Zeta Markets will pause the trading of RNDR on Monday, July 22 at 9 am UTC due to Render’s upcoming upgrade.

On Friday, Zeta Markets notified its users via X that due Render’s (RNDR) token migration to $RENDER, the platform will suspend trading of the current ERC-20 token. Render expects to transition from the current ticker symbol to $RENDER on July 26.

Exchanges to support RNDR to $RENDER migration

Zeta Markets’ announcement comes as most of the top cryptocurrency exchanges announce support for the upgrade.

Binance, OKX, Crypto.com, Kraken, and KuCoin are among those to reveal plans to automatically upgrade RNDR to $RENDER for their users.

In the Friday update, the Zeta Markets team said the trading halt will also see all open positions for RNDR-PERP settled at the token’s prevailing price on the PYTH oracle price feed.

“If you choose to leave your positions as they are, at the halt time your unrealized P/L will automatically convert into realized P/L (settled in USDC),” Zeta Markets warned its users.

To avoid this, users have the option of closing their RNDR positions ahead of the scheduled suspension. Zeta will announce any future re-listing of $RENDER at the time it will have taken such a decision, the announcement reads.

Render network activity spikes

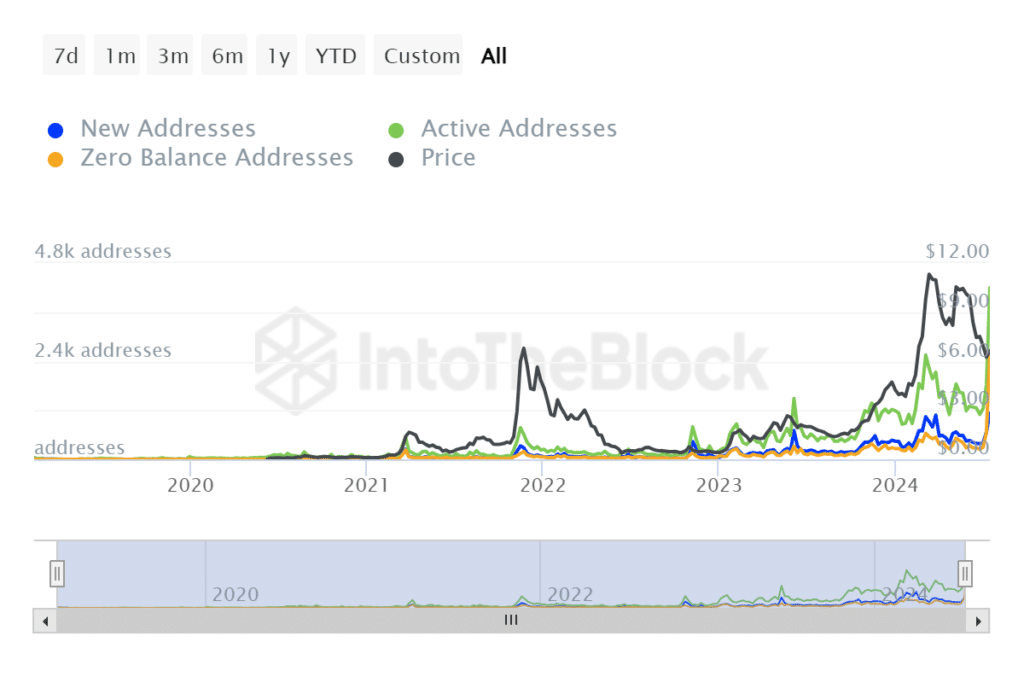

Render has registered a marked increase in network activity ahead of the upgrade. On-chain data shows the Render active address count hit a new peak on July 15, with IntoTheBlock indicating there were over 1.13k new addresses on the day.

The 7-day change for new addresses is currently 27.20%, while active addresses and zero-balance addresses on the Render network have increased 50.26% and 126.13% in the past week.

Render has also witnessed a spike in transaction count ahead of the highly anticipated upgrade.

Over the past 30 days, transactions between $1.00 and $10 have increased 627%, while the 30-day change for transactions valued at $10.00 – $100.00 is 459%. Large transactions involving more than $10k surged 70% over the past month.

However, the RNDR price has dropped over 18% in the past 30 days, from highs above $8.20 to the current level of $6.48.