Whale deposits to Binance slowed down in January, after more substantial transfers in December. At the start of 2026, around 15,800 $BTC were sent to the exchange, signalling a slower pace of deposits.

Binance data shows that since the beginning of 2026, whales have slowed down the rate of transfers to the platform. For December, whales transferred a total of 37,133 $BTC. To date, transfers to Binance are around 42.5% slower. The whale’s approach may signal a wait-and-see strategy.

Whale inflows also dominated over retail deposits, increasing the average size of transfers to Binance. However, even whale deposits could abruptly slow down, signalling a shift in market sentiment. For now, $BTC indicators are not yet bullish, but may signal a market bottom.

Whale movements are closely watched for signals on a potential price recovery for $BTC. The recent slowdown coincided with a $BTC recovery to over $97,000. $BTC retreated to $95,449.56, with predictions for regaining the $100,000 level soon. The most recent price upturn also did not lead to immediate selling, as holders did not rush to liquidate at the higher price.

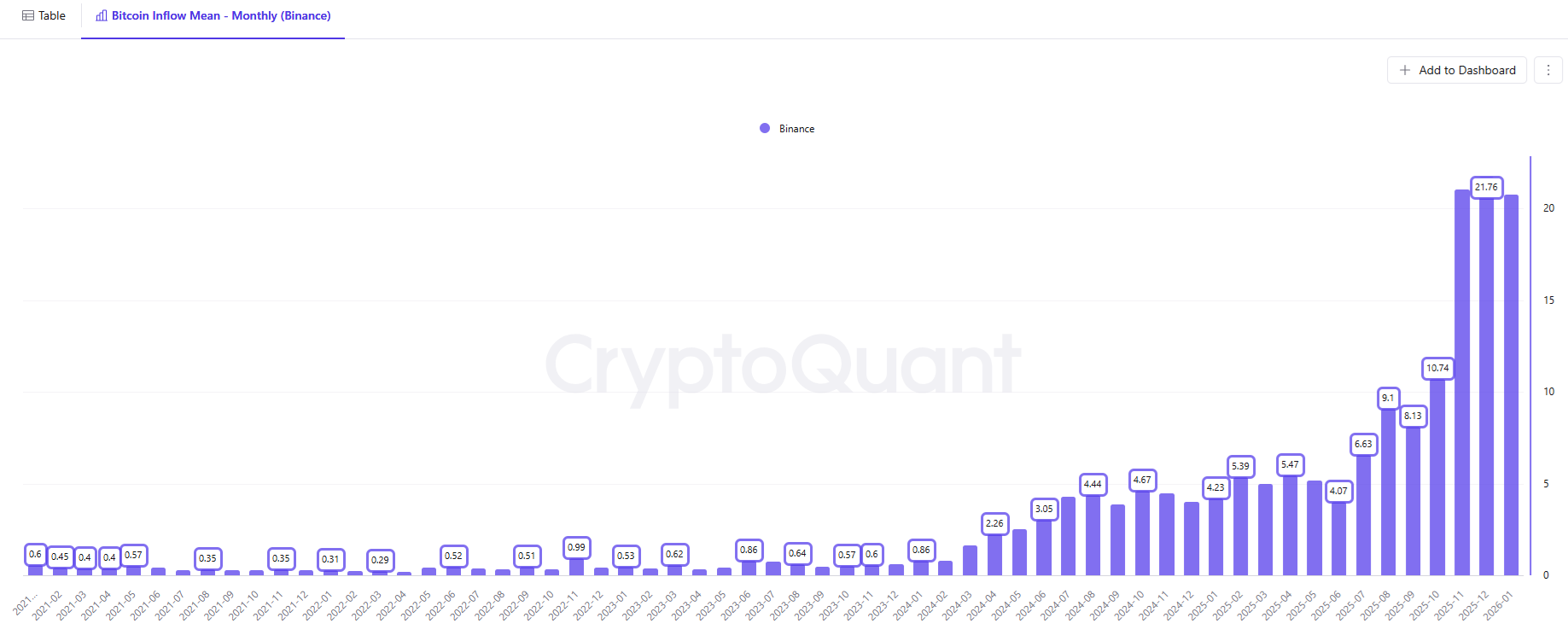

Mean inflows remain whale-sized

Mean inflows to Binance remain near all-time highs. The mean deposit is over 20 $BTC.

Whales make up around 20.85% of total inflows, but are more influential on the size of deposits. Daily whale transfers are at around 2,200 $BTC, a moderate level that can easily be absorbed by the market.

The recent activity shows that the potential for capitulation is lower. $BTC sentiment returned to neutral based on trader activity, and only retail remains bearish.

The December downturn also coincided with a rotation into stocks and precious metals. However, the liquidity did not entirely abandon crypto assets, leading to a price recovery.

Whale transfers may accelerate with more dramatic price moves. If $BTC rises with a new rally, deposits may be an attempt to take profits. Whale transfers also happen during downturns, as a way to cut losses.

$BTC is 101 days from its all-time high

The recent market downturn has continued for 101 days since the all-time high above $126,000. The current market cycle took only 236 days to achieve a new all-time high. During the past three months, $BTC turned more volatile, ranging from its peak to lows just under $80,000.

Historically, big liquidation events take between 3 and 6 months to rebuild liquidity. For now, the market is still affected by last October’s downturn.

$BTC open interest is back down to $30B, and is yet to recover reliably. The market still awaits signs of a direction, instead of a range-bound liquidation of short and long positions.

At the current price range, over 77% of $BTC supply is held in profit, up from 62% in November. The improved market price may mean some whales will be ready to hold onto their assets.

cryptopolitan.com

cryptopolitan.com