- Bitcoin price may have hit the ultimate floor price as the adjusted SOPR on-chain metric rebounds at 0.90.

- A minor dip to $22,000 – possibly $20,800 will allow BTC to collect liquidity before retackling resistance at $24,000.

- BlackRock and Coinbase have partnered to offer institutional crypto trading, custody and brokerage services.

Bitcoin price has struggled to sustain its upside momentum since it got rejected from the seller congestion at $24,000 on July 29. The pioneer cryptocurrency will likely slide to $22,000 and $20,800 as it hunts for fresh liquidity. However, fundamental data on profit/loss suggests that BTC may have bottomed but lacks a strong enough catalyst to push out of the bearish shackles.

BlackRock To Offer Crypto Trading To Institutions

Asset management behemoth BlackRock (BLK) announced via a blog post on Thursday that it has partnered with the publicly listed cryptocurrency exchange, Coinbase (COIN) to offer targeted crypto trading services to institutions. This collaboration will see mutual customers of BlackRock's investment management platform, Aladdin, and Coinbase get access to tailor-made services such as custody, crypto trading and prime brokerage.

"Our institutional clients are increasingly interested in gaining exposure to digital asset markets and are focused on how to manage the operational lifecycle of these assets efficiently," Joseph Chalom, BlackRock's global head of strategic partnerships, said in the statement.

He continued, "this connectivity with Aladdin will allow clients to manage their bitcoin exposures directly in their existing portfolio management and trading workflows for a whole portfolio view of risk across asset classes."

The move by BlackRock emphasizes how traditional financial players on Wall Street are spreading their wings into crypto; the massive correction this year notwithstanding. Bitcoin has shed off nearly half its value since the beginning of 2022, while the crash of the Terra ecosystem and crypto lending platforms like Three Arrows Capital continue to raise questions about the market's stability.

The Moving Average Convergence Divergence (MACD) on the 12-hour chart below reveals that short-term dips will be challenging to avoid. Support is envisaged at the accelerated trend line (broken line) near $22,000 and the primary trend line close to $20,800.

BTC/USD 12-hour chart

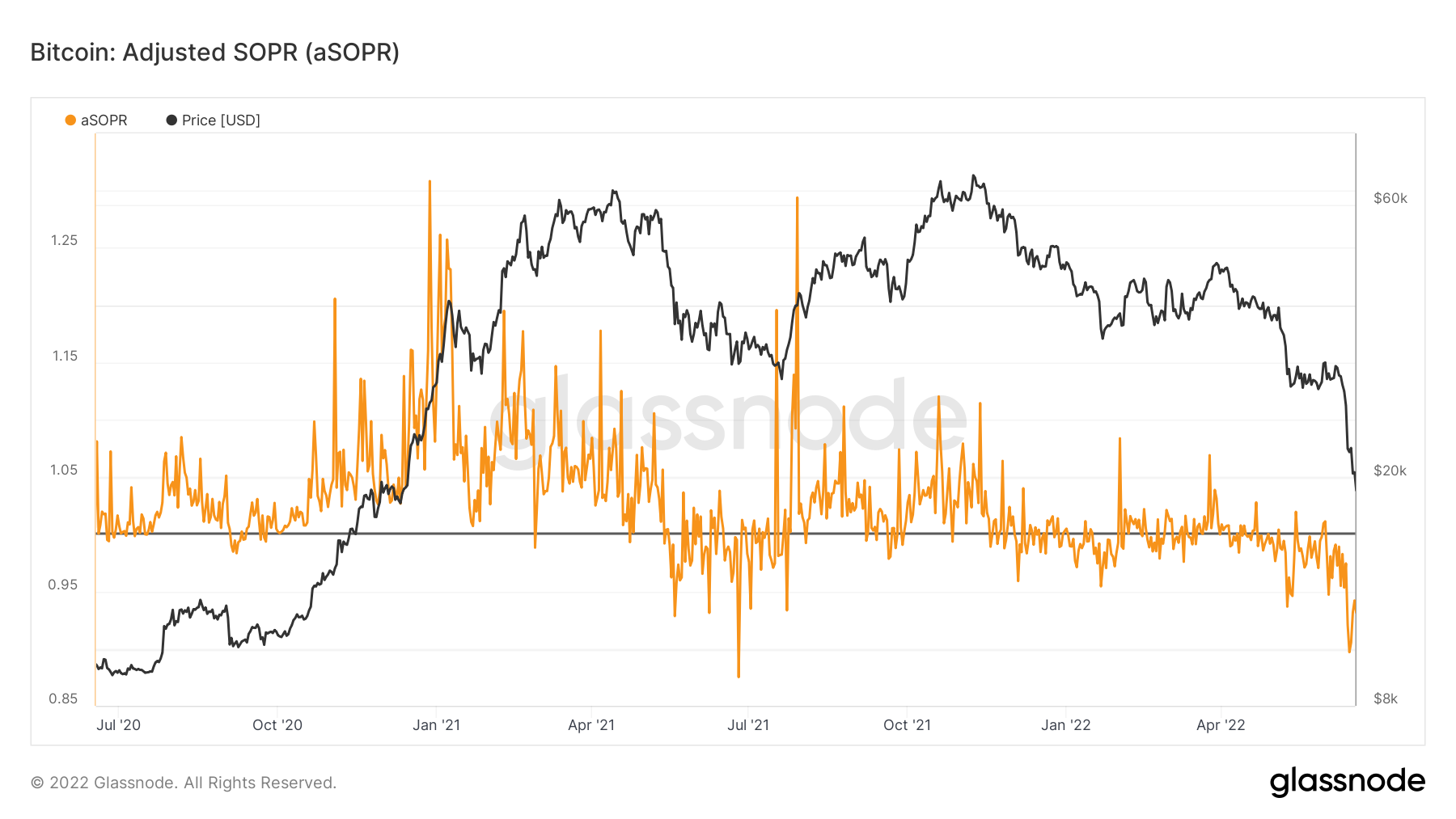

A glance at fundamental factors like the adjusted Spent Output Profit Ratio (aSOPR) affirms the idea that Bitcoin price has bottomed. According to Glassnode, bear markets see a significant decrease in interest and demand for BTC over time. Coupled with high volatility, this tends to "shake out" weak hands in bear market rallies and selloffs.

However, bear markets eventually form a stable final floor price, attracting "money buyers of last resort." As these investors accumulate the asset, momentum builds, prompting a bull run.

Bitcoin aSOPR chart

From the chart above, the aSOPR holds at 0.94 after recoiling from 0.90. The last time this metric dropped slightly below the same level in July 2021, Bitcoin price rallied from $31,670 to an all-time high of $68,968 in November 2021. Therefore, if history repeats itself, BTC is in the prelude of an incoming bullish move.

fxstreet.com

fxstreet.com