Bitcoin futures listed on the Chicago Mercantile Exchange (CME) have lost their shine in recent weeks, and that’s in part due to explosive growth in decentralized finance (DeFi), an analyst says.

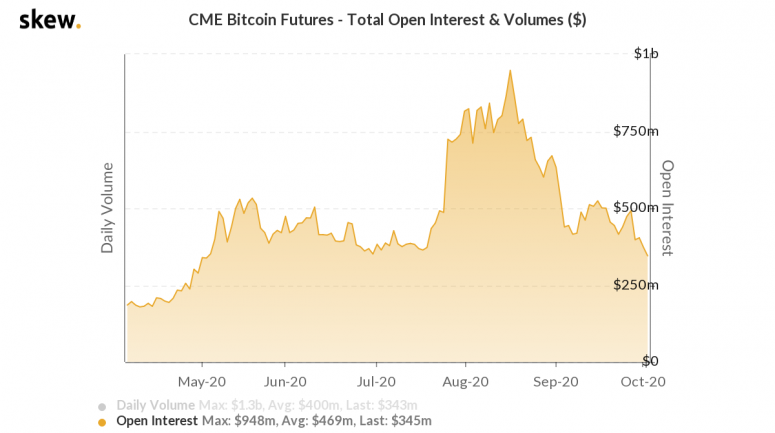

- According to data source Skew, open interest or open positions in CME bitcoin futures fell to $345 million on Friday – the lowest level since May 4. The CME is considered synonymous with institutional activity.

- Open interest is down nearly 64% from the record high of $948 million on Aug. 17. On the same day, bitcoin's price clocked a 12-month high of $12,476.

- Open position in bitcoin futures across all cryptocurrency exchanges stood at $3.6 billion on Friday, having peaked at $5.7 billion on Aug. 17.

- While futures open interest has subsided, the total value locked into the DeFi platforms has nearly tripled to $10.9 billion over the past two months, according to data provider DeFi Pulse.

- "Crypto money has gone into DeFi and yield farming, suppressing futures premium and making cash and carry trades unattractive for traditional/institutional investors," Denis Vinokourov, head of research at London-based prime brokerage Bequant, told CoinDesk.

- As money began flowing into DeFi from the futures market in the second half of August, the spread between futures and spot prices, known as the "futures premium," began falling.

- The premium on major exchanges declined from 12% to 2.5% in the second half of August and has remained sidelined near 7% ever since, per Skew data.

- The near halving of the premium in August has likely kept traditional investors and institutions from putting money into futures over the past four weeks.

- That's because returns on cash and carry trades, a popular strategy among institutions, dropped with the premium.

- Cash and carry trades involve buying an asset in the spot market and selling a futures contract when the latter is trading at a premium to the spot price.

- The strategy seeks to profit from the premium, which eventually converges with the spot price on the expiry date. The higher the premium, the higher is the reward on the carry trades and vice versa.

- Additionally, bitcoin's 7.5% price drop seen in September, the biggest monthly decline since March, likely contributed to the decline in open interest on CME and other exchanges.

- "September's decline in bitcoin has significantly affected short-term optimism in the market with Open Interest falling across all exchanges and derivatives products," said Matthew Dibb, CEO of Singapore-based Stack Funds.

- "We expect that further enhanced selling pressure will lead open interest to sub-$3 billion levels seen in April," Dibb said.

- Bitcoin is currently trading largely unchanged on the day at $10,688, according to CoinDesk's Bitcoin Price Index.

Also read: Bulls Exit BitMEX Bitcoin Futures Market

coindesk.com

coindesk.com