Crypto products on CME reached peak activity in Q4, announced the exchange operator. The shift was driven by $ETH futures, as well as the new $SOL and $XRP markets.

For Q4, CME marked record activity on its crypto products, with peak engagement, volumes, and open interest. The peak activity led to CME’s decision to offer 24/7 trading for its crypto markets, mimicking native trading.

CME completed nine years of $BTC futures trading in the past year, becoming one of the main indicators for the potential direction of $BTC. During those years, both CME and the crypto native market matured.

Based on the strong performance in 2025, CME announced more products in its pipeline, including contracts on ADA, LINK, and XLM, available from February 9. The altcoin products are currently in regulatory review.

The market is also preparing to create a Nasdaq CME Crypto Index, to be launched by the end of 2025.

CME doubled its daily volume

2025 saw the ongoing expansion of crypto activity on CME. The exchange carried over $3T in notional value futures and options trading. Average daily volumes more than doubled in the past 12 months to 280K contracts, and average daily open interest expanded to 313K contracts, or $26B.

Trading momentum accelerated in Q4, with open interest doubling against Q4, 2024. The CME market has a widened participant base, with a record of 1,039 holders of large open interest, an all-time record as of October 21, 2025. The exchange saw its participant base increase, together with other mainstream activities such as ETF trading.

$ETH momentum drove peak futures activity

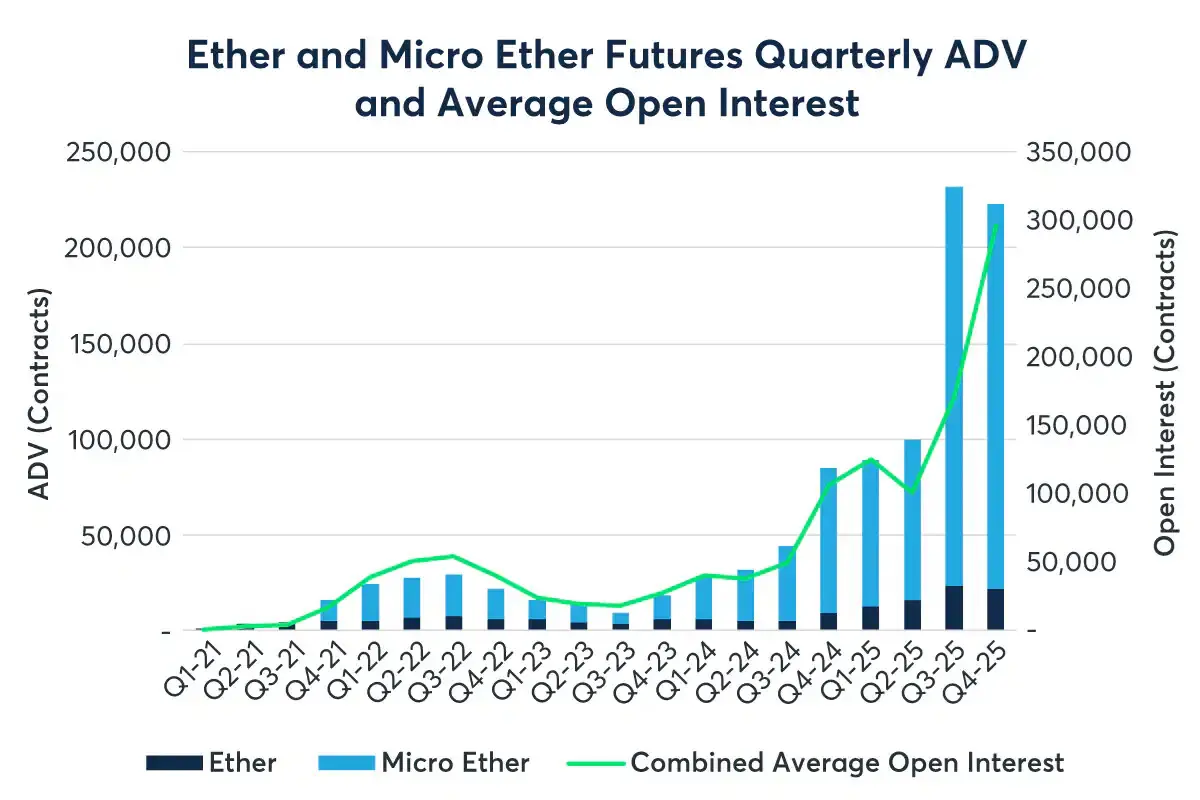

$ETH was one of the most widely traded assets, spiking in activity as the token retained a relatively high range in September and October.

According to CME, $ETH reinforced its status as appealing to institutions, which accelerated trading in Q4. The combined open interest for $ETH and Micro Ether (MET) futures hit a record at 545K contracts traded on November 28.

Ether options took over and reached a peak open interest of 7,240 contracts on November 26. $ETH appealed to institutions for its potential recovery to a higher range, as well as Ethereum’s role in carrying decentralized finance.

The remaining growth came from multiple trading records for Solana and $XRP. Market demand intensified for regulated exposure to $SOL and $XRP products.

$SOL futures traded $37.7B after their launch, with peak open interest of $2.25B on October 29. $XRP open interest peaked at $1.5B on October 28. In Q4, CME also launched options for its $SOL and $XRP products, starting from October 13. The options offered a new layer of capital efficiency for market participants.

Trading peaked in December, after the launch of spot-quoted futures for $BTC, $XRP, and $SOL. Spot-quoted futures on $BTC also reached record trading volumes in the last weeks of 2025.

cryptopolitan.com

cryptopolitan.com