Nigeria’s Securities and Exchange Commission (SEC) has announced plans to ban peer-to-peer (P2P) crypto trading in a significant regulatory move. This development comes amidst a broader crackdown that includes the arrest of two Binance executives.

Indeed, Nigerian regulators’ enforcement is escalating tensions within the crypto sector. It also stirs concerns among global crypto entities about the regulatory environment in the region.

Nigeria to Tighten Regulations as Binance Case Continues

Emomotimi Agama, Director General of the SEC, expressed serious concerns about the effects of P2P trading on the Nigerian naira. Agama emphasized the urgency of these measures to stabilize the national currency.

“The thing that needs to be done is delisting the naira from the P2P space in order to avoid the level of manipulation that is currently happening. […] Recent concerns regarding crypto P2P traders and their perceived impact on the exchange rate of the naira has underscored the need for collective action,” Agama said.

Peer-to-peer platforms allow direct trading between crypto investors and bypass intermediaries. Therefore, the method may have raised concerns for the regulators in Nigeria.

Additionally, Nigerian officials have previously alleged that Binance and several other crypto exchanges engaged in fixing dollar prices. These prices did not refer to the price of the Nigerian naira at the central bank.

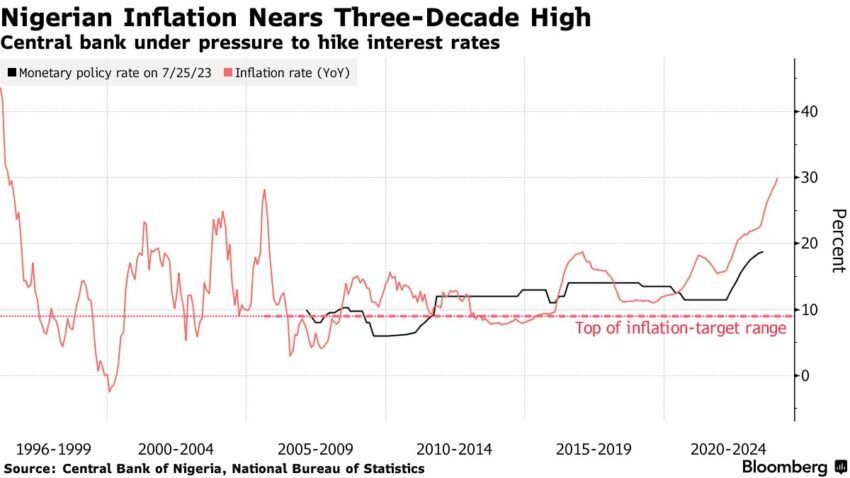

This ultimately made speculators take a chance and make prices on crypto exchanges the standard price used for foreign exchange trading. The issue is particularly noteworthy, considering Nigeria has been battling with inflation.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

As Nigeria grapples with economic instability, the SEC’s approach aims to rein in activities perceived as threats to financial security. This initiative extends to upcoming regulations targeting crypto exchanges and digital asset custodians.

The regulatory body’s aggressive posture was highlighted earlier this year following the ban on Binance operations and the subsequent detention of its top executives, Tigran Gambaryan and Nadeem Anjarwalla. Although Anjarwalla managed to flee, Gambaryan has been arrested in Abuja. He is also facing charges, including tax evasion and money laundering, which will lead him to go on trial this month.

In response to the ongoing case between the company and the Nigerian SEC, Richard Teng, CEO of Binance, has publicly demanded Gambaryan’s release. In an open letter published on May 7, Teng criticizes the Nigerian authorities for setting a “dangerous precedent” for global corporate engagements. Furthermore, Teng defended Gambaryan’s integrity and professional background, particularly his global contributions to combating financial crime.

“It is important to note that Tigran did not go to Nigeria as a ‘decision-maker,’ nor a ‘negotiator.’ He was merely acting as a functional expert in financial crime and capacity building in policy discussions,” Teng stated.

Read more: 7 Best Binance Alternatives in 2024

This is not the first time Binance has publicly called for their executives’ release. In early April 2024, Binance collectively published a statement to “respectfully request that Tigran Gambaryan is not held responsible while current discussions are ongoing between Binance and Nigerian government officials.”

beincrypto.com

beincrypto.com