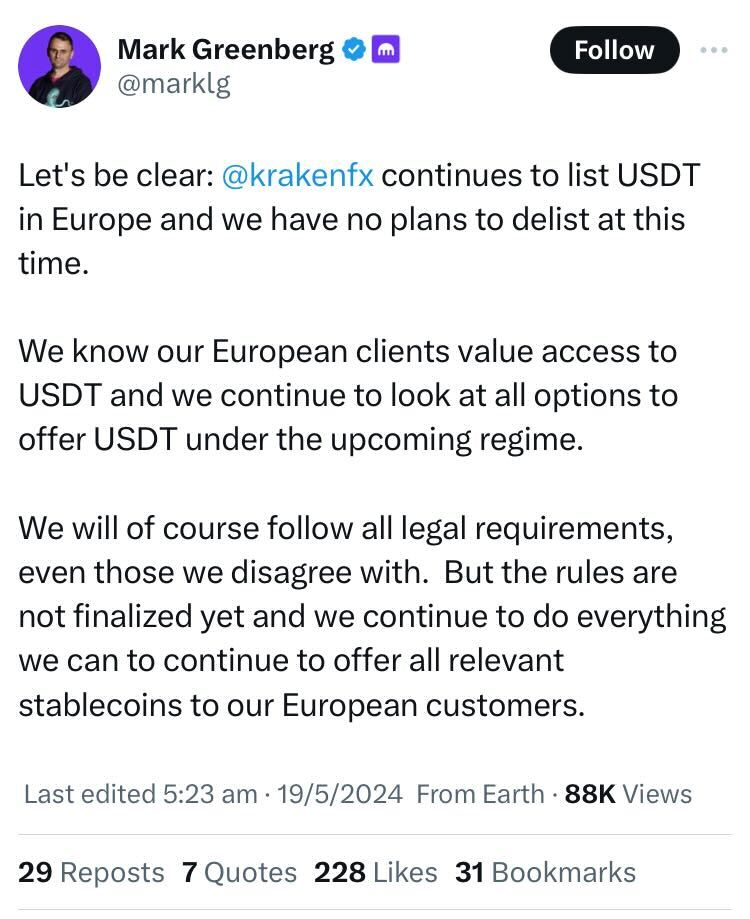

Cryptocurrency exchange Kraken has confirmed that it currently has no intention to delist Tether (USDT) in Europe, despite earlier reports suggesting otherwise. Mark Greenberg, Kraken’s global head of asset growth and management, affirmed the exchange’s commitment to listing USDT in Europe, emphasising their compliance with legal requirements, even if they don’t necessarily agree with all of them. Greenberg reiterated that while regulations are still being finalised, Kraken aims to continue offering relevant stablecoins to European customers.

The discussion about delisting USDT in Europe stemmed from a Bloomberg article reporting Kraken’s active review of plans to comply with the European Union’s forthcoming Markets in Crypto Assets Regulation (MiCA) framework. Marcus Hughes, Kraken’s global head of regulatory strategy, indicated that they are preparing for various scenarios, including the possibility of delisting certain tokens like USDT if necessary.

The MiCA regulations governing stablecoins are set to take effect on June 30, with rules for cryptocurrency service providers following six months later, on December 30. Kraken’s competitor, OKX, took preemptive action by delisting USDT in Europe back in March, while Binance announced similar plans in September, citing the need for MiCA compliance, though they haven’t executed those plans yet.

Kraken’s recent decision to cease Monero privacy token (XMR) support for customers in Belgium and Ireland in April contrasts with its ongoing expansion efforts in Europe. The exchange has obtained registration as a virtual asset service provider in Spain and the Netherlands, as well as an electronic money institution licence in Ireland, signalling its continued investment in the European market.

coinculture.com

coinculture.com