Bored Ape Yacht Club NFT’s popularity among celebrities coupled with increasing interest by individual collectors has seen it surpass CryptoPunks in all-time sales.

Bored Ape Yacht Club has seen its sales outperform competitor projects such as Mutant Ape Yacht Club (MAYC), Art Blocks, Otherdeed, NBA Top Shot, Azuki, CloneX, VeeFriends, and Moonbirds. More importantly, BAYC’s $2.4 billion in sales volume has exceeded one of the most successful digital collectibles projects, CryptoPunks.

Launched in April 2021, Bored Ape Yacht Club is comprised of 10,000 unique NFT digital collectible ape avatars. Like most NFTs, the project struggled in its first month generating just $37,557 in sales. There were 141 unique buyers and 176 total transactions. The average sale value was $213.39 — far below the cost of 1 ETH.

May 2021 was one of the best months in the trading history of Ether, the novel asset behind the Ethereum ecosystem. The use of ETH as the base currency for NFT transactions saw the coin reach a then all-time high of $4,362 during the month, CoinMarketCap data showed.

Bored Ape NFT sales benefitted massively from the huge liquidity that was poured into the market and volume reached approximately $17 million, a 45,463.5% increase in 31 days. Unique buyers and total transactions soared by 2,417.73% and 5,158.52% respectively from April.

BAYC sales reached a new milestone in August 2021 when the market was recovering from a bearish trend that started with the delisting of Bitcoin (BTC) as a payment method for Tesla products and was then followed by China’s continuous crackdown on the crypto finance industry in May.

Within the period, BAYC generated approximately $299 million. Despite a reduced 1,880 unique buyers and 3,506 total transactions, the average sale value ascended to $85,288. This was a 551% rise in the average sale price from July’s $13,091.

Other months which also made significant contributions to BAYC’s all-time sales included September and November of 2021.

Bored Ape Yacht Club continues to see respectable monthly sales in 2022

In 2022, Bored Apes played a major role in the launch of the project’s native asset, APE as well as a Metaverse called the Otherside.

After Bitcoin (BTC), Ether (ETH), and several altcoins reached new all-time highs in November of 2021, bears took over the market.

The result was a drop in global NFT sales from $2.82 billion in November to $2.74 billion in December. This absolutely affected BAYC with sales reaching a two-month low to close 2021.

The entire NFT market reached a yearly high of $4.6 billion in sales with more than one million unique buyers and over 800,000 transactions in January 2022.

Out of this, 7% ($346 million) came from Bored Ape NFTs.

Since the end of January, there has been a decline in NFT sales, and BAYC has not been spared.

There has been a consistent dip in monthly sales, leading to volumes of less than $60 million in July. Sales for August were around $52.7 million, as of Aug. 28. With the substantial fall in the number of unique buyers and transactions, sales for August will likely not be crossing the $60 million mark.

CryptoPunks falls behind Bored Ape in all-time NFT sales

For a long time, CryptoPunks trailed only Axie Infinity in sales rankings. Bored Ape Yacht Club has now usurped the second-place rank after hitting $2.4 billion in all-time sales, slightly ahead of CryptoPunks’ sales of $2.36 billion.

Created by Larva Labs and released in June 2017, CryptoPunks consists of a fixed set of 10,000 characters and is one of the oldest NFT collections in the space.

As a pioneer NFT, CryptoPunks did not see a minimum of $1 million in monthly sales until September 2020 when $2.96 million was generated in sales.

With an insignificant number of unique buyers and total transactions in the first 39 months of its existence, the digital collectibles project finally saw 292 unique buyers, corresponding to 2,079 total transactions. The average sale value crossed $1,000 for the first time in September 2020 and eventually settled at $1,424.

Sales of CryptoPunks took off strongly in 2021 with a minimum volume of $6 million and a maximum which represents its all-time monthly high of approximately $679 million. There was a 316% increase in unique buyers, a 21% rise in total transactions, and an 18,741% spike in average sale value from September 2020.

Other months which made substantial contributions to sales in 2021 were July, September, October, and December.

After mirroring the growing sales of NFTs in January, CryptoPunks saw a yearly peak of $124 million.

Since January 2022, monthly sales have remained below $100 million. In the last four months (May to August), CryptoPunks have seen less than $50 million in volume.

Much of the decline could be attributed to a significant reduction in the number of unique buyers which has led to a further decrease in total transactions and average sale value.

While monthly unique buyers have remained under 300, total transactions have not surpassed 600 since December of 2021.

The acquisition of the project by Yuga Labs in March was supposed to impact the collection positively since “acquisition” is a primary driver of sales. Unfortunately, it has done little to help the fortunes of the NFT.

Aside from that, market saturation (an increase in the number of NFT projects in the industry) can also explain the steep decline in the monthly sales of CryptoPunks.

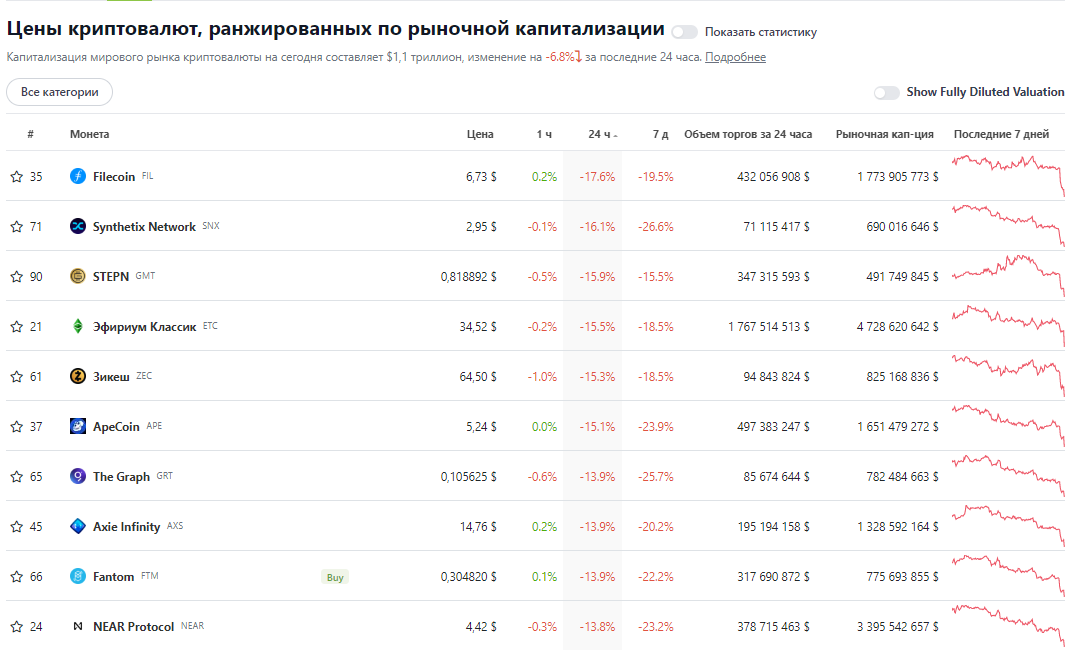

While Bored Ape NFTs have thrived this year due to their popularity and use by celebrities over CryptoPunks, its sale got a boost from BAYC being a major eligibility requirement for the airdrops of ApeCoin as well as land deeds (Otherdeeds) from the Otherside Metaverse by creator Yuga Labs.

Overall, these contributed massively to the above-average monthly sales of BAYC during the market crash of May which deepened in June and extended to July and August.

beincrypto.com

beincrypto.com