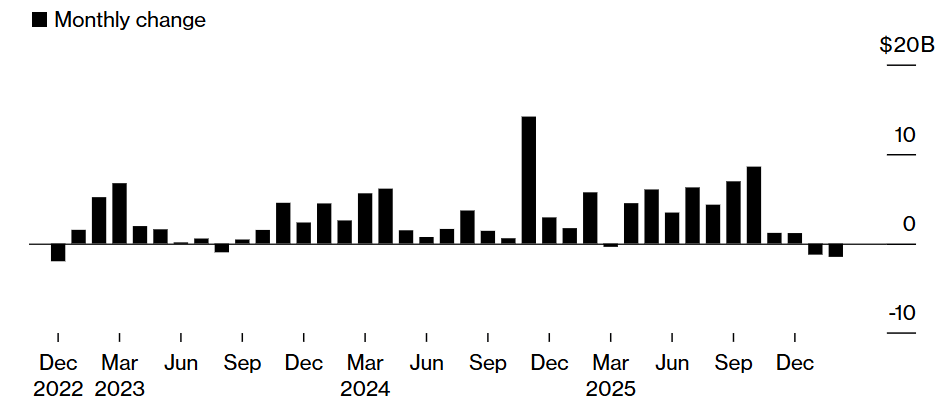

Tether’s $USDT, the world’s largest US dollar-pegged stablecoin, is heading for its steepest monthly decline in years as large holders step up redemptions, according to blockchain data.

The circulating supply of USDt ($USDT) fell by about $1.5 billion so far in February, following an $1.2 billion decrease in January, according to Artemis Analytics data reported by Bloomberg. This puts $USDT on track for the biggest monthly drop in three years, weeks after the collapse of cryptocurrency exchange FTX in November 2022.

The $USDT supply logged a $2 billion decrease in December 2022 after the collapse of FTX and its 150 subsidiaries sent shockwaves through the crypto industry.

The decline may signal a contraction in crypto market liquidity, as Tether’s $USDT is the primary on-ramp for crypto investors. Its $183 billion market capitalization accounts for about 71% of the total stablecoin market, according to CoinMarketCap.

Cointelegraph reached out to Tether for comment on what is driving the February supply drop, but had not received a response by publication.

Related: BlackRock enters DeFi as institutional crypto push accelerates: Finance Redefined

Total stablecoin market cap flat in February

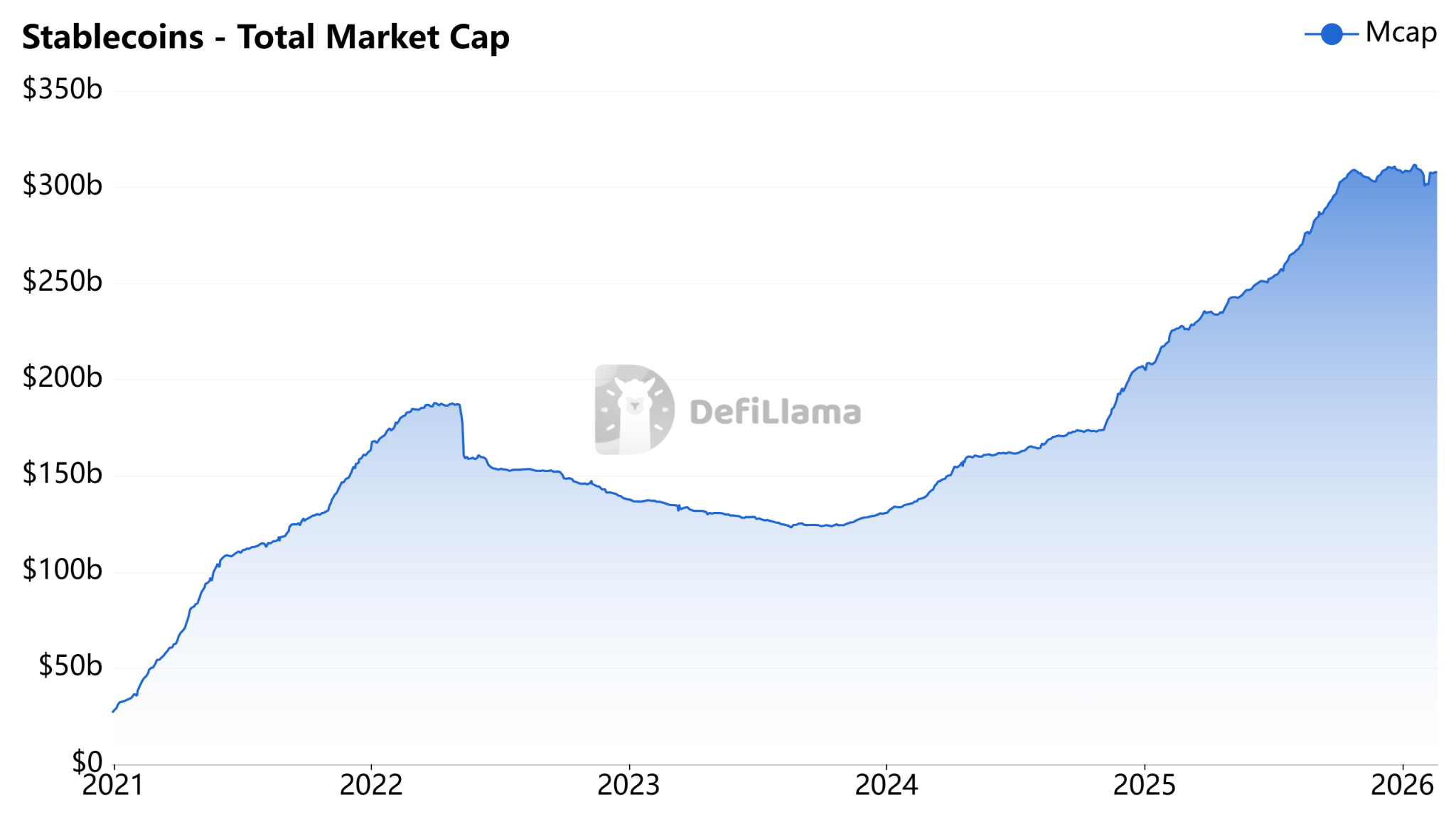

The pullback in $USDT has not translated into a broader contraction across dollar-linked stablecoins.

The total market capitalization of stablecoins across all exchanges has risen 2.33% so far in February, from $300 billion to $307 billion, according to DeFiLlama data.

While the two leading stablecoins, $USDT and Circle’s $USDC ($USDC), both decreased by 1.7% and 0.9%, respectively, the Trump-family-linked World Liberty Financial’s $USD1 ($USD1) stablecoin recorded a 50% increase in market capitalization over the past month and was valued at $5.1 billion as of Friday, according to DeFiLlama.

Related: Wells Fargo sees ‘YOLO’ trade driving $150B into Bitcoin and risk assets

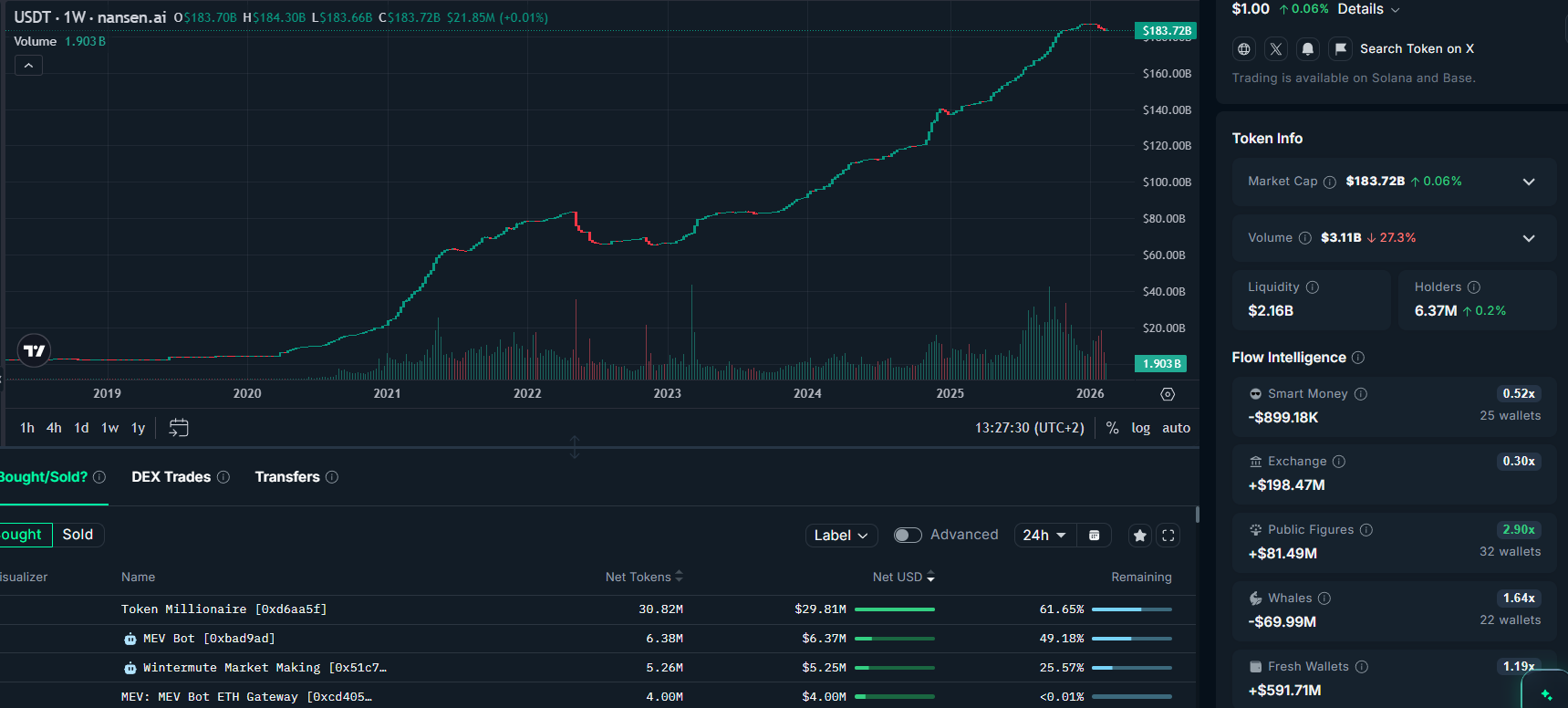

Whales and smart money traders offload $USDT, but fresh wallets stepping in

Whales, or large cryptocurrency investors, have been cutting their $USDT holdings, but new participants are bringing fresh demand for the leading stablecoin.

Whale wallets sold $69.9 million $USDT across 22 wallets over the past week, marking a 1.6-fold increase in the selling rate of this cohort, according to crypto intelligence platform Nansen.

The leading traders by returns, tracked as “smart money,” have also been net sellers of $USDT. At the same time, new wallets created in the past 15 days bought roughly $591 million worth of $USDT over the week, according to the platform.

The mixed flows highlight a market split between large holders redeeming or reallocating capital and new entrants stepping in to take the other side, even as overall stablecoin issuance remains broadly steady.

Magazine: Crypto wanted to overthrow banks, now it’s becoming them in stablecoin fight

cointelegraph.com

cointelegraph.com