Bybit announced the discontinuation of services in France amid new regulatory developments from the country’s regulator. Henceforth, French nationals and residents will have to look elsewhere for their crypto trading activities.

France’s regulator, the Autorité des Marchés Financiers (AMF), announced blacklisting Bybit, calling on retail investors to exercise the utmost vigilance.

Bybit Bids Goodbye to French Market

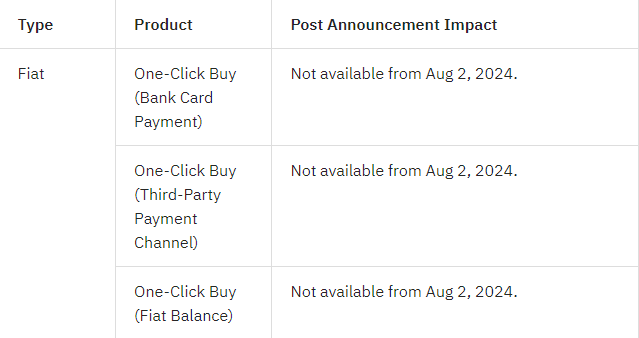

Bybit, one of the leading centralized crypto exchanges, informed French users they can no longer open or add new positions. Additionally, none of Bybit’s products will be accessible, and the deposit function is restricted.

“Please wind down and close all of your open positions across all products and begin to withdraw your assets and funds and assets from your account,” the announcement said.

The exchange will liquidate all unclosed positions starting August 13, and no withdrawal requests will be processed. According to the announcement, several services are already restricted.

Read more: Bybit Review 2024: Review of Its Security, Fees, and Features

As BeInCrypto reported earlier, the AMF blacklisted Bybit, citing a lack of prior registration. The official announcement from the French regulator referred to the Monetary and Financial Code, saying unregistered platforms are illegal under French law.

“The AMF reserves the right, under the terms of the Monetary and Financial Code, to take legal action to block the website of this platform, which is providing its services illegally in France,” the AMF stated in May.

The measures come as the AMF aims to curb illicit activities such as money laundering and terrorist financing, while also protecting retail investors. Bybit’s operations have faced bans beyond France. Canada prohibited Bybit following its 2023 market exit, and the UK expelled the exchange for non-compliance with market rules.

Notwithstanding, CoinGecko data puts Bybit at the top of the list among top crypto exchanges ranked by trust score. Second only to Binance, Bybit records up to 33.4 million monthly visits.

EU Crypto Industry Braces for MiCA Phase 2

This regulatory development traces back to August 2023, when European nations began preparing for the Markets in Crypto-Assets (MiCA) regulation framework. The second phase of this regulation will occur in December, following the debut of phase one in July, which targeted the stablecoin market.

The country introduced enhanced registration framework for Digital Asset Service Providers (DASPs). It also revised DASP rules in alignment with local licensing requirements under MiCA. With these changes in 2023, it became harder to obtain a crypto license in France.

The second part of the MiCA framework will be fully applicable by December 30, 2024, addressing the prevention and prohibition of market abuse. To navigate these regulatory changes successfully, proactive preparation, strong internal policies, and sophisticated surveillance systems will be critical.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

The oversight, promoting regulatory clarity and transparency, will inspire increased customer confidence because of improved consumer protection. For new players looking to join the space, however, entry barriers will likely be higher as the MiCA framework aims to achieve its mandate — to protect consumers and investors, ensure financial stability, and nurture innovation.

beincrypto.com

beincrypto.com