Comparing pros and cons of the most popular mining pools.

To make high profits from mining, the right powerful machines aren’t enough, you need to pick the right pool. A miner’s income is directly impacted by the platform’s fee percentage, and whether it has built-in exchange and storage tools. We evaluated the top mining services and built a rating of the best pools for mining in 2024.

How to Choose a Mining Pool

To catch a block a solo-miner needs more that 112.5 thousand TH/s (as of January 2024). For that, you’d need to have about 800 s19xp 141th ASICs. That’s not an option for everyone. That’s why miners join pools – to raise their chances of successfully earning a reward. What should you pay attention to when choosing a pool?

Your Mining Pool Criteria:

- The fee. Its size directly affects a miner’s profits, so it’s better to choose a service with a minimal percentage and check if there’s additional charges on withdrawals to external wallets.

- Transparent mining stats. If each worker’s hashrate for different periods shows up in the interface, a miner can easily figure out if the hashrate is reaching the pool and pinpoint any potential issues with their equipment.

- A built-in P2P platform. This allows miners to exchange their rewards for fiat right on the pool’s platform without having to resort to third-party exchanges and services or additional fees.

- A savings account. An additional opportunity to open a savings account, like in a bank, and store your crypto there while it earns a fee, means an extra passive income option. Users choose the conditions: account flexibility and coins affect the interest rate. This is a great option for those who plan to hold crypto.

- Support in your language. When all is said and done, it’s always easier when it’s said in a language you’re comfortable with, especially when it’s about important issues like your assets.

- A user-friendly interface. This is more than just a bonus, it shows that the platform cares about its users. Working with your account intuitively is faster and easier.

- Minimal ping. The closer the servers are, the lower the ping and response time between a miner and their pool. This means that shares will be accepted by the platform and rewarded.

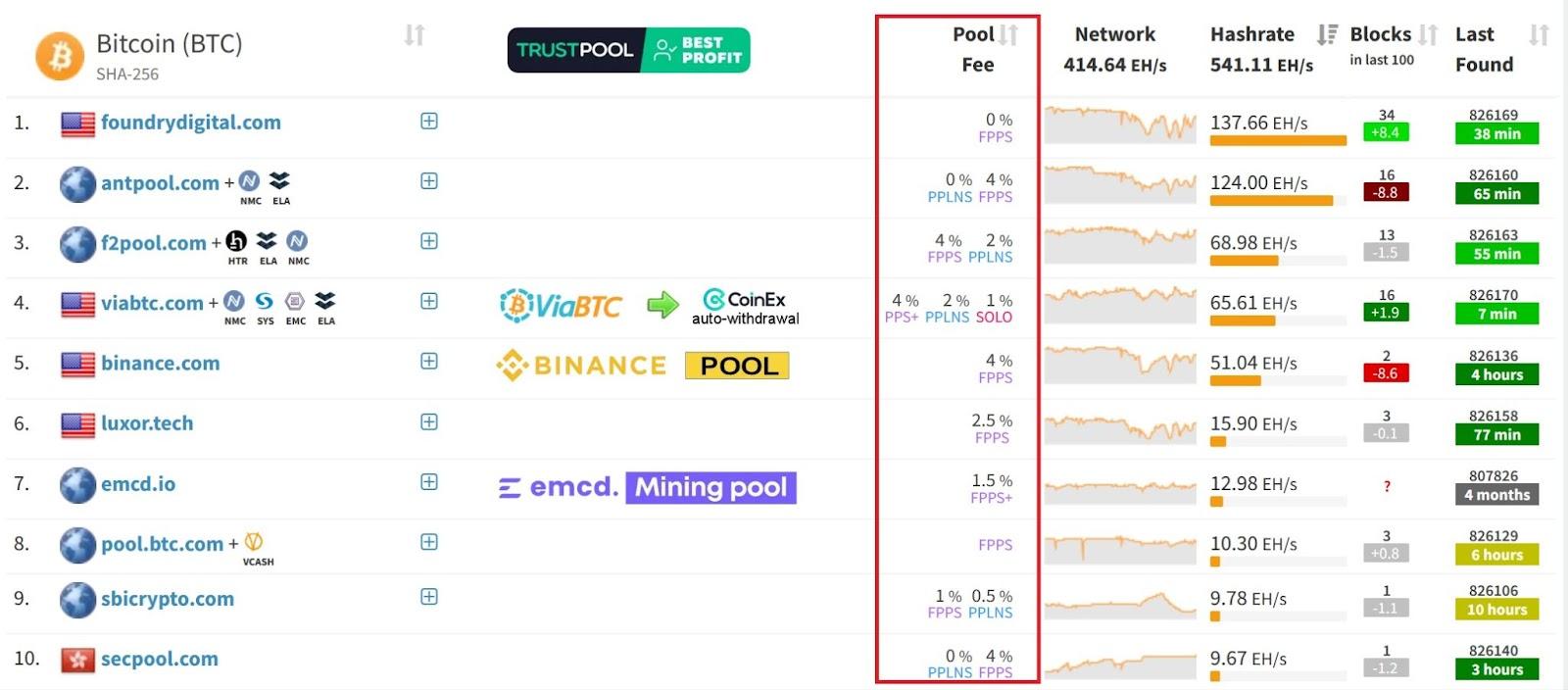

Pay close attention to the fee when choosing a platform – it can range from 1% to 4%

It’s also important to check how the rewards are split in the pool – it can affect how regularly you get your rewards and how much you earn.

How Mining Pool Rewards Get Distributed

- Full Pay Per Share (FPPS) – Fixed payments for each hash, even if no block was created. This system also pays out transaction fees to miners, which is why it includes the ‘Full’ prefix.

- Pay Per Share (PPS) – Works like FPPS, but without the transaction fees payout.

- Pay Per Last N Shares (PPLNS) – Rewards are given only for found blocks. It considers the number of hashes submitted by each user, multiplies them by the result, and divides it among all miners.

Best Mining Pools of 2024

| POOL | FEE | PAYMENT TYPE | HASHRATE |

| EMCD | 1,5% | FPPS+ | 12.85 EH/s |

| SBI Crypto | FPPS — 1% PPLNS — 0.5% |

FPPS PPLNS |

11.18 EH/s |

| Binance | 4% | FPPS | 53.37 EH/s |

| Luxor | 2,5% | FPPS | 17.28 EH/s |

| Braiins | 2% | FPPS | 8.34 EH/s |

1. EMCD / Mining pool

Launched in 2017, this pool has now become a whole ecosystem of products and services for miners. It ranks in the top 7 Bitcoin mining pools worldwide and has one of the largest miner communities in Eastern Europe.

Pros:

- Low fixed fees of 1.5% FPPS

- High pool profitability according to Poolproof and Pools.top

- Built-in user-friendly P2P platform

- Direct withdrawal to Visa, Mastercard, Mir cards in several currencies

- No fees on withdrawals to external wallets

- 24/7 live support

- Comprehensive ecosystem

- Built-in savings account – Coinhold – which offers additional income for crypto holders with up to 12% per annum.

Cons:

- The mining pool only supports 7 coins: BTC, LTC, BCH, ETC, DASH, DOGE, KAS

- Direct card withdrawal works only with select Eastern European and Central Asian banks

2. SBI Crypto pool

A promising platform from a Japanese holding that’s listed as one of the largest financial organizations. The company collaborates with German developers.

Pros:

- Rapidly growing mining pool

- Low pool fees — 1% FPPS or 0.5% PPLNS

- High profitability

- Leasing options for purchasing equipment in large quantities

- Accounting options available

Cons:

- Issues with foreign language tech support

- Complex and inconvenient interface

- No additional options to store or withdraw cryptocurrency

3. Binance Pool

The largest exchange of digital assets in the world by trading volume.

Pros:

- Comprehensive ecosystem within the platform

- Mining options for ZEC, RVN, ETHW

- User-friendly interface

- Mobile app for Android and iOS

Cons:

- High 4% FPPS fees

- Doesn’t operate in several regions, including Russia and others

- Regulatory issues with the SEC — the company’s operations could be partially restricted

- No option to track mining statistics in the app

4. Luxor pool

An American pool founded in 2018. Ensures high mining performance through load balancing and memory management.

Pros:

- Relatively high profitability

- Reasonable 2.5% FPPS fees

- Attractive and user-friendly interface

- Supports ZEC, ZEN, SC coins

Cons:

- Issues with foreign language tech support

- No additional options to store or withdraw cryptocurrency

5. Braiins pool

One of the oldest pools, founded in 2010 in the Czech Republic. Considered one of the most reliable platforms with a good reputation.

Pros:

- Reasonable 2% FPPS fees

- A hash rate proxy aggregator and mining firmware with auto-tuning

- Foreign language tech support

Cons:

- No additional options to store or withdraw cryptocurrency

- Translation issues in non-English versions

Summary

It’s worth focusing on mining pools with an established ecosystem — they already have all the tools you need to store and exchange your funds profitably. To receive payments consistently without having to worry about your platform’s reliability, choose from the top Bitcoin mining pools with a reputation and solid reviews.