Despite an exceptionally successful start of the year for non-fungible tokens (NFTs), the second quarter doesn’t look as optimistic as the public’s interest in digital collectibles begins to decline.

Specifically, data shows that NFT trading volume in Q2 2022 has dropped by 41%, according to the ‘2022 Q2 NFT Industry Report’ created by Footprint Analytics and published on August 7.

As per the report, which summarizes and analyzes the overall data of the NFT industry for the observed period, investment capital since the year’s turn “was flowing into the NFT market for collectibles, gaming, and art” due to lower prices in the cryptocurrency market.

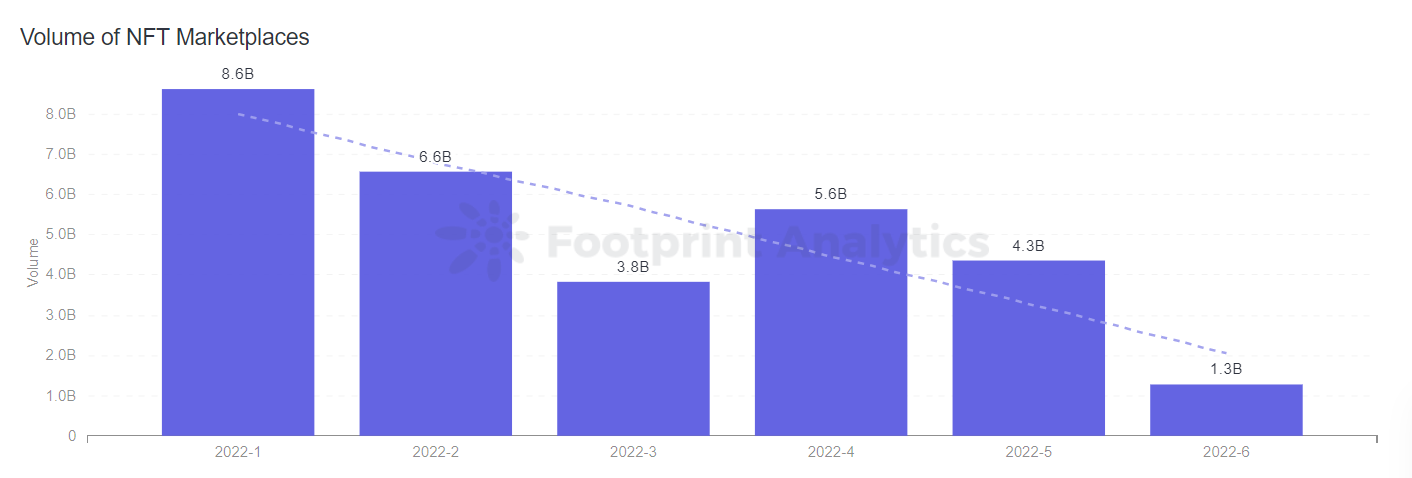

Consequently, these positive developments “drove the NFT market to an unprecedentedly active trading volume, hitting a new high of $8.6 billion.” That said:

“However, in mid-May, the crypto market faced considerable challenges and the NFT market cooled off. NFT trading volume dropped from $19.02 billion in Q1 to $11.26 billion in Q2.”

Motivation behind buying NFTs

It’s worth mentioning that Finbold reported in mid-April that the total volume traded in NFTs had exceeded $54 billion in aggregate value at the time, growing from $16.94 billion on January 1, 2022, to $54.58 billion on April 17, which was an increase of over 222% since the start of the year.

Elsewhere, in June, an industry survey discovered that the majority of consumers, specifically 64.3% of people polled, only bought NFTs ‘to make money’, With more than half of investors only buying NFTs to make money, perhaps it isn’t surprising that Q2 trading volume dropped as the crypto market experienced downward pressure.

The second most popular reason was to ‘join a community and flex’, with 14.7%, while only 12.4% of survey participants said their prevalent motivation for purchasing NFTs was collecting digital art. An even smaller percentage – 8.6% – said they bought NFTs primarily for accessing games and tools.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

finbold.com

finbold.com