FTX creditors continue to hope they will be made whole following the exchange’s collapse in November 2022. As the decision regarding the platform’s restructuring looms, it remains to be seen what form the payments will take.

More developments are expected in Q4, starting October, with creditor payments likely to cause market volatility.

FTX Creditors Compensation Update

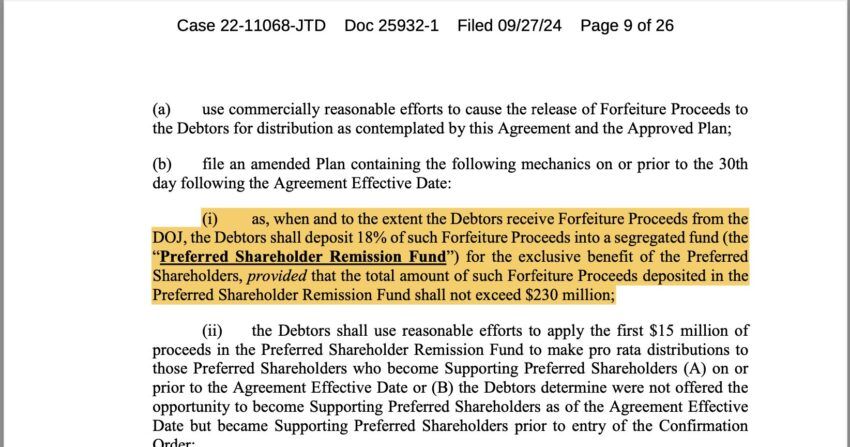

According to FTX creditor activist Sunil Kavuri, the exchange’s customers could get between 10% and 25% of their crypto back. The update comes as the now-defunct exchange moves 18% of the forfeiture funds ($230 million) to equity holders (shareholders), which some find concerning.

“[This is] Just a quick estimate of how much petition date is going to pay us versus current value,” the activist explained.

Read more: FTX Collapse Explained: How Sam Bankman-Fried’s Empire Fell

The update comes amid frothing buzz that FTX will begin distributing $16 billion to its creditors starting October. Notably, this remains unconfirmed, as the decision regarding the restructuring plan for the exchange’s customers is pending court confirmation. The court hearing related to this scheduled is due on October 7.

“The decision regarding the restructuring plan for FTX customers will not be made until October 7. Because the court hearing related to it is scheduled for that date. Personally, I could not find any information about what form of repayment it will be, crypto or cash, and this is very important in the context of withdrawals from the cryptocurrency market,” CryptoTrail wrote.

It comes barely two months after the court agreed to a $12.7 billion repayment. Nevertheless, the court banned FTX and its sister enterprise, Alameda Research, from trading digital assets and did not impose any civil monetary penalty.

There is still controversy around the reorganization plan after a US trustee objected, citing the need for more equitable distribution among creditors. Before the US Trustee’s objection, FTX creditors, including Sunil Kavuri, had also filed an objection to the reorganization plan. The bone of contention is that the plan contains broad exculpation provisions and a lack of in-kind distribution options for customers.

“It is painfully apparent that the Debtors’ proposed Plan will inflict additional hardships on customers through forced taxation that could be avoided by making an ‘in kind’ distribution,” the creditors argued.

Similarly, the US Securities and Exchange Commission (SEC) questioned the plan. It demanded the removal of the discharge provision and other modifications. The securities regulator committed to challenging the plan’s confirmation if the exchange does not make these changes.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

Meanwhile, crypto markets are bracing for impact on two different fronts. On one hand, FTX still holds over $1 billion in Solana tokens amid ongoing liquidation efforts post-bankruptcy. As BeInCrypto reported, this significant number of tokens could pressure Solana’s market valuation.

On the other hand, customer repayments could inject a new wave of capital, likely to flow into Bitcoin and altcoins.

beincrypto.com

beincrypto.com