Decentralized perpetual exchanges are quietly stacking nine-figure monthly volumes as traders continue shifting leverage-heavy activity onchain, away from centralized venues.

Decentralized Perps Platforms See Sustained Growth in Trading Activity

Decentralized perpetual exchanges, often called perp DEXes, are a growing segment of decentralized finance ( DeFi) that allow traders to speculate on the price of assets like bitcoin and ether without owning them outright.

Instead of spot trading, users open leveraged long or short positions using perpetual contracts—derivatives with no expiration date—executed entirely via smart contracts. Unlike centralized exchanges, perp DEXes are noncustodial.

Essentially, traders connect a wallet, post collateral directly into smart contracts, and retain control of their funds at all times. Margin requirements, funding rates, liquidations, and profit-and-loss accounting are enforced onchain, removing the need for a trusted intermediary and reducing traditional counterparty risk.

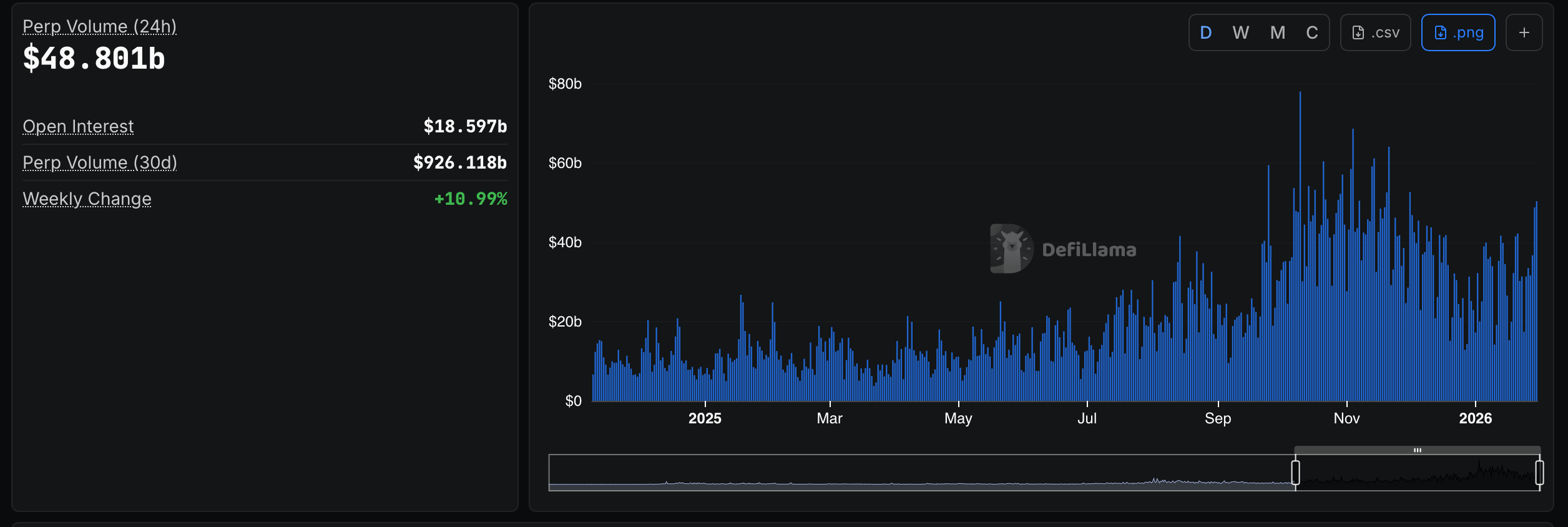

That model has proven increasingly attractive. According to the latest defillama.com data, total decentralized perp trading volume reached $48.8 billion over the last day, while 30-day volume stands at $926.1 billion, reflecting a 10.99% weekly increase since the start of 2026. Open interest (OI) across platforms is currently $18.6 billion, signaling sustained speculative engagement rather than fleeting bursts of activity.

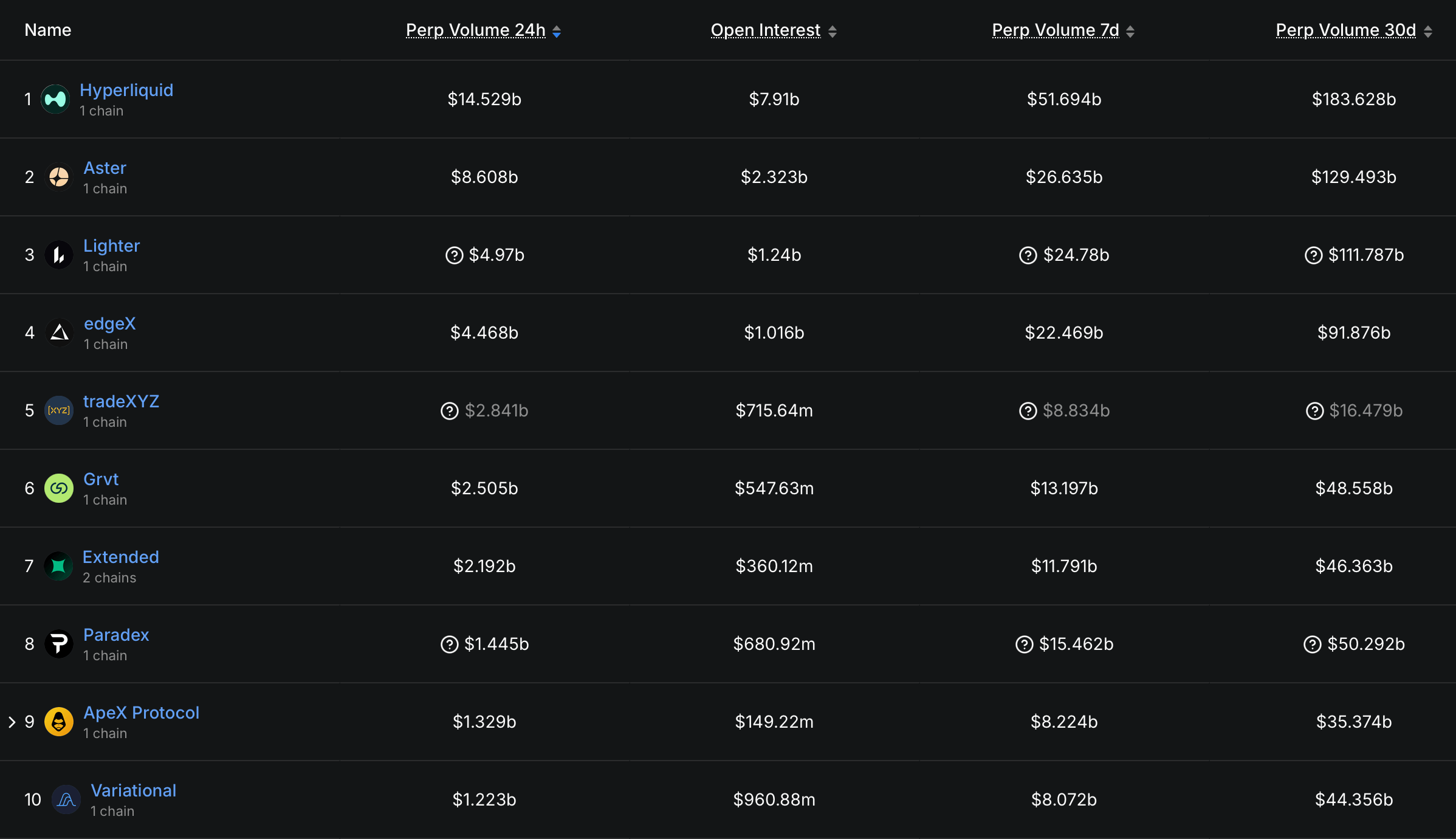

The real story, however, is concentration. A small group of platforms is responsible for the bulk of that 30-day activity, led decisively by Hyperliquid. The popular onchain perp venue posted $183.6 billion in 30-day volume, far outpacing every competitor. Its $7.9 billion in OI further highlights how deeply embedded it has become in leveraged crypto trading.

Aster ranks second, with $129.5 billion in 30-day volume and $2.3 billion in open interest, followed by Lighter at $111.8 billion. EdgeX is close behind with $91.9 billion, while TradeXYZ rounds out the top five with $16.5 billion over the same period.

The bottom half of the top 10 still commands a serious scale. Grvt recorded $48.6 billion in 30-day volume, Extended posted $46.4 billion, Paradex reached $50.3 billion, ApeX Protocol saw $35.4 billion, and Variational closed the list at $44.4 billion. Combined, the top ten perp DEX platforms account for the vast majority of all decentralized perp trading activity in the space.

Also read: Coinbase Turns Forecasting Into a Trade With New US Prediction Markets

The broader upward trend in 2025 and into 2026 reflects a structural shift. After years of exchange collapses, regulatory pressure, and opaque balance sheets, traders appear increasingly comfortable executing high-risk strategies directly onchain. The nearly $1 trillion in 30-day volume suggests decentralized derivatives are no longer experimental—they are today’s infrastructure.

If current momentum holds, perp DEXes may soon rival mid-tier centralized derivatives venues, not by copying them, but by offering a fundamentally different risk and custody model that aligns with crypto’s original promise.

FAQ ❓

- What is a decentralized perp DEX?It is a noncustodial exchange that allows users to trade perpetual futures directly from a wallet using smart contracts.

- Why are perp DEXes popular?They offer leverage, shorting, and transparency without requiring custody of user funds.

- Which platform leads in 30-day volume?Hyperliquid leads all decentralized perp DEXes with more than $183 billion in 30-day volume.

- How large is the market right now?Total decentralized perp trading volume reached roughly $926 billion over the past 30 days.

news.bitcoin.com

news.bitcoin.com