Decentralized perpetuals exchange and Layer 1 blockchain Hyperliquid has unveiled two new features in pre-alpha: portfolio margin and its BLP Earn vaults.

Founder Jeff Yan announced the change in the Hyperliquid Discord, and says the “initial rollout has intentionally low caps as safeguards, with $HYPE as the only collateral asset and $USDC as the only borrowable asset. USDH will be added as borrowable, and $BTC will be added as collateral in a future upgrade.”

Portfolio margin unifies users’ spot and perpetuals trading accounts for greater capital efficiency. The pre-alpha phase is gated to accounts with more than $5 million in all-time volume, with a $1 million $USDC global borrow cap and a $1,000 $USDC per-user borrow cap in the initial stage.

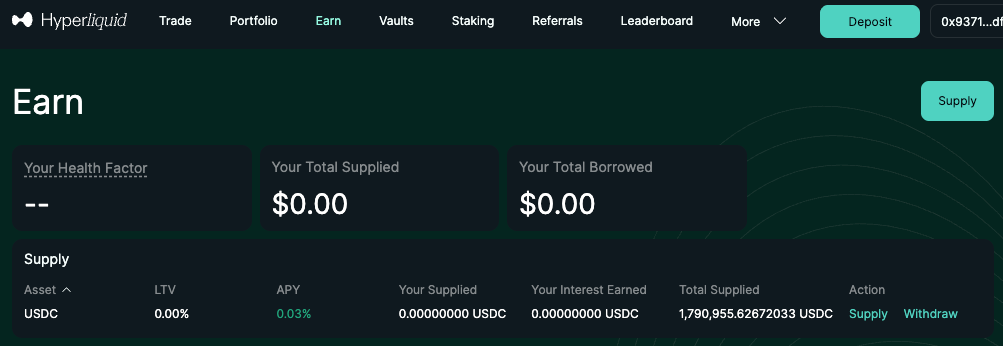

The BLP earn feature allows users to earn yield on stablecoins or to borrow against their $HYPE holdings to increase purchasing power on the Hypercore DEX.

$HYPE is down 3% today, in line with the rest of the market as $BTC and ETH dropped 2% and 4% respectively. However, the token is looking to shake off a multi-month downtrend, with $HYPE falling from an all-time high of $59 in September to just $24 today.