Bitcoin mining company Marathon Digital Holdings has recently announced a significant move towards increasing its operational capacity.

Marathon has entered into a purchase agreement to acquire two operational Bitcoin mining sites, amounting to 390 megawatts of capacity. The deal, valued at $178.6 million, marks Marathon’s transition from an asset-light organization to one managing a diversified and resilient portfolio of Bitcoin mining operations.

Marathon Digital Bolsters Operations

According to a recent statement, the acquisition represents Marathon’s first fully owned sites, pointing to a pivotal shift in its business model.

Currently, Marathon’s Bitcoin mining portfolio has 584 megawatts of capacity, with only 3% directly owned and operated by the company.

BeInCrypto recently reported that Marathon Digital has grown its Bitcoin production by 467% in one year.

However, following this acquisition, Marathon’s portfolio will surge to approximately 910 megawatts, with 45% directly owned sites and 55% hosted by third parties.

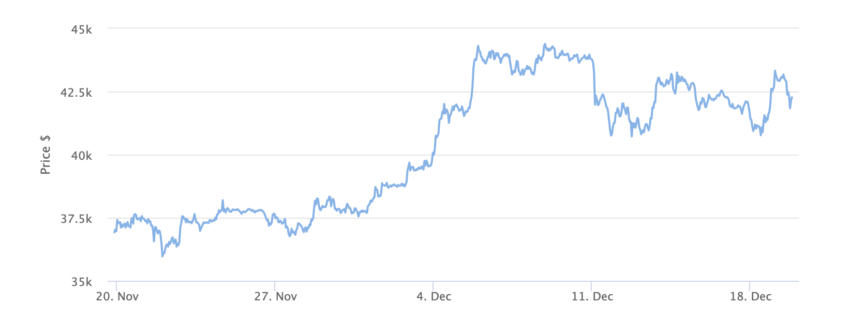

This comes amid Bitcoin’s price seeing a surge in recent times. At the time of publication, Bitcoin’s price stands at $42,310.

Furthermore, the acquired sites, located in Granbury, Texas, and Kearney, Nebraska, offer substantial expansion opportunities. Marathon aims to leverage the additional 390 megawatts to potentially double its operational hash rate to around 50 exahashes over the next 18-24 months.

Additionally, this move aligns with Marathon’s year-long strategy of vertical integration and developing a sophisticated and diverse Bitcoin mining portfolio.

Fred Thiel, Marathon’s Chairman and CEO, expressed enthusiasm about the acquisition. He emphasized the potential for cost reduction, energy hedging, and operational optimizations.

Furthermore, Thiel noted, “This transaction increases the size of our Bitcoin mining portfolio by 56%. And it also provides us with a roadmap to double our current operational hash rate.”

Marathon Digital Purchase Will Cut Operating Costs

On the other hand, Salman Khan, Marathon’s CFO, highlighted the company’s strengthened financial position. Khan noted the cash acquisition without additional debt or equity issuance.

Additionally, the strategic move is expected to reduce current operating costs by 30% and provide ample expansion opportunities.

Meanwhile, David Hirsch, Principal at Generate Capital, Marathon’s partner in the transaction, commended the company’s leadership in the Bitcoin ecosystem.

However, the deal allows Generate to focus on sustainability initiatives, while Marathon gains physical assets to reduce production costs and facilitate future growth.

The transaction, subject to customary closing conditions, is anticipated to conclude in the first quarter of 2024.

beincrypto.com

beincrypto.com