Crypto data provider CoinMarketCap has changed its exchange ranking system, just over a month after it was acquired by crypto exchange Binance, for a rumoured $400 million. The new system now puts Binance first—and it removes previous numbers that suggested the exchange was home to rampant wash trading.

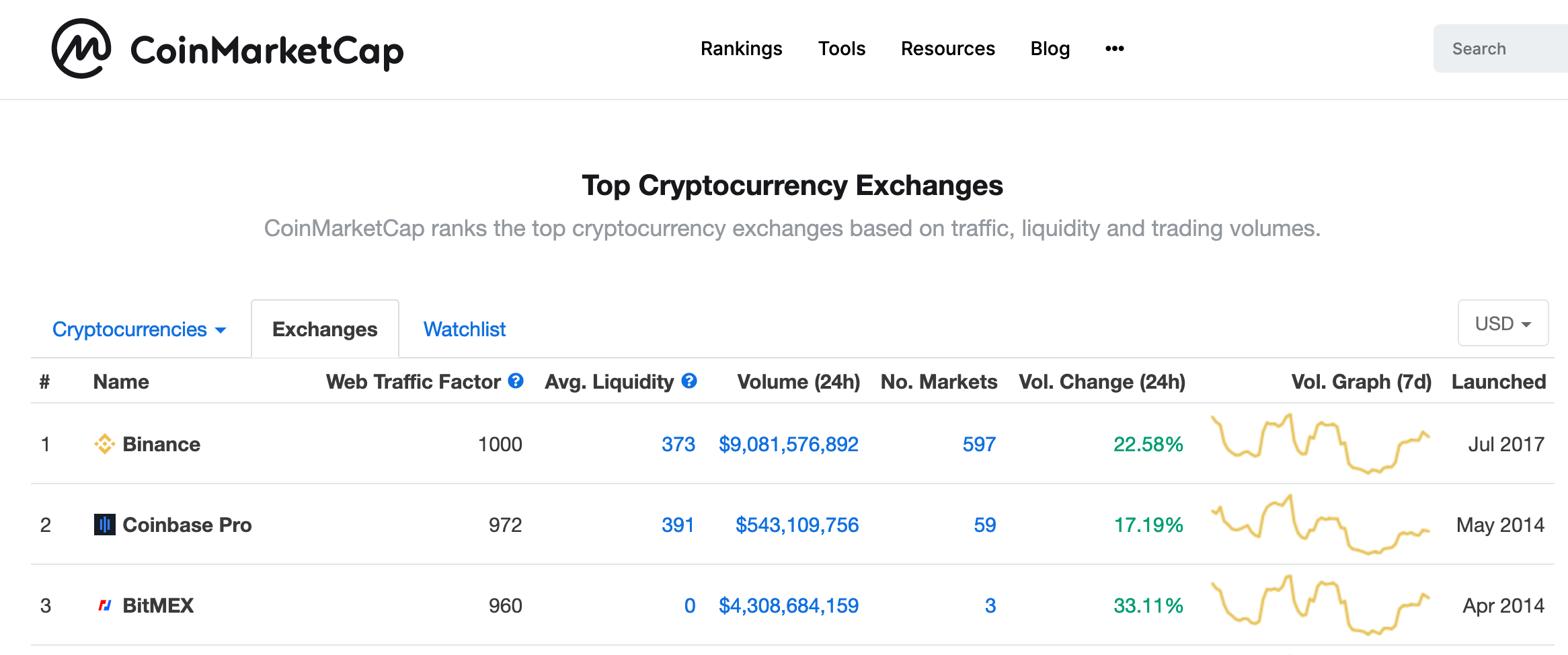

The new system ranks exchanges by web traffic. “Instead of asking exchanges to submit their user numbers, a good intermediate proxy will be web traffic,” CoinMarketCap stated. It is now the default metric for ranking exchanges. It puts Binance at the top with a score of 1,000, followed by Coinbase Pro and BitMEX.

We listened. @coinmarketcap updated exchange rankings by incorporating web traffic factor. Checkout the update rankings at URL below and let us know what you think.https://t.co/00jEVwiC6c https://t.co/WGmyM0MkCj

— CZ Binance 🔶🔶🔶 (@cz_binance) May 14, 2020

“We listened. Coinmarketcap updated exchange rankings by incorporating web traffic factor. Checkout the update rankings at URL below and let us know what you think,” Binance CEO Changpeng Zhao tweeted yesterday.

As CoinTelegraph pointed out, CoinMarketCap’s chief strategy officer and acting CEO Carylyne Chan said, in an interview last year, "We've seen other people do things like you've said, web traffic as a way [to verify exchanges are legitimate] but people trade using API keys so that's why web traffic is not a good indicator."

We have reached out to Binance and CoinMarketCap and will update this story if we hear back.

CoinMarketCap removes indicator of wash trading

But the data provider hasn’t just changed its stance on using web traffic, it has also removed an indicator it created in July 2019 designed to provide more accurate data, and weed out wash trading.

At the time, CoinMarketCap CEO Brandon Chez told Forbes fake trading volume “is an important issue, and we’re actively trying to solve it.”

On April 3, the day after Binance acquired CoinMarketCap, the exchange was ranked 15 on the site. The data provider listed Binance’s claimed exchange volume as $6.7 billion. But it put its adjusted volume, a metric designed to remove any suspicious activity, at $2.1 billion.

“Adjusted volume is a way to view all exchanges, excluding data that is skewed (too different from other exchanges) or potentially suspicious. As such, you might think of adjusted volume as a way for us to provide a more nuanced presentation of the data, and reported volume as plainly what the exchanges provide to us through their API,” CoinMarketCap explained.

But that metric has now gone. The original metric, including wash trading and “potentially suspicious” data—according to CoinMarketCap—is the only one that remains. Here too, Binance ranks top.

Why is the top important?

Ranking at the top of exchange comparison sites is important for exchanges. A Bitwise report claimed that up to 95% of exchange volumes are fake, as they use wash trading to inflate their volumes—and move up the rankings.

As Coindesk reported, inflating numbers on exchanges is big business. Alexey Andryunin, a 20-year-old sophomore student at Moscow State University, charges $15,000 to his 30 clients to fake trading volumes for them. While he’s increasing volumes for token projects as opposed to exchanges, he claimed that exchanges are aware of what he does and make no moves to counter him.

Exchanges even pay to be listed in sponsored slots at the top of exchange rankings, rather than having to pump their own volumes to reach the actual top slot. Crypto news site BeInCrypto, for example, lists crypto exchange Stormgain in a sponsored slot at the top of its exchange rankings, despite the exchange having much lower volumes than the ones beneath it.

Fundamentally the top spot is important because it increases exposure for the brand and makes it look like it’s the most popular exchange, thereby attracting new customers. These new customers not only pay trading fees, and withdrawal fees, but they also increase trading volumes—putting the exchange even higher on the rankings and bringing in more customers. A virtuous circle—or a vicious one.

decrypt.co

decrypt.co