Luxury brands like Gucci and Tiffany & Co. have continued to embrace NFTs despite the ongoing crypto winter. But as floor prices keep dropping, how long until they throw in the towel?

The Christmas season is almost here. That Mariah Carey song is already playing on repeat and people are out purchasing gifts. Decorations are beginning to adorn shopping malls and stores. This also means that 2023 is just around the corner.

It seems that more and more each year, the adoption of digital goods and services has been increasing across several industries.

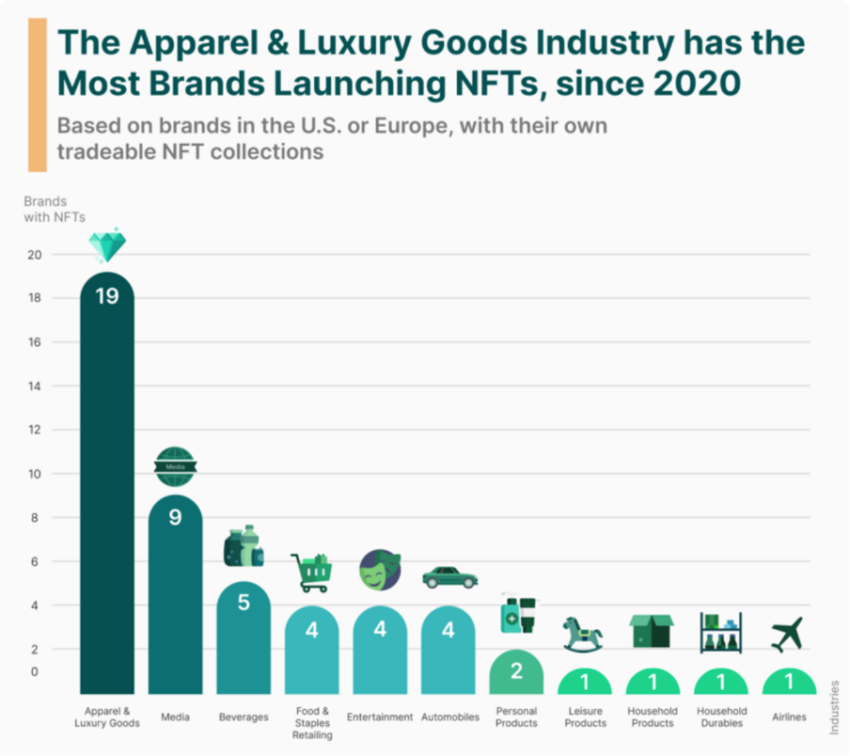

Luxury brands have certainly benefited from this transition. The world’s top brands are incorporating technologies to recreate brand images and reinvent the consumer experience. The fashion industry, especially, is experiencing a historic transformation thanks to emerging technologies such as blockchain and non-fungible tokens (NFTs).

This article looks to explore the trend of digital fashion as incorporated by luxury brands, thanks to the pervasion of NFT collectibles.

But one question that arises time and again: will this trend of buying products in the digital world really overtake the physical-world model?

NFTs and Luxury Fashion: The Combo

Many brands have developed digital strategies in the aftermath of the COVID-19 pandemic. Possessing immense potential and what seems like limitless possibilities for the future of fashion, NFTs have caught the eyes of luxury fashion moguls.

NFTs have changed how brands and their respective customers interact with each other. But not just that, the non-fungible aspect even allowed brands to innovate their revenue models by utilizing royalties and second-hand markets.

“The ability to trade products freely created a new revenue stream with the charging of creators’ fees in second-hand resales, an estimated $96 billion market in 2019.”

Another aspect of this ‘conscious’ coupling also helped brands to cut expenses. Platforms such as Twitter and Discord have become new marketing channels that engage communities at a low cost and have created new ways for customers to communicate and interact with each other.

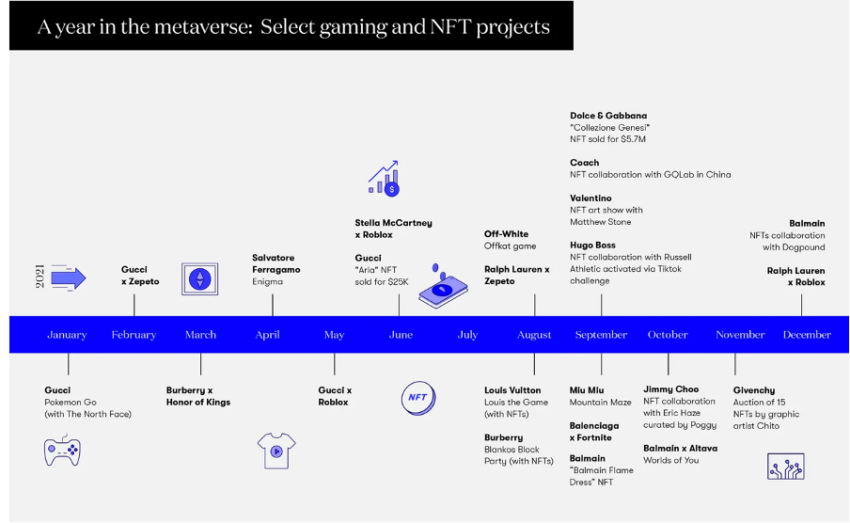

Luxury groups such as Gucci, Dolce & Gabbana, Tiffany & Co., Moncler, and Burberry, among many others, have already joined the NFT race.

The entry list

Data collected in December 2021 for the Vogue Business Index showed that 17 percent of brands in the Index were already working with NFTs. This number increased in 2022 as more luxury brands jumped on the NFT bandwagon and began experimenting with this new medium.

Gucci, the iconic fashion powerhouse, has been around since 1921. It is known for its luxurious, high-end designs and quality craftsmanship—and now NFTs.

In collaboration with the brand’s luxury creative director, Alessandro Michele, and digital artisan Wagmi-san, the 10KTF Gucci Grail collection came to life in Q1 2022.

As a part of the Gucci Vault metaverse, the director took inspiration from his trip from Rome to create New Tokyo—a floating city in a parallel universe.

“Within this metaverse metropolis, he crosses paths with the famed digital artisan Wagmi-san, legendary for crafting coveted items in his 10KTF Shop.”

In May of this year, Dolce & Gabbana and Polygon-based Metaverse fashion company UNXD teamed up with Chainlink for the DGFamily Glass Box reveal:

On the latest front, Moncler debuted its NFT collection in October. Arianee, one of the leading web3 brand platforms, announced its partnership with the luxury brand.

Moncler integrated Arianee’s NFT and web-based custodial wallet solution within its ecosystem to offer a seamless experience to its most engaged consumers.

The list goes on and on. However, as we near the conclusion of 2022, we are witnessing a significant fall in crypto prices. This has, in turn, heavily impacted NFT sales.

Expectations vs. reality

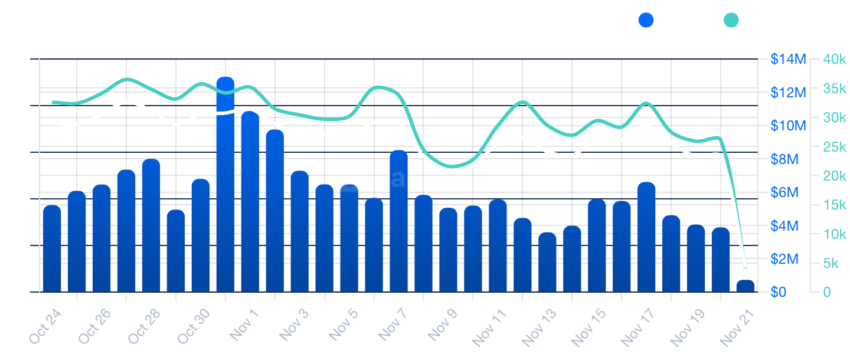

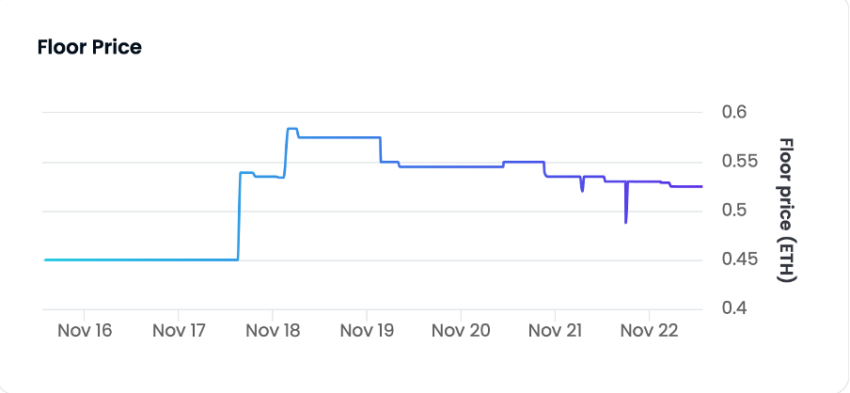

The number of users on OpenSea, the largest NFT marketplace by volume, fell drastically in 2022. The chart below gives a glimpse of the downturn within a month period.

In this period between Oct. 24 and Nov. 21, monthly trading volume saw a range high of around $13 million and has now slid back to $4 million.

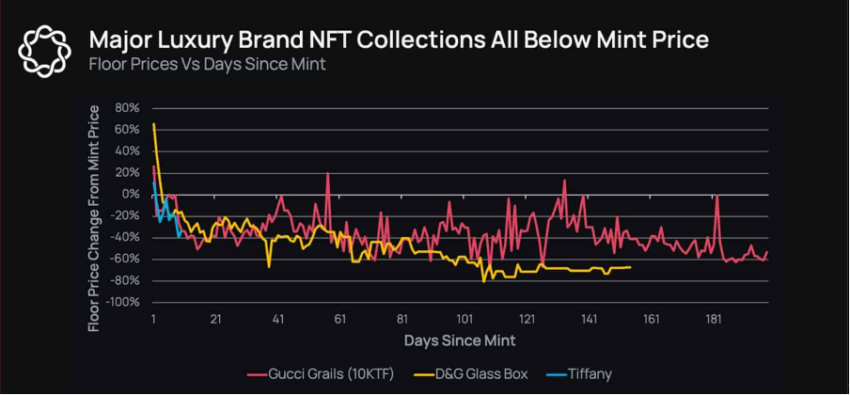

This has massively lowered the floor prices (lowest price for a single NFT) for some of the top brand NFT collections.

Consider Gucci’s 10KTF Gucci Grail collection. The price to mint one of the NFTs from the first generations of this collection was 1 ETH ($2,800 at the time) when it launched.

But given the correction in the Ethereum price and declining interest, the floor price currently sits at 0.52 ETH (currently ~$570) on OpenSea.

Similarly, the Dolce & Gabanna Glass Box collection floor price dropped to 0.24 ETH from 0.4 ETH only a month ago.

Other collections, too, suffered the wrath of fading interest. For instance, Tiffany and Co. raised more than $12.5 million on its first NFT collection, dubbed NFTiff.

The collection consisted of 250 CryptoPunk-inspired NFTs at a price point of 30 ETH each. At the time, the collection sold out in around 20 minutes. The floor price has now declined far below its mint price.

The floor prices of the aforementioned NFT collections have fallen below the mint prices. This can be seen below in a chart with data from Delphi Digital:

Still fancy this trend?

Many luxury brands continue to see the NFT market as an integral part of their businesses despite the slump in prices.

BeInCrypto reached out to representatives from some of these brands on Twitter to get their thoughts on this NFT adoption trend. However, none have responded by the time of publishing.

Despite the falling interest, Morgan Stanley believes that the metaverse, gaming, and NFT sectors could represent 10% of the luxury goods market by 2030.

beincrypto.com

beincrypto.com