Over the past seven months, data from cryptoquant.com reveals a staggering $26 billion worth of bitcoin and ethereum has been pulled from centralized crypto exchanges. During the same period, trading platforms have seen an influx of $9.1 billion ERC20-based tethers since Jan. 1.

Bitcoin and Ethereum Scarcity Grows as $26 Billion Leaves Centralized Exchange

Bitcoin is becoming harder to come by this year. While investors are busy withdrawing the leading digital asset from centralized exchanges, miners are also seeing their reserves dwindle. Data from cryptoquant.com reveals that miners have offloaded 29,377 BTC, with their reserves dropping from 1.84 million BTC to 1.81 million BTC. This means that, in addition to losing half or more of their revenue after the fourth halving in April, miners have also parted with bitcoin reserves valued at approximately $1.8 billion at today’s BTC exchange rates.

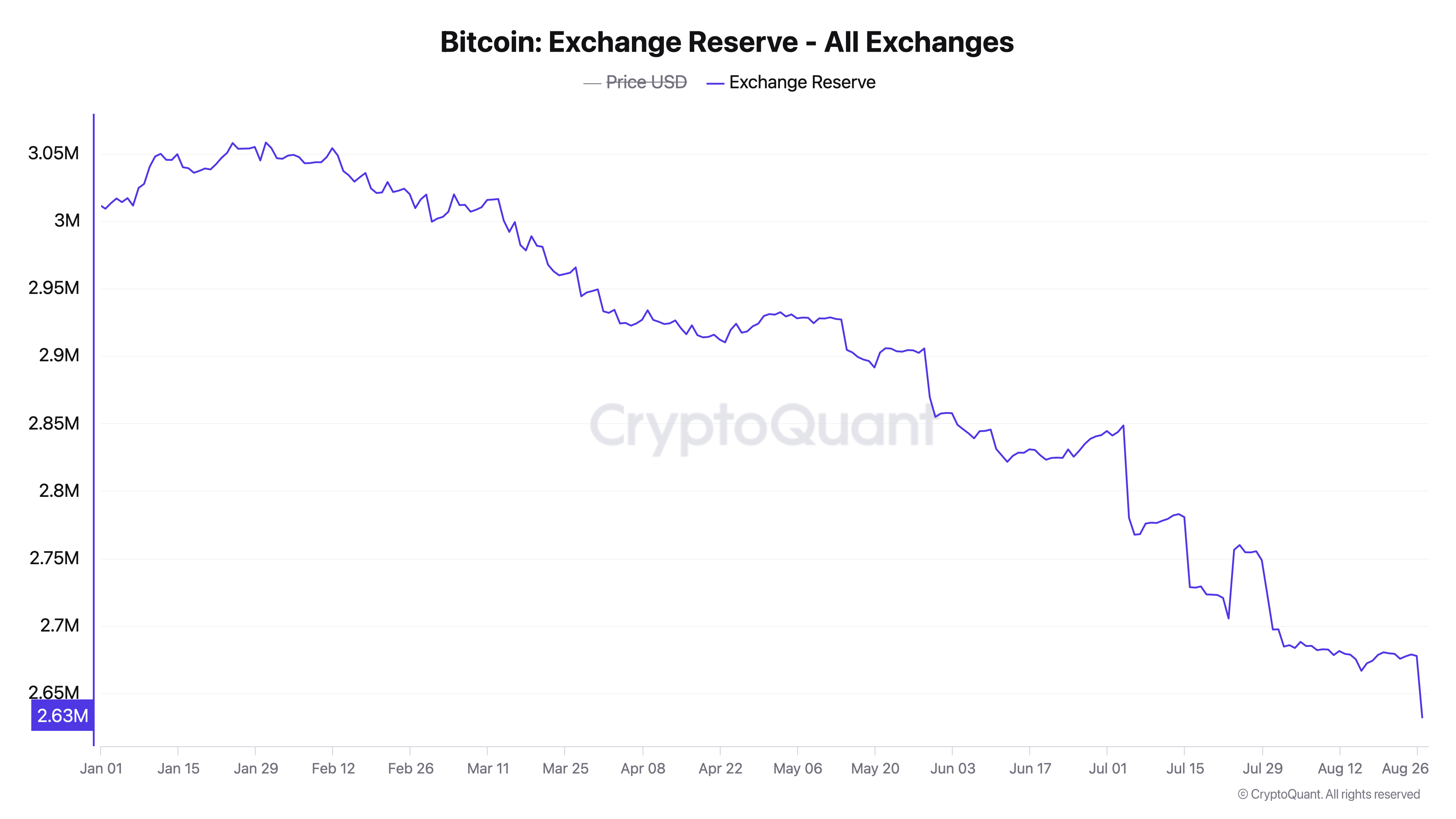

Cryptoquant data reveals that centralized crypto exchanges have experienced a significant outflow of BTC this year. Between Jan. 1, 2024, and Aug. 24, a staggering 330,560 BTC, valued at $20.8 billion, has been withdrawn from these trading platforms. Seven months ago, exchanges collectively held 3,009,239 BTC, but today that figure has dropped to 2,678,679 BTC. Additionally, exchanges have seen a substantial decrease in ethereum (ETH) reserves, with 1.9 million ether, worth $5.2 billion, leaving centralized trading platforms since the start of the year.

On the other hand, exchanges have witnessed a notable influx of Ethereum-based tether (USDT) this year. Data indicates that since Jan. 1, the amount of USDT on these platforms has grown from $12.6 billion to a significant $21.7 billion. Whether driven by institutional investors or retail traders, the removal of $26 billion in BTC and ETH is reshaping the crypto asset landscape. If this pattern persists, the increasing scarcity could affect future market stability. Currently, the amount of BTC on exchanges is at its lowest level since Nov. 2018.

What do you think about the $26 billion in bitcoin and ether that has left centralized crypto exchanges this year? Share your thoughts and opinions about this subject in the comments section below.

news.bitcoin.com

news.bitcoin.com