With only a few days left until the end of 2025, CoinGlass has released its year-end report for 2025.

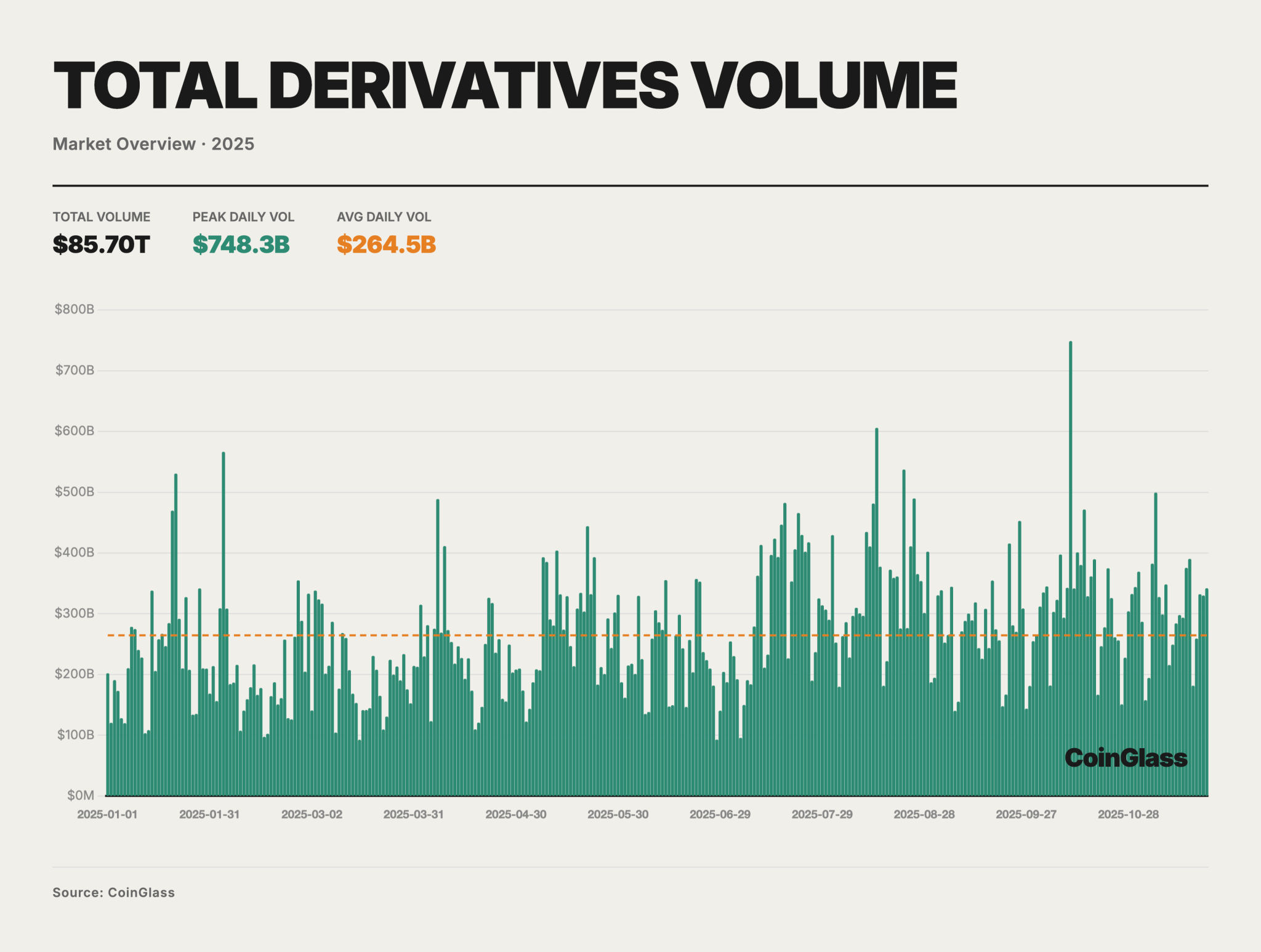

According to CoinGlass’ report, the total trading volume of the cryptocurrency derivatives market will be approximately $85.7 trillion in 2025, with an average daily trading volume of $264.5 billion.

2025 is the Year of DAT!

The report highlighted that 2025 is the year of DATs (Depth of Activated Transactions). DAT companies increased their Bitcoin holdings from 600,000 $BTC at the beginning of the year to 1.05 million $BTC by November, acquiring approximately 5% of the total Bitcoin supply.

The total trading volume in the crypto derivatives market reached approximately $85.7 trillion throughout the year, with a daily average of $264.5 billion. Global crypto derivatives open positions fell to their lowest level of the year in the first quarter, around $87 billion, following a reduction in leverage, before rapidly increasing in the middle of the year to reach a record high of $235.9 billion on October 7th.

The fourth quarter was also tough, and a sharp reset in early October wiped out over $70 billion in positions, representing roughly a third of total open positions, through a sudden delegitimization event.

CoinGlass attributed the decline and liquidations to US President Donald Trump’s decision to impose a 100% tariff on goods from China.

Despite this decline, year-end open positions reached $145.1 billion, a 17% increase since the beginning of the year.

The total nominal value of liquidated long and short positions reached $150 billion, while daily liquidations averaged between $400 million and $500 million.

These purges were concentrated mainly in October and November.

“Unexpected extreme events occurring in 2025 subjected existing collateral mechanisms, liquidation rules, and cross-platform risk transfer methods to unprecedented stress tests.”

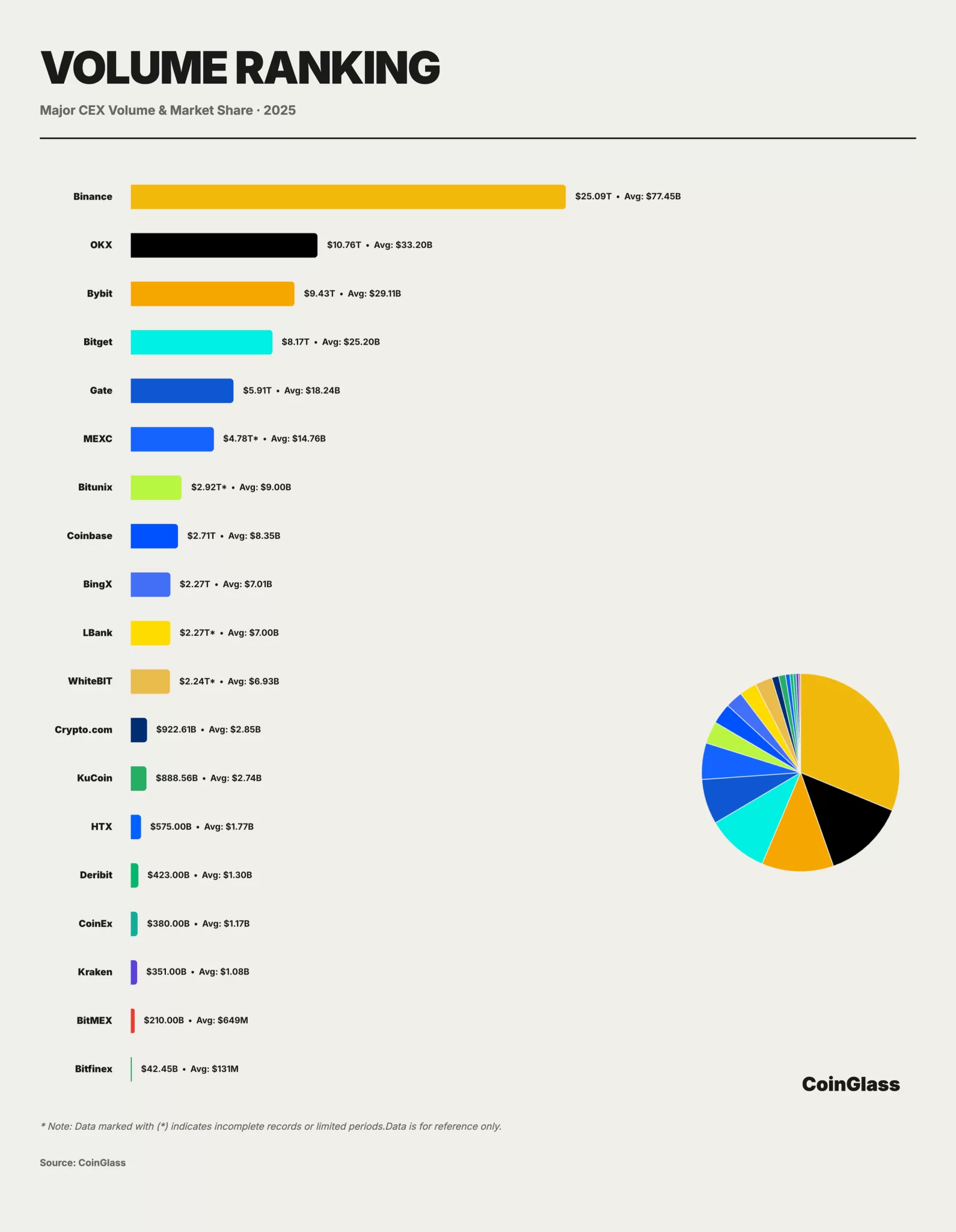

Binance Took the Lead!

According to the CoinGlass report, Binance led the market with a total derivatives trading volume of approximately $25.09 trillion.

This accounts for approximately 30% of global trading volume, meaning that about $30 out of every $100 traded takes place through this exchange. Binance was followed by OKX with a volume of $10.7 trillion, Bybit with $9.4 trillion, and Bitget with $8.1 trillion. These four exchanges accounted for approximately 62.3% of the total market share.

*This is not investment advice.