On-chain prediction markets have grown quickly over the past two years, with total monthly volume jumping from under $100 million in early 2024 to more than $13 billion today.

That’s a 130-times increase, making them one of the fastest-growing financial sectors, according to a new report from Keyrock and Dune Analytics, shared with The Defiant. Most of the growth in 2025 is coming from non-sports-related markets, despite sports betting leading U.S. prediction market activity in recent months.

“Economics” and “Tech & Science” show the biggest volume gains this year, up 10 times and 17 times, respectively. Open interest is also expanding fastest in Economics (7x) and Social & Culture (6x).

Politics, Elections, and Economics dominate the main platforms, according to the report. On Kalshi — the U.S.-regulated platform that started adding crypto infrastructure this year — these three categories hold 2.5 times the open interest of Sports bets, while on Polymarket, Politics outpaced Sports by 400% this year.

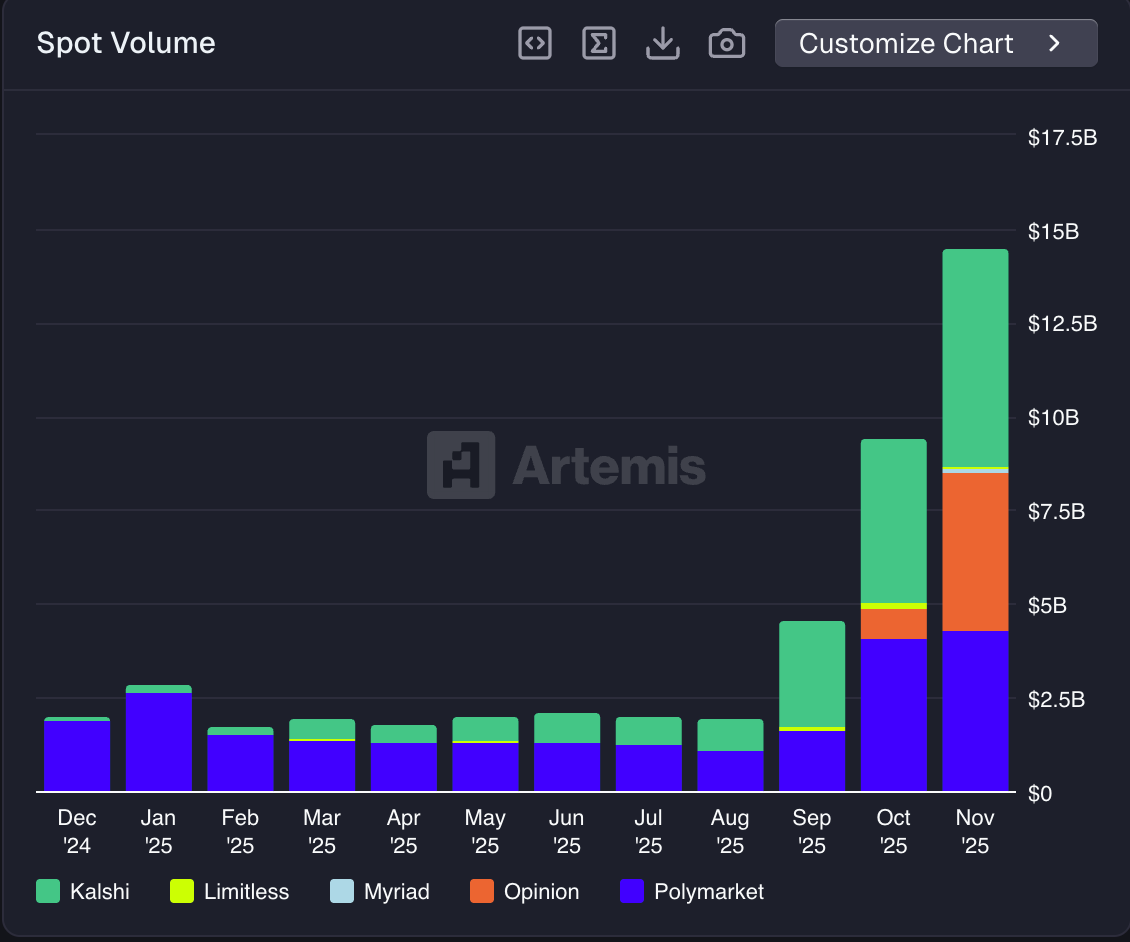

Meanwhile, data from Artemis shows even higher volumes, with total spot volume for the sector reaching as high as $14.5 billion last month, setting new records for both Polymarket and Kalshi, up from $9.4 billion in October.

The rise of prediction markets underscores how they are becoming a leading tool for real-time insights, boosted further by high-profile partnerships with news media giants like CNN, CNBC, and Yahoo Finance. Unlike traditional models, these markets adjust constantly, often spotting trends before conventional indicators, the report noted. For example, Kalshi’s inflation market is 4.3-times less volatile than the Cleveland FedNow model.

According to the joint report, they are also highly accurate, as Polymarket and Kalshi forecasts have Brier scores around 0.09, sometimes even 200 days before events resolve. The Brier score is a metric that measures the accuracy of probabilistic predictions — a score of 0 refers to perfect accuracy and 1 reflects inaccuracy.

Polymarket prices outcomes correctly 90-95% of the time, the report stated, with accuracy rising as liquidity increases. One month before an event, forecasts are 90.4% correct, dipping to 88.5% one day before resolution, and climbing to 94.1% in the final four hours.

US Expansion

The findings come a few weeks after Polymarket officially returned to the U.S., after receiving CFTC approval late last month. The platform initiated its U.S. rollout with the launch of its app in the U.S. App Store for waitlisted users, in a move that lets Americans place real-money prediction bets on sports, politics, and other events.

In a recent interview, Polymarket’s founder, Shayne Coplan, called prediction markets “the most accurate thing” we have right now. “You make money if you're right. You lose money if you're wrong,” he said. “And as a result it creates this information that's really useful for people.”

Polymarket’s return to the U.S. also followed a $2 billion strategic investment from Intercontinental Exchange (ICE), the owner of the New York Stock Exchange.