Bitcoin miners are set for a potential reprieve in three days, with the difficulty anticipated to decrease on Feb. 29. This follows the year’s most significant difficulty escalation of 8.24%, which occurred on Feb. 15. The upcoming adjustment is predicted to record a reduction of 2.5% to 3%, as block time intervals extend beyond the intended ten-minute mark.

Bitcoin Miners Eye Relief as Difficulty Adjustment Looms

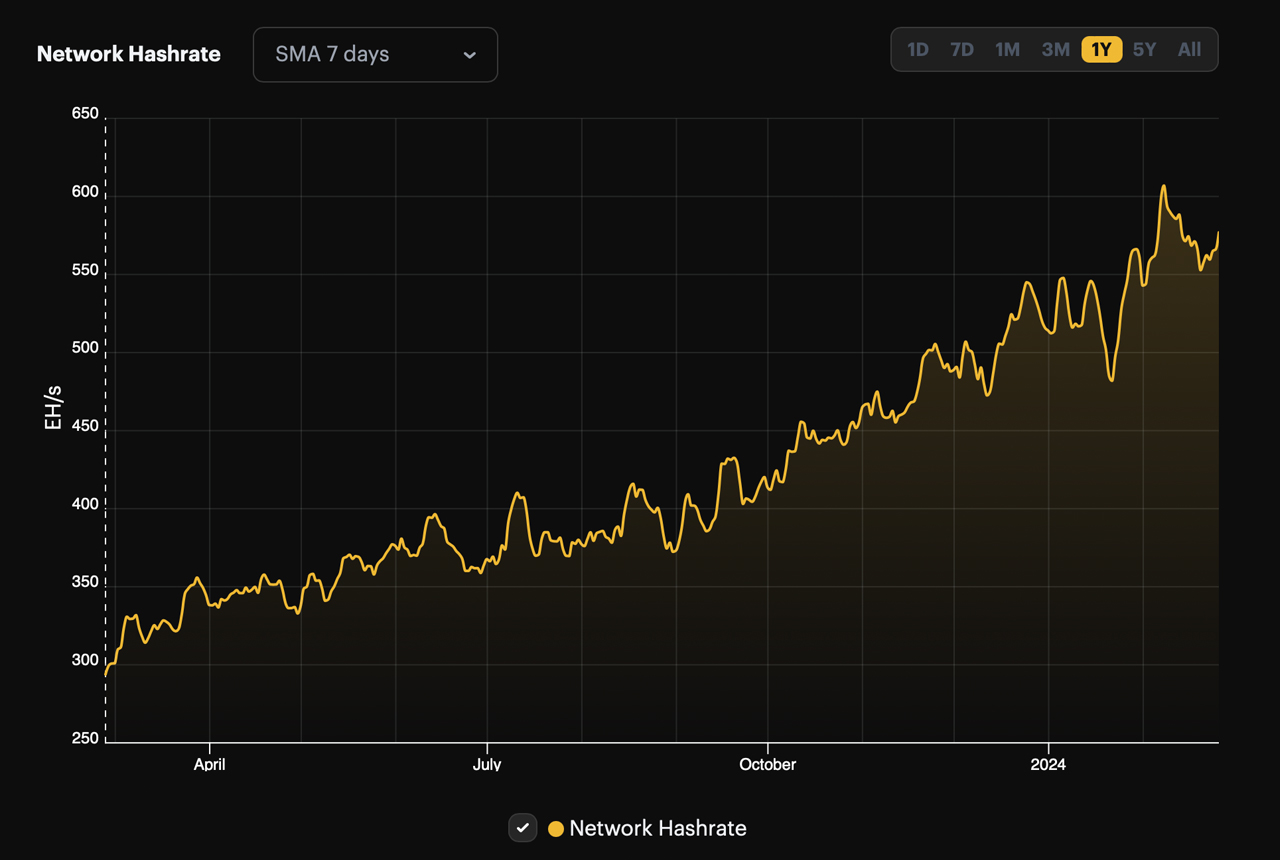

Just prior to the most recent difficulty increase, Bitcoin’s total hashrate climbed to 609 exahash per second (EH/s) on Feb. 8. Following this achievement, six days later, the difficulty escalated to 81.73 trillion, marking an 8.24% increase.

Since that point, it has been the most challenging period in history for discovering $BTC blocks. Nonetheless, the hashrate has since receded from its peak, and as of now, the network’s total hashrate is hovering around 577 EH/s, based on the seven-day simple moving average (SMA).

Estimated metrics, which could change between now and then, indicate a 2.5% to 3% decrease is anticipated for the next difficulty adjustment, scheduled for Feb. 29, 2024. Currently, block intervals are lagging behind the ten-minute norm, with block times ranging from 10:08 to 10:21 per block, and the adjustment is expected in less than 450 blocks.

Additionally, fewer than 4,900 blocks are left until the fourth Bitcoin network halving, projected around April 19, 2024. Should the difficulty decrease on Thursday, it will mark the year’s second reduction.

The initial difficulty decrease in 2024 occurred on Jan. 20, dropping 3.9% at block height 826,560. Prior and subsequent adjustments have seen increases of 1.65%, 7.33%, and 8.24%.

Currently, Foundry USA dominates the hashrate landscape with 30.41% of the total, equivalent to 178.07 EH/s, while Antpool holds 23.87% with 139.82 EH/s. A total of 52 mining pools are contributing hashrate to the $BTC chain, with Viabtc, F2pool, and Mara Pool trailing behind Foundry and Antpool.

Miners are poised to earn similar revenue to January, as February’s figures indicate $1.14 billion in earnings, compared to January’s $1.35 billion. As the price hovers above $53,000 on Monday, the estimated value of one petahash per second (PH/s) of hashing power per day has experienced a marked increase.

What do you think about the upcoming difficulty retarget? Share your thoughts and opinions about this subject in the comments section below.

news.bitcoin.com

news.bitcoin.com