Say hello to Fixed Rate Loans!

Now we have more options for stablecoin borrowing and lending with fixed terms and custom APR.

More information ➡️ https://t.co/VZ9684CDbKpic.twitter.com/Pt0HmmKNT7

— Binance (@binance) September 5, 2024

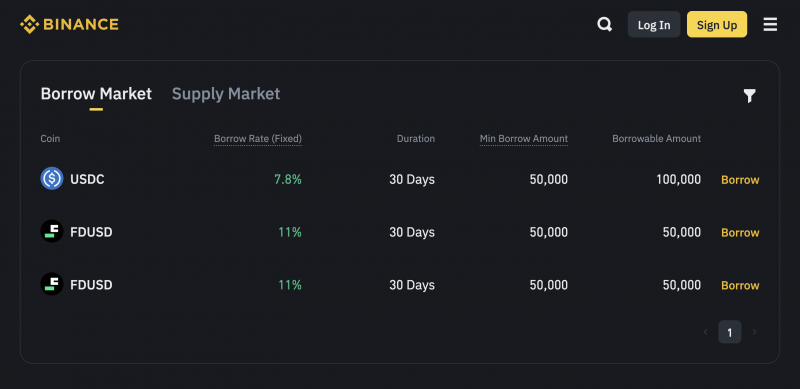

The platform currently provides fixed-rate loans for two stablecoins: USDC and FDUSD. For USDC, borrowers can access loans with a 7.8% fixed rate for 30 days, with a minimum borrow amount of 50,000 USDC. FDUSD loans are offered at an 11% fixed rate for 30 days, with a borrow amount of 50,000 FDUSD.

To utilize the fixed rate loans, users must first place an order through the Binance platform, selecting eligible assets as collateral. Once an order is matched, the borrowed funds are transferred to the user’s Spot Wallet, minus any pre-calculated interest. It is crucial for borrowers to repay the loan by the due date to avoid late fees, which are calculated at three times the loan interest rate.

Suppliers, on the other hand, will have their funds principal-protected by Binance once an order is matched, with return interest accruing upon matching. The supplied assets, along with accrued interest, are returned after the loan’s expiry.

Binance ensures a smooth process by managing the loans, which are over-collateralized to minimize liquidation risks. The platform also supports auto-repay and auto-renew options to enhance user convenience.

cryptobriefing.com

cryptobriefing.com