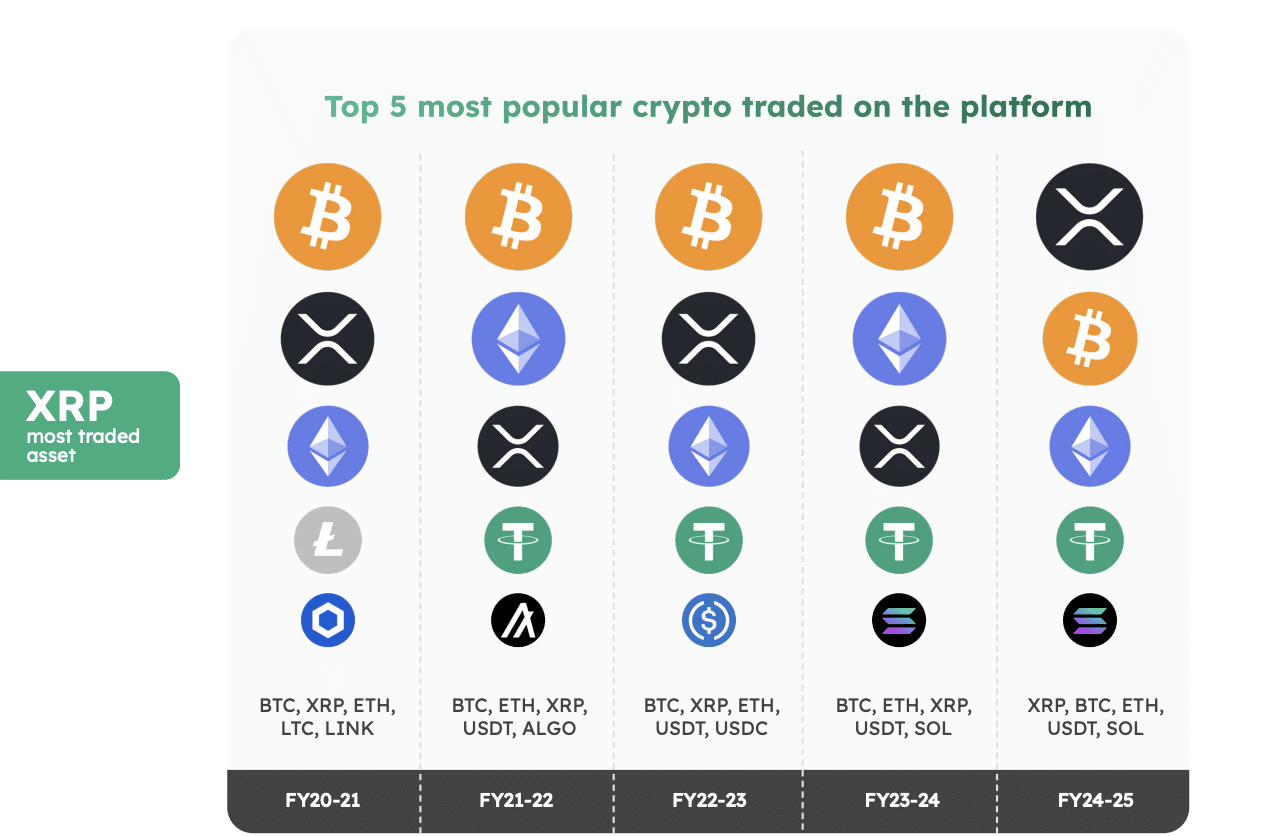

$XRP has overtaken Bitcoin to become the most traded digital asset on $BTC Markets, Australia’s largest local crypto exchange.

This was revealed in the platform’s newly released 2025 Investor Study Report. The development marks a notable shift in how Australian investors are engaging with the crypto market.

Key Facts

- $XRP surpassed Bitcoin to become the most traded asset on Australia’s largest crypto exchange, $BTC Markets.

- Strong community support and Ripple ODL ties helped drive $XRP’s trading dominance in 2025.

- Bitcoin remains the most widely held asset, even as traders focus more on utility-driven tokens.

- Rising trade sizes and broader participation confirm a maturing Australian crypto investor base.

$XRP Takes the Lead on Australia’s Largest Exchange

For the first time in four years, $XRP surpassed Bitcoin in trading activity on $BTC Markets. The exchange attributes this development to its role as an On-Demand Liquidity (ODL) partner with Ripple, alongside strong and sustained engagement from the Australian $XRP community.

$XRP community figure WrathofKahneman drew attention to the report in a post on X.

$BTC Markets "Investor Study Report 2025" claims #$XRP overtook $BTC as the platform's most traded asset and notes their role as a #Ripple ODL parter. pic.twitter.com/1FkuEB45a9

— WrathofKahneman (@WKahneman) January 13, 2026

Notably, the report highlighted that Bitcoin posted an impressive 70% surge to a new all-time high in 2025, outperforming equities and gold. Yet trading data shows that investor attention on $BTC Markets increasingly gravitated toward $XRP during the financial year.

In 2025, $XRP also delivered a strong performance at the start of the year, first soaring to $3.34 in January for the first time in eight years. By July 2025, it reached $3.66. Meanwhile, its price later dipped by roughly 50% to $1.80 by year-end.

Utility and Strategy Over Familiar Names

$XRP’s rise reflects more than short-term momentum. Designed for fast, low-cost international payments, the asset continues to attract users focused on real-world utility.

Improved regulatory clarity and strong community momentum reinforced confidence, translating into higher trading activity.

Behind $XRP and Bitcoin, Ethereum, Tether, and Solana rounded out the top five most traded assets on $BTC Markets for FY24–25.

Notably, USDC dropped off the leaderboard, suggesting a gradual rotation away from capital-preservation assets toward tokens perceived to offer stronger upside or network activity.

What Investors Hold vs. What They Trade

Despite $XRP leading in trading volume, Bitcoin remains the most widely held crypto asset. $BTC Markets’ national consumer study found that 68% of respondents own Bitcoin, underscoring its role as a long-term portfolio anchor.

This gap between holdings and trading activity suggests investors are comfortable trading utility-driven narratives while maintaining longer-term positions in $BTC.

Ultimately, $XRP’s emergence as the most traded asset on $BTC Markets signals growing confidence in diversification and use-case-driven investments among Australian crypto participants.

The data suggests a market in transition in which investors are not abandoning Bitcoin, but are willing to look beyond it in search of utility, opportunity, and long-term value.

Maturing Investor Base Driving the Shift

Meanwhile, the report highlights a broader evolution in investor behavior across Australia. Over the 2024–2025 financial year, $BTC Markets supported 374,000 Australians, with total trading volume reaching $4 billion.

Average trade sizes rose by 25%, while daily trade volumes increased by 17%, pointing to more deliberate and confident capital deployment.

Participation has also broadened, with older Australians, women, SMSFs, and sole traders entering the market in greater numbers and integrating crypto into structured portfolios rather than treating it as purely speculative exposure.

thecryptobasic.com

thecryptobasic.com