Slumps in Bitcoin prices and the total cryptocurrency market cap coincided with reduced trading activity on centralized exchanges like Binance.

Data from the WuBlockchain team revealed that crypto spot volumes on centralized exchanges (CEXs) dropped 17% month-on-month (MoM) in June. Bitcoin (BTC) declined around 5% in the last 30 days, while the total crypto market dropped hundreds of billions within the same period.

As capital exited the digital asset market and investor sentiment turned bearish, several CEXs, including Upbit, Bitfinex, and KuCoin, recorded significant reductions in trading volumes, with declines of 45%, 38%, and 32%, respectively.

Binance saw a 22% drop in spot tradin, trading dropped around 22%, while Coinbase experienced a 15% decline, losing its second-place global ranking. Bybit overtook Coinbase for the number two spot after a small 1.6% drop in spot trading.

Interestingly, MEXC and HTX bucked the trend, with spot activity increasing by 13% and 7%, respectively. The report also highlighted that cryptocurrency derivatives trading patterns mirrored the drop in spot trading, with a 19% MoM decrease in derivatives trading volumes.

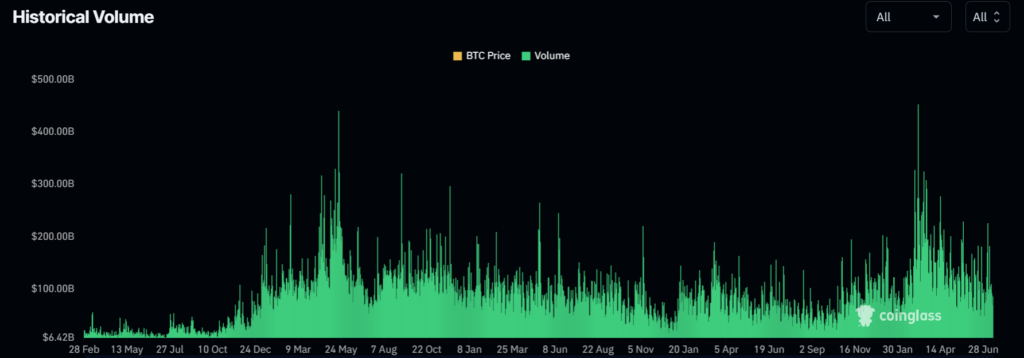

Monday’s report is part of a broader trend of declining volus since around March.CoinGlass data indicates that historical trading volumes have been decreasing for four months. This year’s highest trading volumes coincided with Bitcoin’s rally to an all-time high of $73,738, underscoring Bitcoin’s role as the primary driver for the digital asset market.