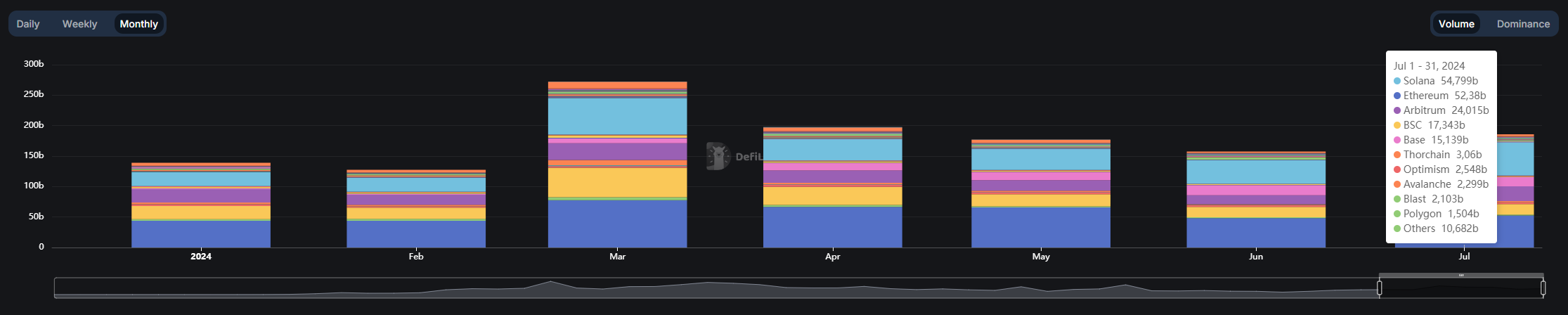

Decentralized exchanges (DEX) gained traction in July by nearing $186 billion in monthly trading volume, 18% up from June. This is the first time since March that DEX monthly volumes have risen.

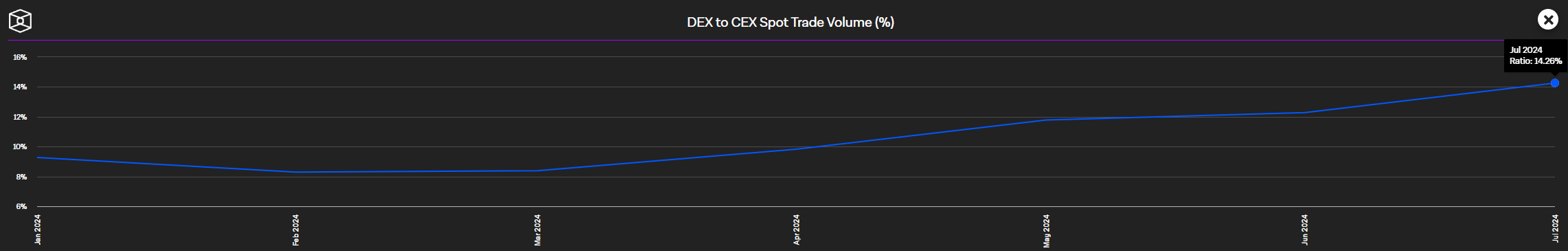

Notably, the ratio of trading volume on DEX compared to centralized exchanges reached an all-time high at 14.26%, according to data from The Block. The steady growth in this ratio highlights the demand for more decentralized and transparent platforms for crypto trading.

Solana-based DEX registered the largest trading volume last month, nearing $55 billion and growing 41% since June. This is the first time Solana has surpassed Ethereum in monthly trading volume, as Ethereum-based DEX amounted to $52.4 billion.

Despite Solana’s significant growth in trading activity, Arbitrum showed the largest growth in July by leaping 61% and surpassing $24 billion in trading volume. Meanwhile, Base and Binance Smart Chain maintained their June trading volume levels, registering $15.1 billion and $17.3 billion in activity, respectively.

Moreover, Avalanche reclaimed a spot among the largest blockchains by trading volume last month reaching $2.3 billion. In June, Avalanche lost ground to the Linea ecosystem and stood out of the top 10 blockchains in monthly trading volume.

The decentralized exchanges for derivatives trading (perp DEX) also saw 22.4% growth in July, surpassing $252 billion in trading volume. Blast not only maintained its dominance in the perp DEX sector but grew 21% in July, surpassing $57 billion in monthly volume for the first time.

Base and Starknet registered the most significant growth movements among the perp DEX in July, rising 89.5% and 103%, respectively.

cryptobriefing.com

cryptobriefing.com