Trading activity on NFT marketplace Blur has again hit record levels, this time days after finishing its initial incentive scheme with a final crypto airdrop.

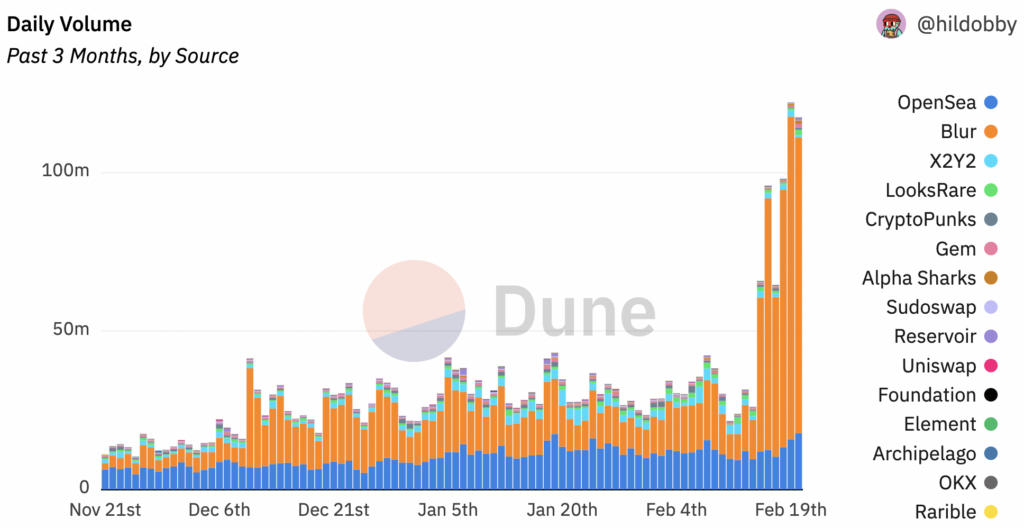

Blur processed NFT trades worth more than $101 million on Sunday, its highest ever daily volume, per Dune user hildobby’s dashboard. That beat its previous $81.3 million record set one day earlier.

The platform rewarded early users with their third and final airdrop on Feb. 14 — points scaled to their trading activities — which could then be converted to a new cryptocurrency BLUR on the same day.

Since then, Blur has seen more than five times the trade volume as incumbent marketplace OpenSea, even without token incentives. Blur processed $455 million in NFT trades between Feb. 15 and Feb. 20 to OpenSea’s $81.4 million.

The marketplace consistently topped the rankings in terms of trade activity and market share while the incentive scheme was active, and it seems that trend is continuing.

Blur’s total weekly market share, based on trade volumes, is sitting steady at about 80% versus next in line OpenSea’s 16%. The start of the month saw Blur and OpenSea at 46% and 36% of the total market, respectively.

Unlike straightforward venues like OpenSea, Blur doubles as a marketplace aggregator. Blur enables NFT trading across a variety of platforms under a single UI, including its own.

Although, questions loom over the authenticity of some of Blur’s volumes, which have been linked to wash trading.

Another dashboard calculates about 12% of Blur’s historic volumes were phony, compared to 2.03% of OpenSea’s (Blur indirectly acknowledged wash trading on the platform in a tweet last week, and Blockworks has reached out for comment).

OpenSea hopes low fee NFT trades will help compete with Blur

Blur’s trade volumes are holding up in any case, but its brand-new token BLUR has so far struggled to retest highs set just after launch.

BLUR set a price record beyond $5 shortly after it first appeared on crypto exchanges. It quickly dropped more than 75%, now hovering around $1.20, with volatility mapping previous crypto airdrops.

Token incentives aside, the platform also encouraged traders to adopt the platform by promising zero fees on trades, which effectively eradicated royalty payments to NFT creators. The move made Blur-listed NFTs cheaper than its competitors, echoing SudoSwap’s strategy.

Last week, OpenSea hit back by temporarily reducing its own fees to zero and making royalty fees optional (with a minimum of 0.5%). The platform also removed restrictions that forced some creators away from rival marketplaces with similarly low fee structures.

Andrii Yasinetsky, CEO of NFT data firm Mnemonic, told Blockworks that OpenSea’s Gem, which it acquired last year, is expected to eventually provide the same functionality as platforms such as Blur — cheap and quick trades for “pro” users interested in handling high volumes.

“If you remove Blur’s token from the equation you get OpenSea in terms of business fundamentals,” he said. “That is not to say that there will be no NFT trading in the future, but rather I don’t think it’s going to be the primary use case.”

David Canellis contributed reporting.

blockworks.co

blockworks.co