- Gemini secured $75m Ripple credit line, may expand to $150m with $RLUSD loans.

- Exchange struggles with $282.5 million loss, $2 billion liabilities, IPO aimed at debt relief.

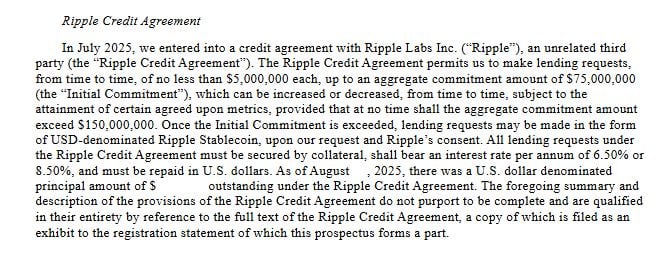

Gemini, one of the largest US-based cryptocurrency exchanges, has secured a $75 million credit line from Ripple Labs just ahead of its planned Nasdaq debut. The agreement, detailed in the company’s public S-1 filing, allows Gemini to borrow in increments of at least $5 million. Borrowings carry an annual interest rate capped at 8.5 percent.

The S-1 also verified that Gemini has previously utilized the credit facility for liquidity purposes. Although the present limit remains at $75 million, the exchange revealed that this amount may be increased to $150 million if specific circumstances are satisfied.

Under the initial cap, Gemini is allowed to borrow directly in US dollars.If the company crosses the $75 million mark, it will be able to draw on further loans in Ripple’s stablecoin, $RLUSD, which debuted in December 2024.

Ripple Stablecoin Gains Momentum

$RLUSD, dollar-pegged and constructed on both the $XRP Ledger and Ethereum, has increasingly gained institutional approval. By allowing Gemini to pay back parts of its loan in $RLUSD, Ripple cements the token’s standing in the market. The move can lead towards increased adoption and increased stablecoin liquidity.

Gemini has already been using $RLUSD in its business, and this highlights Ripple’s vision to expand the token’s application through deliberate financial partnerships. This adds another dimension to its current strategy, while the company has ruled out short-term IPO ambitions.

Ripple recently said that it is still in an acquisition stage, following renewed movement within $XRP’s trading. In spite of being one of the planet’s biggest privately held firms, Ripple clarified that it has no plans toward a stock exchange listing at the moment.

Gemini Battles Mounting Losses

The IPO arrives during a cash-strapped period for Gemini. The exchange registered a remarkable net loss of $282.5 million during the first six months of 2025, dramatically higher than losses of $41.4 million in the same period of 2024.

The filing states that Gemini’s cash position had reached $162 million in mid-2025. Its liabilities, on the other hand, were over $2 billion, highlighting the level of financial strain leading up to the IPO. The IPO is fundamentally meant to pay off debt liabilities and normalize operational funding.

The IPO share sale is being led by Goldman Sachs, Citi, Morgan Stanley, and Cantor Fitzgerald. Shares will be listed under the ticker symbol GEMI on the Nasdaq, said the company. It would be the third US crypto exchange listing in the public markets, after Coinbase and Bullish if it is successful.

With financial restructuring, Gemini has split operations between New York-based Gemini Trust and Moonbase in Florida. This move was designed to navigate stringent state-level licensing requirements while maintaining regulatory compliance.