- Ethereum $NFT volume has more than doubled in just one week.

- Blur generated a whopping $460 million worth of Ethereum $NFT trades over the last week.

- $BLUR is trading hands at $1.22 after a 4.25% drop in price.

Ethereum $NFT volume has more than doubled over the last week. This could mostly be because Blur made investors focus on the $NFT industry because of its rewards model and after overtaking OpenSea.

DappRadar reported that Blur generated a whopping $460 million worth of Ethereum $NFT trades over the last week alone, which is a more than 360% increase over this same time period.

On the other hand, OpenSea only saw a 12% increase in trading volume over the same time, which amounts to about $107 million. X2Y2’s $11 million over the same time period is dwarfed by Blur and OpenSea.

The surge in volume comes during a week in which Blur airdropped its $BLUR governance token to $NFT traders who earned rewards through the marketplace. Adding fuel to this buying and selling fire is the fact that Blur is testing its next Season 2 token airdrop.

Traders that put in a bid close to the floor price of a popular project will maximize their eventual rewards. As a result, people are now both buying and selling in bulk as a result.

In response to Blur’s recent success, OpenSea announced on Friday that it has temporarily cut its 2.5% market fee. This means that OpenSea will basically be going “zero fee” in an attempt to gain some competitive edge over Blur.

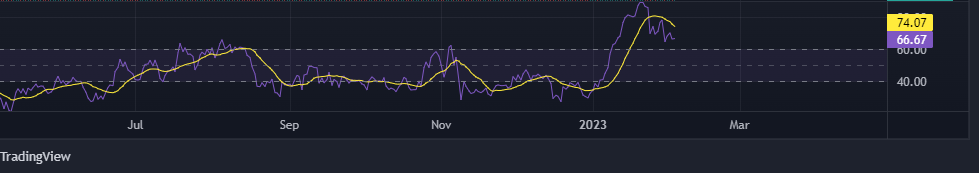

The success of the past week is not reflected in the price of $BLUR at the moment. The crypto is trading hands at $1.22 after a 4.25% drop in price over the last 24 hours. In addition to this, $BLUR is also down by more than 75% over the last week.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

coinedition.com

coinedition.com