This is a segment from the Empire newsletter. To read full editions, subscribe.

That seems to have been Robinhood’s approach to crypto this past year, from its Bitstamp acquisition (still expected to close in the first half of next year) to its response to the Wells notice it received from the SEC. The firm has shown an interest and, dare I say, commitment to crypto.

Johann Kerbrat told me that’s not changing anytime soon and, if anything, the “enthusiasm in crypto,” is serving to help the firm as it plots out the upcoming year.

But even before the bullishness really took off after Donald Trump won the presidential election, the firm reported $38 billion in crypto assets under custody as of November 2024. And while Kerbrat wasn’t able to provide a more updated number, he did note that the company’s seen an increase in engagement if you’re looking at customer behavior, echoing what he told Empire back in October.

“In November alone, we did more than $3 billion in volume, which is, I think, almost twice as much as Q3,” he added. “If you look at the activity onchain … we see people buying on Robinhood, transferring to their self-custody wallet or transferring to other places,” he noted.

To put these figures in perspective, this is just a year after Robinhood’s trading revenues tanked in the same quarter back in 2023.

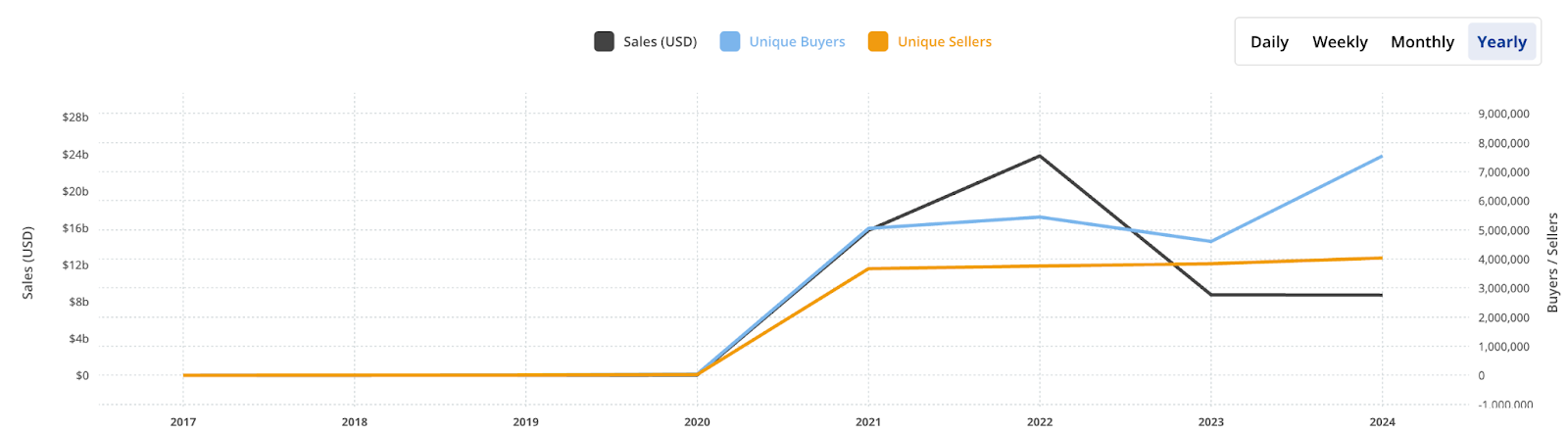

Kerbrat’s also noticed a tick up in NFT activity. While activity is still way down from 2022 (to no one’s surprise), it’s looking like sales will either match or fall just under last year’s total figure, according to data from CryptoSlam.

As of right now, with a little over a week left in the year, NFT global sales volume sits at $8.69 billion. Last year, that figure totaled $8.71 billion. If we’re just looking at the average sale in US dollars, though, then this year outperformed last year at $122 on average in comparison to 2023’s $95.

Europe has also been a big focus for Robinhood this year, arguably one of their bigger years in terms of expanding their EU footprint. However, that looks poised to change once the aforementioned Bitget acquisition closes.

But it’s not just Bitget that has Kerbrat’s attention next year. He and his team are eager to “do more in tokenization,” he said.

The firm, alongside Kraken, Paxos and others, announced the Global Dollar Network based on a new stablecoin offering, USDG, earlier this year.

“We want to be a pioneer” in tokenization, he told me, given that the publicly-traded company feels like it can “bring a lot to the table.”

He’s also starting to loosely look into artificial intelligence, but he’s wary due to how narratives tend to play out (story gets big, then bad actors come in to prey on the weak). Specifically, his concern is focused on AI being used for deep fake videos that could be used to scam people. But that’s not to say he doesn’t think AI and crypto can find common ground.

“I think the intersection between crypto and AI is something that I’m following pretty closely. When I hear a lot of the issues around AI right now on like micro payments or fair remuneration of the data that is training the models you handle, like personal information, all this kind of thing, makes me feel like … we can actually combine [crypto and AI] and get somewhere that is pretty exciting,” he explained.

blockworks.co

blockworks.co