USDC is now available through traditional financial institutions in Brazil and Mexico after the issuer Circle connected the stablecoin to banking rails in the countries. In a release, Circle said it connected USDC to SPEI, a system powered by Banco de Mexico and PIX, the payment systems launched by the Central Bank of Brazil.

With the move, businesses can convert the USD-pegged stablecoin directly into Brazilian Reais (BRL) and Mexican Pesos (MXN) without converting to USD first. According to Circle CEO Jeremy Allaire, the move is part of USDC’s expansion into the global banking infrastructure through integration with leading banks.

He said in an X post:

“Today, we announced the availability of banking and USDC minting/redemption native in Brazil and Mexico, with 24/7 rails (PIX & SPEI) and using local currencies. This is part of our continued global banking infra expansion for USDC.”

Meanwhile, Circle has been busy recently. The stablecoin issuer had recently announced that it will integrate USDC into the layer-1 network SUI Network as part of its expansion across multiple blockchain networks.

Circle promises faster and cheaper settlements with USDC.

According to the press release, Circle integration will make the USDC stablecoin more accessible to corporate customers in these countries, where its availability has been limited to crypto exchanges. This will allow businesses to use it for their own purposes and as payment options for their retail customers.

The move is also expected to streamline cross-border settlements and transactions in both countries, eliminating the need for international wires. Circle believes USDC would be more attractive to businesses within these countries now that conversion is direct from USDC to fiat, making it cost-effective.

By choosing the two countries, Circle wants to capitalize on the US dollar-denominated transactions that account for most of their trades and, in the case of Mexico, the high remittance flow between the US and Mexico. The firm noted that Mexico and the US are major trading partners, with over $800 billion in trading activity between the two countries, while 95% of Brazil’s $640 billion in annual foreign trade in goods is denominated in dollars.

Meanwhile, it also highlighted that the remittance flows from the US to Mexico are the highest in the world, at around $63 billion in 2023, noting that using stablecoins for these remittances is expected to be more cost-effective than using US dollars. With time, the company plans to integrate with more payment systems and local banks.

Stablecoin adoption is growing as Circle faces criticisms

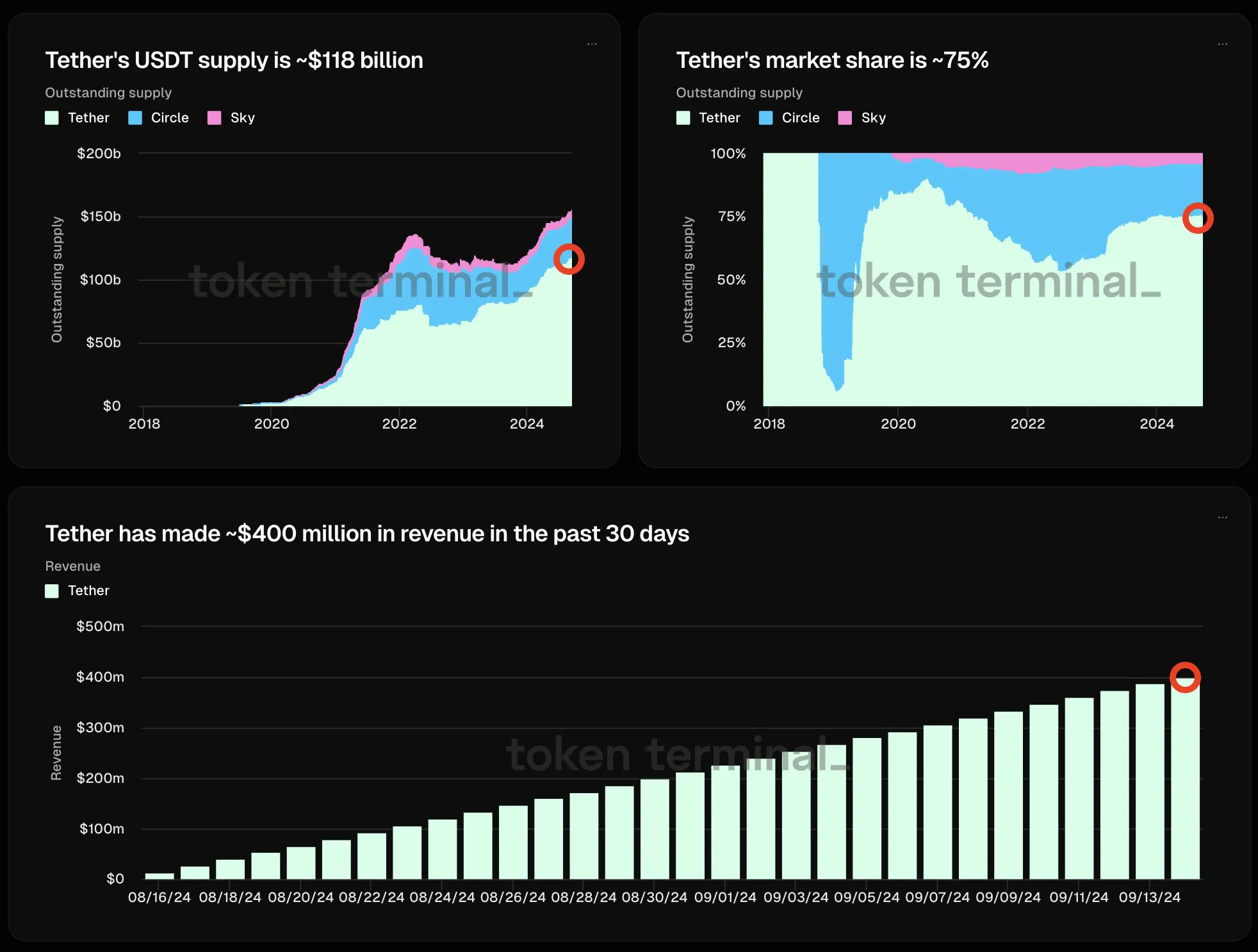

USDC’s integration highlights how blockchain-based stablecoins slowly merge with the traditional financial system amidst the growing adoption of stablecoins globally. The biggest beneficiary of that adoption has been Tether USDT, which has seen its supply grow by 75% over the last two years, going from $65 billion to $118 billion, according to TokenTerminal.

USDT growth has made Tether a major money-generating machine, with the company earning around $400 million monthly as the yield on its more than $97 billion treasuries and repurchase agreements, which it holds as reserves for USDT. These positive returns have clearly made the stablecoin business attractive to other institutions, with the likes of Ripple also venturing into it.

However, USDT’s biggest competition is still USDC, which ironically has a market cap of less than one-third of its size at $35 billion. Circle’s recent efforts seem calculated to grow USDC adoption and make it more competitive against USDT, particularly as a more regulatory-compliant alternative.

Despite Circle positioning itself as regulatory compliant, the issuer has faced criticisms recently for failing to protect the crypto ecosystem. On-chain sleuth, ZachXBT recently criticized the issuer for delays in blacklisting wallets of malicious actors, enabling them to move these funds in some cases.

He posted:

“You do not care at all about the ecosystem except extracting from it. Not once have you ever blacklisted after a DeFi exploit / hack when there was ample time while you continue to profit off the transactions. You took 4.5 months longer than every other major issuer to blacklist Lazarus Group funds.”

He added that Circle had shown reluctance to assist users who mistakenly transfer USDC to the contract address on various chains when the company could easily do it, noting that Circle usually claims the transactions are irreversible. deBrigde Finance co-founder Alex Smirnov had earlier highlighted this issue, noting that Tether has a dedicated recovery process and prioritizes users, which might explain why its adoption is growing.

cryptopolitan.com

cryptopolitan.com