$NFT lending has had its strongest month, with $444 million in monthly volume throughout January.

A new report from NFTGators noted the “significant surge in $NFT activity” as Polygon NFTs again surpassed Ethereum in volume. The rise in $NFT lending is partly responsible for the increase in activity. BendDAO had the most significant volume in January at $36 million.

$NFT activity increases

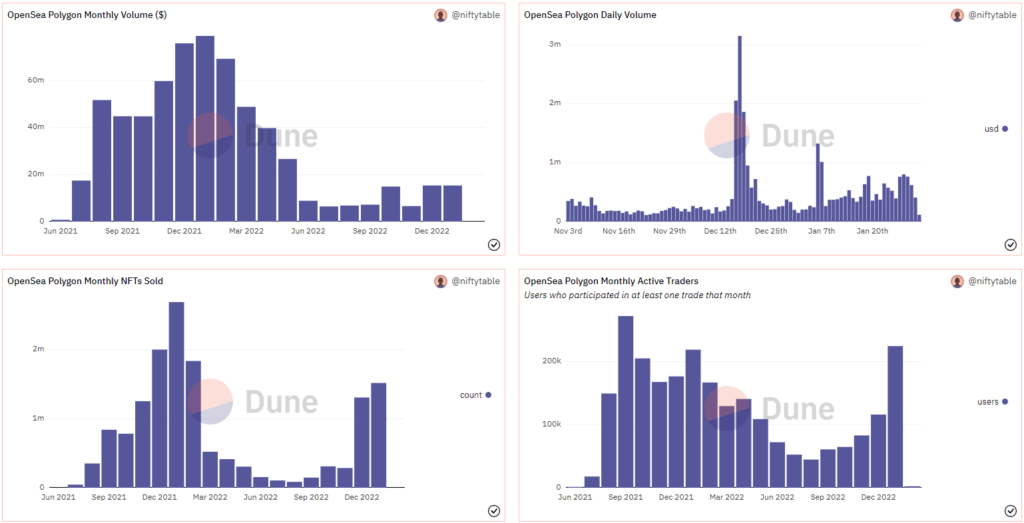

The rise in $NFT lending is a part of a wider $NFT resurgence. OpenSea activity increased as 319,641 Ethereum users sold 1,132,681 NFTs, while 224,719 Polygon users traded 1,514,895 NFTs in January.

As a result, the average $NFT on Ethereum traded for $1390, buying an average of 3.54 NFTs. On the other hand, the sale price on Polygon was just $69, with an average of 7 NFTs per user. Therefore, Ethereum traders spent an average of $4,920, and Polygon traders invested $483.

The below charts visualize the data and the uptick in Polygon $NFT activity.

The surge in $NFT Lending

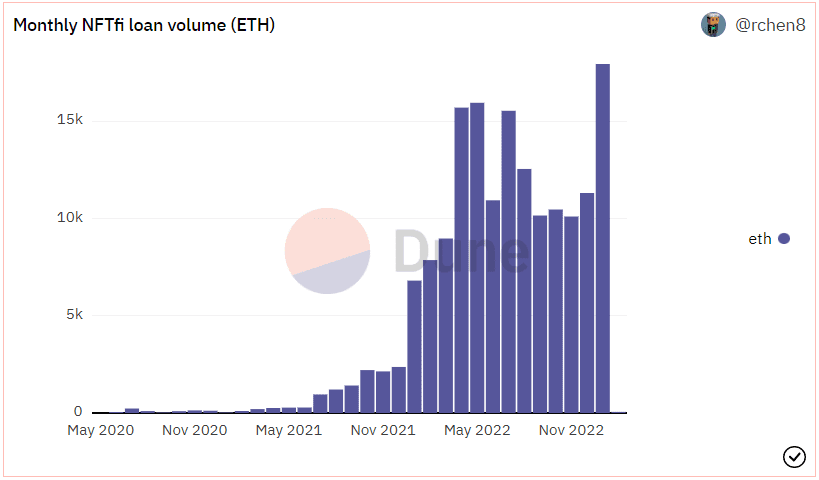

The report disclosed that 17,900 $ETH was distributed through 4,399 loans. The average loan value was 4 $ETH per loan, 29 $ETH per borrower, and 61.5 $ETH per lender.

The increased activity has also reduced the cost of $NFT loans, as lenders pay an average of $90 per loan in interest payments.

Outside of the market leader, BendDAO, other platforms such as NFTfi, X2Y2, and Arcade made up an additional $44.8 million.

Loan volume was below 1,000 $ETH per month during the $NFT bull run of 2021, and it previously peaked shortly before the Terra Luna crash in May 2022.

cryptoslate.com

cryptoslate.com