Amina Bank, a Switzerland-based financial institution, has announced the implementation of Ripple Payments, Ripple’s integral cross-border payment solution. With this move, Amina Bank becomes the first European bank to adopt Ripple’s service, reducing costs and friction for stablecoin and fiat payments.

Amina Bank Pioneers Ripple Payments’ Implementation in Europe

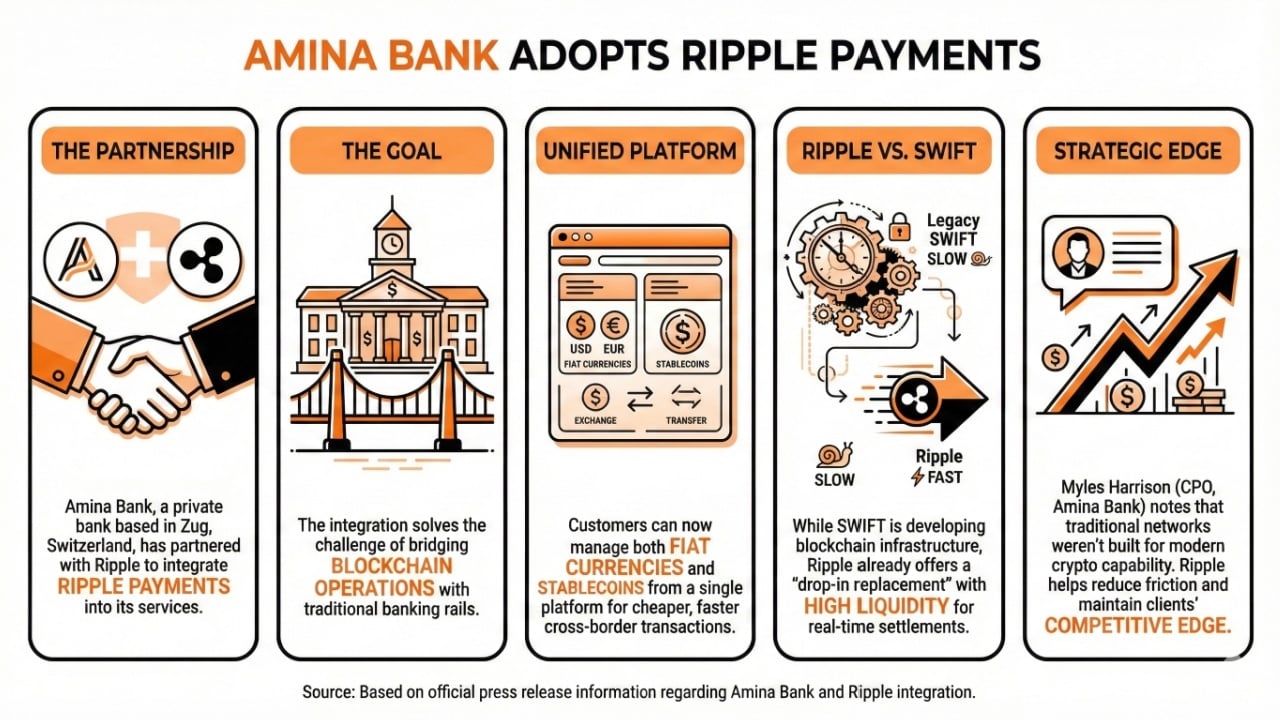

Amina Bank, a private bank based in Zug, Switzerland, has opened its doors to Ripple’s alternative cross-border settlement solution.

Amina Bank disclosed a partnership with Ripple to include Ripple Payments, Ripple’s signature payments solution, on its platform. In a press release, the company explained that this move was focused on solving the “challenge of integrating blockchain operations with traditional bank rails.”

With Ripple Payments, customers can manage fiat currencies and stablecoins from a single platform, simplifying and making cross-border transactions cheaper and more convenient.

While SWIFT is preparing its blockchain-based infrastructure to support real-time payments with support for over 30 banks from all over the world, Ripple already offers a drop-in replacement for companies seeking alternatives with high liquidity.

Myles Harrison, Chief Product Officer at Amina Bank, stressed that traditional corresponding banking networks, such as SWIFT, weren’t designed with this functionality in mind.

He stated:

With Ripple’s support, we are now able to significantly increase our capability, reducing cross-border friction and helping our crypto-native clients maintain their competitive edge.

Amina Bank’s relationship with Ripple is not new, as the institution was the first one to support RLUSD, Ripple’s stablecoin, earlier this year. Now, it becomes the first European company to adopt this solution.

Cassie Craddock, Managing Director, UK & Europe at Ripple, stated that the bank embodied the “forward-thinking approach needed to advance wider adoption of digital assets technology.”

Ripple claims it already has coverage of over 90% of the foreign exchange markets and processes over $95 billion in volume. Earlier expansions of Ripple Payments extended its settlement corridors to include fiat currencies like the Nigerian naira, the Brazilian real, and the Mexican peso, broadening its usability and reach.

Read more: Ripple Payments Accelerates XRP and Stablecoins Through NGN Lane

FAQ

-

What is Amina Bank’s recent development regarding Ripple?

Amina Bank has partnered with Ripple to integrate Ripple Payments, enhancing its cross-border settlement solutions. -

What advantages does Ripple Payments offer to customers?

Ripple Payments allows customers to manage both fiat currencies and stablecoins from a single platform, streamlining and reducing costs for cross-border transactions. -

How does this partnership compare to SWIFT?

Unlike SWIFT, which is developing its own blockchain infrastructure, Ripple provides an existing solution that addresses the limitations of traditional banking networks. -

What is the significance of Amina Bank adopting Ripple’s platform?

Amina Bank is the first European institution to implement Ripple Payments, strengthening its position in the digital asset space and supporting wider adoption of blockchain technology.

news.bitcoin.com

news.bitcoin.com