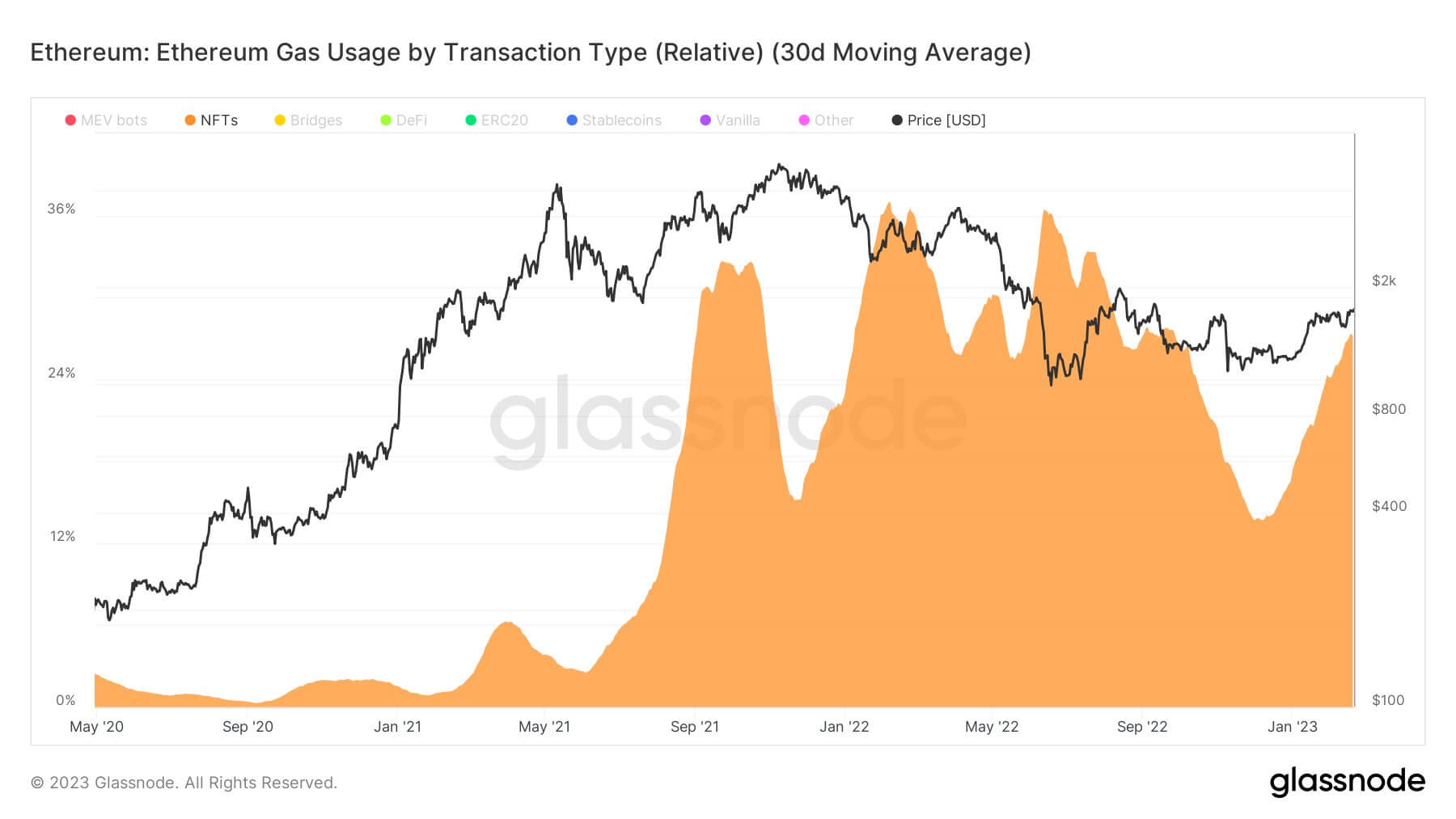

A new chart looking at Ethereum gas usage by transaction type relative to a 30-day moving average shows that NFTs now make up for 27% of ETH gas usage, up from around 15% towards the end of 2022.

In Ethereum, gas is the unit of measurement that determines the amount of work needed to execute a transaction or smart contract on the Ethereum network. The gas price is denominated in Gwei, a subunit of Ether.

The amount of gas used in Ethereum transactions varies depending on the type of transaction. For example, simple transactions, like sending Ether from one account to another, require less gas than complex smart contract executions or multi-sig authentications.

NFTs, or non-fungible tokens, are a type of digital asset that represents ownership of a unique item or piece of content, such as artwork or gaming collectibles. NFTs have become increasingly popular on the Ethereum network, and according to recent data, they now account for a significant portion of Ethereum’s total gas usage, 27%.

However, a new market competitor has recently upended the NFT marketplace, which analysts point to as a reason behind the recent surge in NFTs as a percentage of ETH gas usage.

How Blur is starting to siphon ETH gas

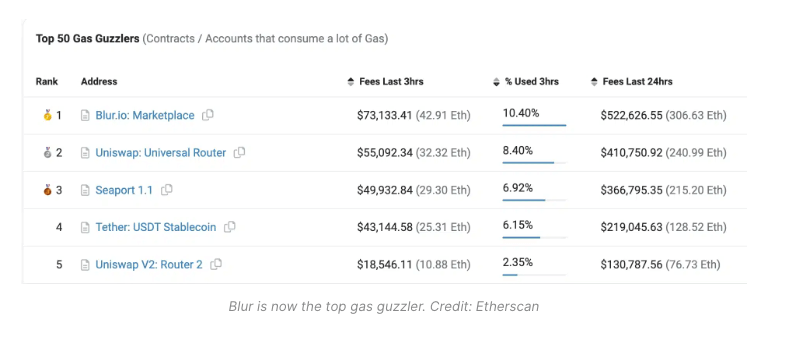

This week, Blur, a new NFT marketplace, achieved a significant milestone by surpassing OpenSea in daily NFT trading volume, and has now surpassed UniSwap and Seaport to become the leading “Gas Guzzler” on the Ethereum network.

On Wednesday, February 15, Blur’s daily trade volume reached 6,602 ETH, exceeding OpenSea’s 5,649 ETH for the first time. This accomplishment has resulted in soaring Ethereum gas fees due to the surge in trade activity.

According to Crunchbase, Blur has a valuation of $1 billion, funded by Paradigm, Coinbase Ventures & E-GIRL Capital to the tune of $11 million in seed funding in its initial round in Mar. 2022.

Blur offers its users attractive benefits such as zero trading fees, a key factor likely contributing to the increase in gas usage.

The platform released its native token, BLUR, on February 15 and rewarded its most active users with token airdrops. The airdrop resulted in a significant surge in Blur’s trading volumes, albeit an 84% decline in price. The platform airdropped a total of 360 million BLUR tokens as of yesterday set an all-time high for its own trading volume of $1.59 billion.

According to DappRadar, Blur has surpassed OpenSea in both 7-day ($435.24 million) and 30-day trading volume ($711.83 million).

cryptoslate.com

cryptoslate.com