Blur has been growing by leaps and bounds. In a major milestone for the platform, this new NFT marketplace has overtaken OpenSea in daily NFT trading volume. Blur’s daily trade volume reached 6,602 ETH on February 15, surpassing OpenSea’s 5,649 ETH for the first time.

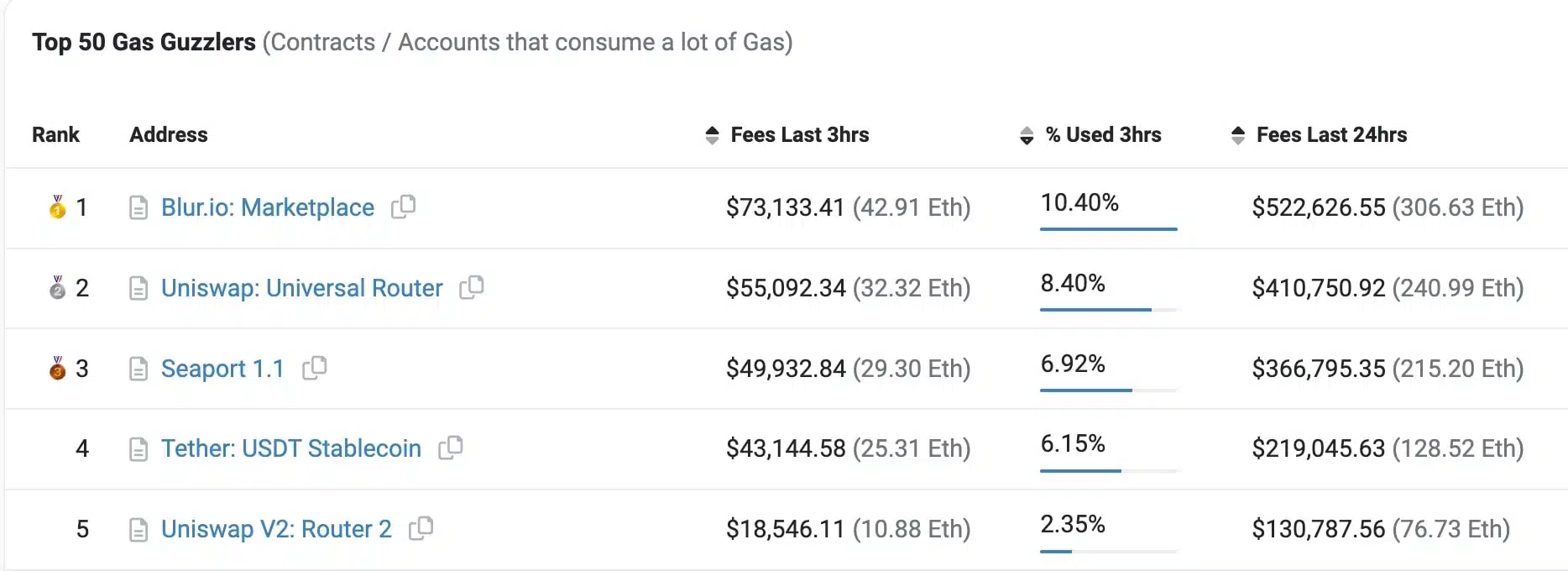

Furthermore, Ethereum gas fees are also exploding because of growing trade activity. Illustratively, Blur has now exceeded Seaport and UniSwap to become the leading “Gas guzzler” on Ethereum.

Here is everything you should know about Blur surpassing OpenSea:

What Happened?

A recent report published by Nansen.ai data analytics firm showed that Blur overtook OpenSea in daily trading volume for the first time on Wednesday last week. Notably, another analytics platform, Dune, published a significantly higher difference in trading volumes between the two NFT marketplaces. Based on a Dune dashboard by sealaunch.xyz, Blur and OpenSea’s trading volumes reached 30,410 ETH and 7,232 ETH, respectively.

At the time of publication, while these trades dropped considerably, Blur is still dominating the market with 20,428 ETH. In the meantime, OpenSea is only at 4,369 ETH.

For now, Blur has a market valuation of $1 billion. The marketplace’s daily trading volume increased by almost four times after it released its native token, considerably solidifying its position as a major OpenSea competitor. Moreover, in the past week, Blur released a blog post that asked its users to block sales of their nonfungible tokens on OpenSea.

This move came as a considerable pushback to OpenSea’s earlier decision to ban NFT marketplaces that offer all types of optional royalties.

In the meantime, Blur has surpassed Seaport and Uniswap to become the biggest Ethereum gas guzzler. This is expected given how NFT trading has massively increased in the marketplace. The more active the network is the higher its transaction fees.

Why Is Blur Gaining Popularity?

First, Blur is funded by some of the bigwigs in the Web3 sector, including Coinbase Ventures, Paradigm, and & E-GIRL Capital. Additionally, it provides users with some attractive perks like no trading fees. On February 15, it introduced its native token, BLUR, rewarding its most active users with attractive token airdrops. The airdropping strategy was a huge success, which resulted in Blur’s trading volumes surging considerably.

In general, Blur airdropped a staggering 360 million tokens. Today, it has an all-time trading volume of $1.6 billion. Based on DappRadar data, the marketplace has also surpassed OpenSea in 7-day ($435.24 million) and 30-day trading volume ($711.83 million).

OpenSea vs. Blur

For a long time, OpenSea has been the dominant marketplace in the NFT industry. Then Blur came in. This royalty-optional marketplace offers users multiple attractive features. Amid the developer royalty debate that gained steam in 2022, OpenSea made a massive decision: to ban NFT marketplaces that provide optional royalties.

For explanation, to get full royalties on the OpenSea marketplace, developers have to stop the sale of their nonfungible tokens on royalty-optional marketplaces like Blur. Nonetheless, with a new and intriguing policy update, Blur hit back at OpenSea. This new policy needs its developers to block their sales on OpenSea to enjoy these royalties.

In that context, Blur appears to be making huge leaps. Whether it can maintain the top spot and topple OpenSea in all-time trading volume is yet to be seen.