As offshore markets diversify, Binance’s Bitcoin market share has declined to 55%, while Bybit emerged as a frontrunner with a surge from 2% to 9.3%

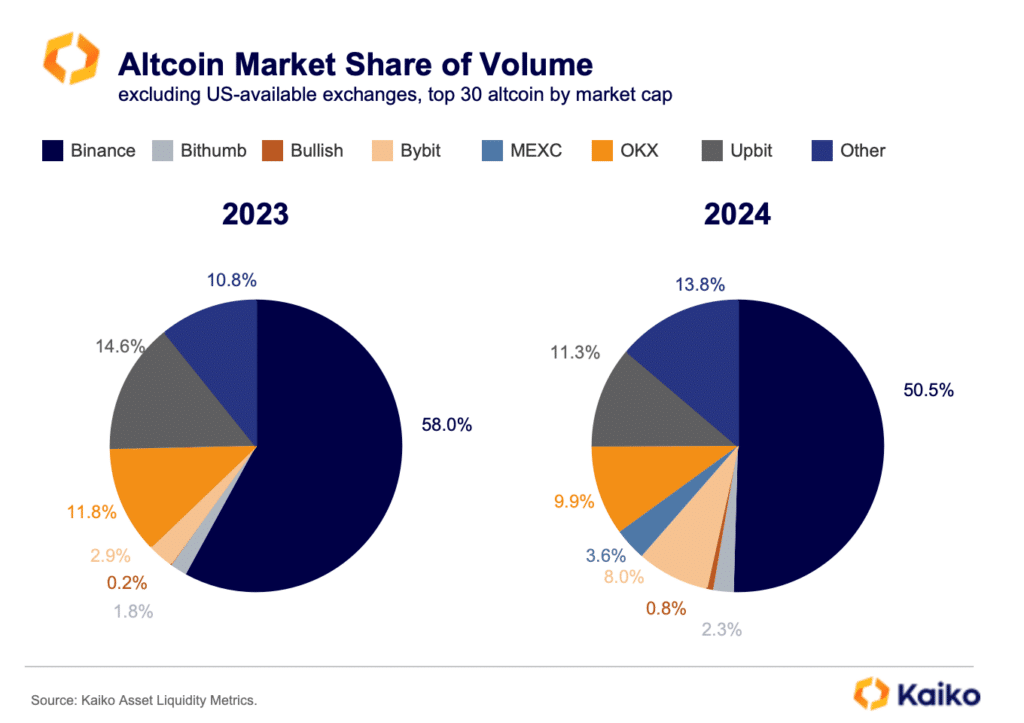

Binance‘s dominance in Bitcoin trading outside the U.S. market appears to be shrinking, as its share dropped from 81.3% to 55.3% over the past year as the exchange faced increased competition following the removal of its large-scale Bitcoin zero-fee promotion. According to data from Kaiko, the same trend can also be observed with smaller altcoins, where Binance’s share declined from 58% to 50.5%.

Analysts at the Paris-headquartered firm attributed the shifts to the growing competition in the market, as smaller exchanges are gaining traction as trading volumes recover. For example, platforms like Bybit and OKX are expanding their presence, especially in regions like Asia, with Bybit’s share of non-U.S. Bitcoin trading surging from 2% to 9.3%, while OKX’s gaining from 3% to 7.3%. Bullish, MEXC, and Bithumb also saw significant increases, the analysts added.

In the meantime, Binance is facing challenges, as its $4.3 billion deal with U.S. regulators imposed certain restrictions on the exchange. Binance COO Noah Perlman earlier noted that the monitoring agreement with U.S. regulators is now posing challenges for the exchange despite viewing the deal as an opportunity for improvement. Perlman says the U.S. now acts as an “authorized referee,” and even though the exchange is “not thrilled to have it,” Binance still considers it “as an opportunity to continue to enhance the programs, procedures we have.”

Read more: Philippines SEC to ban Binance app from Google and Apple store