OKX has released its 32nd proof-of-reserves report. As of June 14, the total $BTC and $USDT holdings held in user wallets have plummeted significantly compared to the previous month’s report.

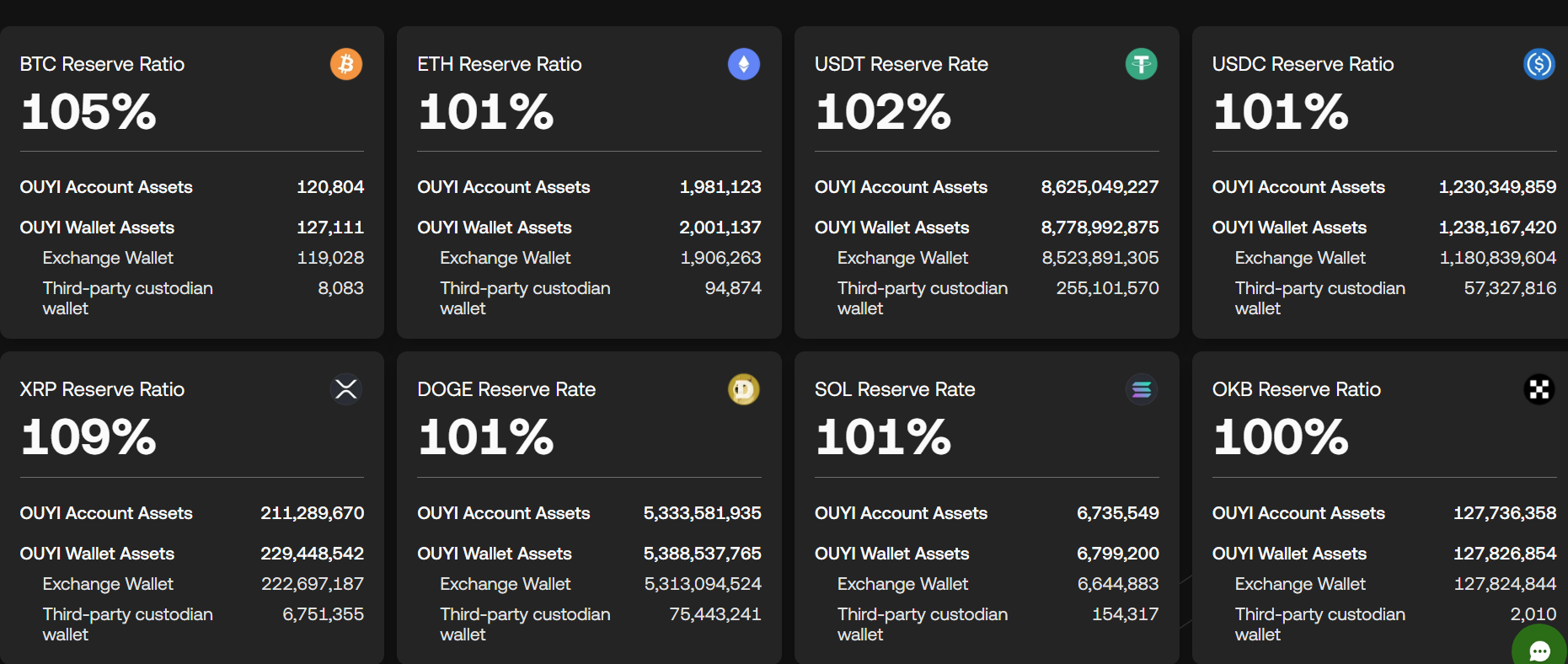

On June 30, the crypto trading platform released its 32nd proof-of-reserves report containing the number of assets held within its reserves compared to the number of assets deposited by customers. So far, all of its reserves exceed the 100% ratio. This means that the platform’s reserves for major tokens like $BTC ($BTC), $ETH ($ETH), $SOL ($SOL) and $USDT ($USDT) has surpassed the number of assets held in customer wallets.

The reserve rate for Ethereum Classic (ETC) holds the largest ratio, which stands at 107%. Meanwhile, Bitcoin remains the second largest asset by reserve to holding ratio, sitting at 105% as of June 14. However, the number of $BTC held by customers has experienced a significant drop.

Compared to the previous month’s report, specifically for May 10th, the number of currently held $BTC in June has decreased by 4,360 $BTC or around $470 million according to current market prices. Compared to May’s customer holdings for $BTC, which stood at 125,164 $BTC, the number fell by 3.48%.

Aside from $BTC, $USDT also fell by 1.44% in June compared to the previous month. This means that the amount of $USDT held by OKX users decreased by $126.4 million. Although the decline is not as steep as the drop experienced by $BTC, it is still worth noting due to the boom stablecoins in the wider market as of late.

On the other hand, customer wallet holdings for Ethereum rose by nearly 6% in June. This signifies a rise of 110,153 $ETH ($272.8 million) in the span of a nearly a month. The report shows that OKX users have been depositing more Ethereum into the exchange compared to Bitcoin.

What could the drop in OKX user $BTC holdings mean?

The 3.48% drop in $BTC holdings show that users may have chosen to withdrawn more Bitcoin from the exchange compared to the previous month. A possible reason behind this trend is the increasing number of traders keen on self-custody.

This means that users might be moving more of their $BTC to cold wallets, reflecting growing concerns over exchange security or a preference for holding during uncertain market conditions. Another possibility is that some traders may be trading away their $BTC holdings in favor of other assets in the wake of recent price movements.

$BTC had recently recovered from its short-lived slump when Trump announced a ceasefire between Israel and Iran, bouncing back to the $105,000 mark. However, the Fed rate decision and other geopolitical uncertainties have caused Bitcoin to flatline for the most part.