Exploding institutional appetite for regulated altcoin derivatives is driving a powerful new wave of product growth, with fresh $XRP and $SOL futures poised to accelerate liquidity, sharpen price discovery, and redefine the next phase of digital-asset market evolution.

$XRP and $SOL Futures Expand Regulated Crypto Access

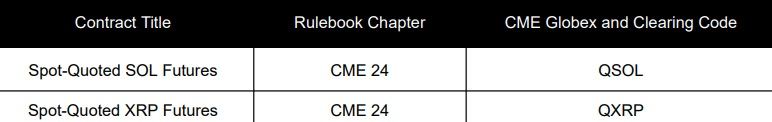

Growing demand for regulated digital-asset derivatives is accelerating product expansion. CME Group released a Special Executive Report on Nov. 14 stating that it will list Spot-Quoted $XRP Futures and Spot-Quoted $SOL Futures on Dec. 14 for trade date Dec. 15, pending regulatory review periods.

The Special Executive Report outlines that both contracts are cash-settled and incorporate a daily financing adjustment to account for the basis between futures prices and the underlying spot index. Spot-Quoted $XRP Futures will reference the CME CF $XRP-Dollar Reference Rate and trade under code QXRP, with a 250-token contract size, a $0.0004 minimum tick, and a $0.10 tick value. Spot-Quoted $SOL Futures will reference the CME CF $SOL-Dollar Reference Rate and list under code QSOL, using a 5-token contract size and a $0.02 minimum tick, also with a $0.10 tick value.

Each product launches with a single June 2026 maturity—QXRPM6 for $XRP and QSOLM6 for $SOL—and will trade on CME Globex with clearing through CME ClearPort. The report states that trading for both contracts will end on the second Friday of the contract month at 4 p.m. ET unless adjusted for a U.S. holiday.

Read more: CME Highlights Surging $XRP Futures as Institutional Trading Momentum Builds

The report also details fee structures, including quarterly maintenance fees of $0.15 for both the $XRP and $SOL contracts and CME Globex transaction fees ranging from $0.10 for certain member categories to $0.20 for non-members.

Market strategists view the parallel introduction of $XRP and $SOL as a broadening of institutional hedging options across two high-liquidity altcoins. While skeptics warn of altcoin volatility and evolving regulatory considerations, supporters contend that regulated $XRP and $SOL futures strengthen transparency, improve price discovery, and expand tools for institutional risk management in digital assets.

FAQ ⏰

-

What are the key features of the new Spot-Quoted $XRP and $SOL Futures?

They are cash-settled contracts with daily financing adjustments and June 2026 maturities trading on CME Globex. -

How do the contract sizes differ between $XRP and $SOL?

$XRP uses a 250-token contract size, while $SOL uses a 5-token contract size with similar $0.10 tick values. -

What fees apply to the new altcoin futures?

Both products carry quarterly maintenance fees of $0.15 and CME Globex transaction fees ranging from $0.10 to $0.20. -

Why are institutions interested in regulated $XRP and $SOL futures?

They offer transparent, regulated exposure that enhances hedging, price discovery, and risk management for high-liquidity altcoins.

news.bitcoin.com

news.bitcoin.com