DeFi Technologies, a company bridging the gap between traditional capital markets and decentralised finance, has just received regulatory approval to start trading Cardano (ADA) and Polkadot (DOT) exchange-traded products (ETPs) on the Boerse Frankfurt Zertifikate AG (Frankfurt Stock Exchange).

These products have been dubbed Valour Cardano EUR and Valour Polkadot EUR, and will be traded via Valour (a subsidiary of DeFi technologies and a pioneering platform for digital asset ETPs).

ADA and DOT on the Frankfurt Stock Exchange

Valour Inc. is a Switzerland-based subsidiary of DeFi Technologies that specialises in exchange-listed financial products targeted towards both retail and institutional investors. After gaining approval to list Solana (SOL) on the Frankfurt Stock Exchange earlier this month, they have moved on to Cardano and Polkadot.

Currently, Cardano and Polkadot’s native tokens (ADA and DOT) rank the seventh and tenth-largest cryptocurrencies (by market cap), at $46.9B and $28.4B AUD respectively. Therefore, these are cryptos that new people entering the crypto space will likely take interest in. As such, Valour Cardano and Valour Polkadot will target retail and institutional investors who are interested in the Cardano and Polkadot networks, providing a more convenient way to join the space – while having better security and cost-effectiveness.

This is a huge positive, and that’s not even discussing the Frankfurt Stock Exchange; the largest stock exchange in Germany, and the 12th largest globally by market capitalisation. Suffice to say, followers of either coin can expect this to be a considerably beneficial development.

Crypto interest in the European market is increasing

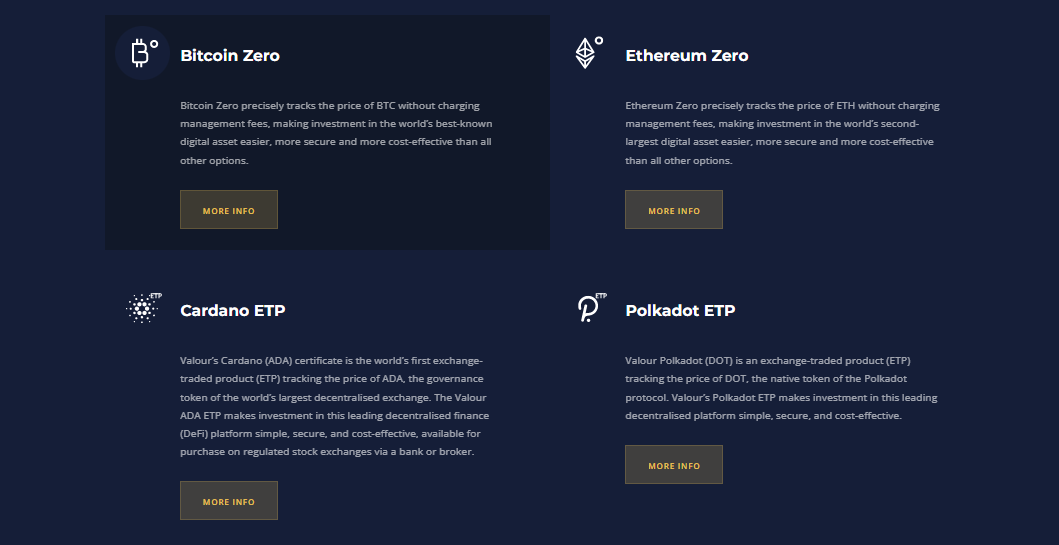

These two ETPs are only the latest in Valour’s crypto-asset product line. Valour’s crypto portfolio is fairly comprehensive, including Valour Uniswap (UNI), Solana (SOL) ETPs, as well as their fully-fledged fee-free flagship Bitcoin Zero and Valour Ethereum Zero products.

Source: Valour

What’s key to note is that the addition of the new Cardano and Polkadot to the rapidly-growing portfolio is a strategic move. According to Valour CEO Tommy Fransson, the decision to list the new products in Frankfurt was informed by increased interest in the Swedish market.

“We are expanding our product offerings in the large German market through these listings on Boerse Frankfurt. In Scandinavia, where Valour Polkadot and Cardano are already listed, we have seen a big interest in these crypto assets. We look forward to empowering more investors throughout Europe to have access to leading industry ETPs.”

He has also declared intentions to bring these products to other countries, including Switzerland and Austria.

The launch of all these crypto-related products has contributed to Valour’s financial results in a stellar manner. In November 2021, Valour’s assets under management (AUM) for their NGM and Frankfurt stock exchanges accelerated past $515 million AUD.

Valour is simply one of many

Cardano and Polkadot being listed on the Frankfurt Stock Exchange isn’t just a singular occurrence, but rather the latest in a long line of ETP launches outside the US.

- 21Shares AG, another Switzerland-based crypto ETP platform, launched products focused on Aave (AAVE), Chainlink (LINK), UNI, Decentraland (MANA) and FTX Token (FTT), as recently as this month.

- Coinshares, Europe’s largest digital asset investment firm, launched the world’s first physically-backed crypto exchange-traded products (ETPs) designed to share staking rewards with investors, focused on Polkadot and Tezos.

- Grayscale Investments recently published a list of 25 assets under consideration (for investing in), including Algorand (ALGO), Axie Infinity (AXIE), Cosmos (ATOM), Fantom (FTM) and Helium (HNT).

There’s a lot happening regarding crypto ETFs, and no doubt a ton more to come.

coinculture.com

coinculture.com