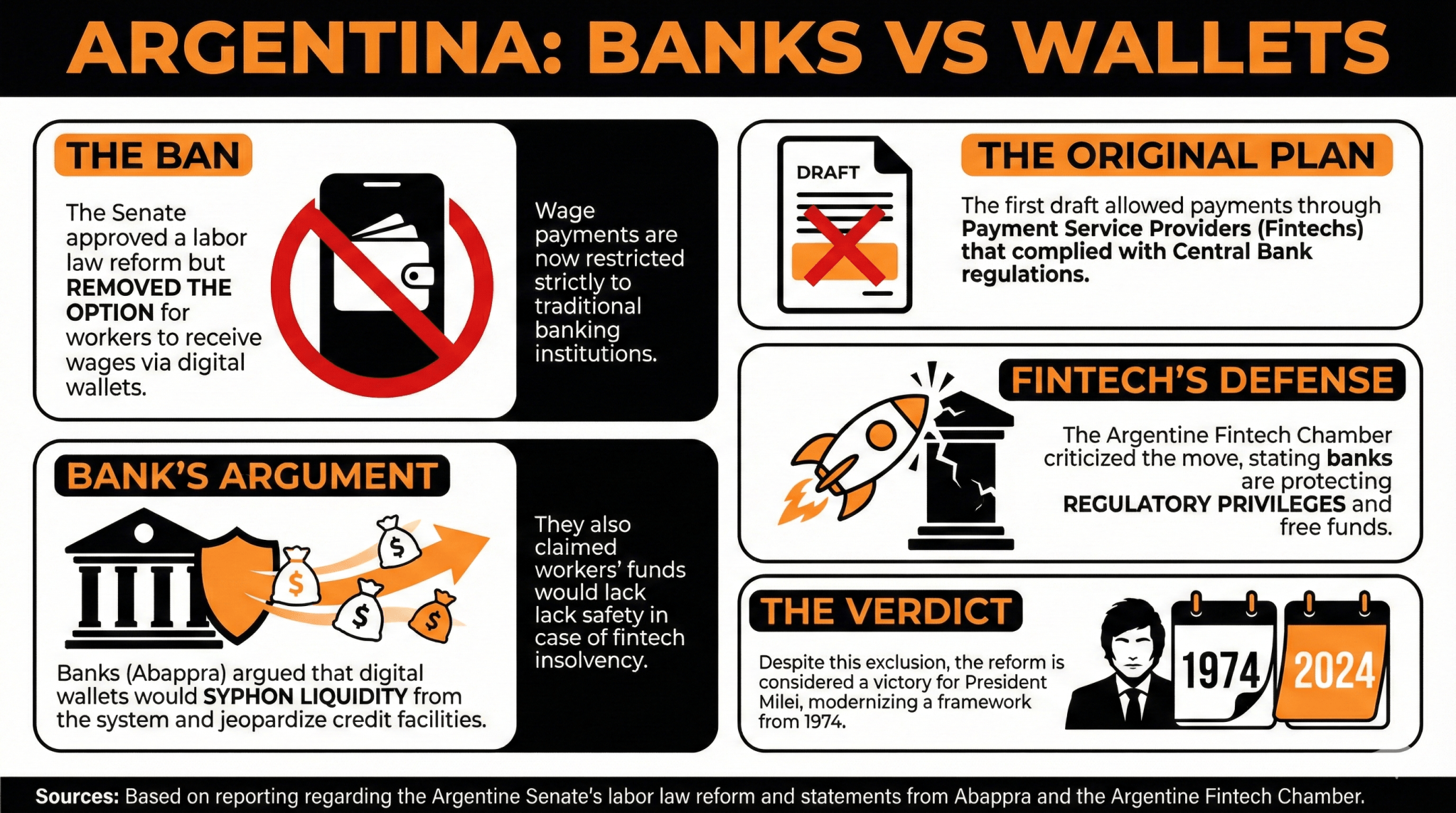

A proposal that would have allowed workers to receive wages in digital wallets managed by payment providers was defeated after banks pressured lawmakers to exclude that option during debates over Argentina’s new labor law reform.

No Choice: Digital Wallets Left Out as Eligible Payment Options in Labor Law Reform

Argentina has failed to advance in providing more choices for workers to receive their wages.

The option of receiving wage payments via digital wallets managed by payment providers was finally removed from the labor law reform text approved by the Senate. The text, strongly contested by opposition parties, only allows wage payments through traditional banking institutions, leaving fintech companies out of the loop.

The first draft included an article that declared as follows:

“Remuneration in cash owed to the worker must be paid, under penalty of nullity, only through credit to an account opened in his name in a bank or official savings institution, or through Payment Service Providers that comply with the regulatory requirements established by the Central Bank of the Argentine Republic (BCRA) for such activity.”

Nonetheless, banks opposed this, stressing that it would syphon the liquidity from the banking system to fund their activities. Marcelo Mazzon, executive manager of the Association of Public and Private Banks (Abappra), stressed that this measure would “jeopardize the liquidity of the system and the existence of productive credit facilities.”

In addition, Abappra alleged that approving this article would increase the risks to users, given that they don’t have the same protections as banks regarding the safety of these funds. “In the event of insolvency, workers’ funds would be included in the bankruptcy estate without priority,” it declared.

The Argentine Fintech Chamber criticized the outcome of this measure, warning that this knee-jerk reaction does not defend the security of users’ funds, but the availability of these free funds to finance banks’ business model.

“Their business model relies on maintaining regulatory privileges rather than offering better services than fintech companies,” the chamber concluded.

Even so, the approval of this reform is considered a victory for President Javier Milei’s Administration, given that it modernizes a framework established in 1974.

FAQ

-

What recent decision did Argentina make regarding wage payment options?

Argentina’s Senate removed the option for workers to receive wages via digital wallets, limiting payments to traditional banking institutions. -

What was originally proposed in the labor law reform draft?

The draft included provisions allowing wage payments through compliance-authorized Payment Service Providers alongside bank accounts, but this was ultimately eliminated. -

What concerns did banks raise about the proposed inclusion of fintech companies?

Banks argued that including fintech would drain liquidity from the banking system and expose users to increased risks without the same protections as traditional institutions. -

How does the Argentine Fintech Chamber view the outcome of the reform?

The chamber criticized the decision, arguing it favors banks’ interests over user security and limits competition from fintech firms.

news.bitcoin.com

news.bitcoin.com